We welcome you

16 October 2020

Crazy times continue this week. If the year could be harnessed and reviewed it might be in a t-shirt:

Now speaking of feedback and review, maybe Black Swan will open this week, addressing the gift of feedback given last week by Gary Newton. Now Gary seems like a lovely lad. Best guess from details we have seen, he loves his Holden cars, meat pies and magpies. No details of education, but he appears quite literate…he proffered the following:

“I wish more people in Adelaide would leave their Gas on and then use a lighter when they got home, that way there would be far less scummy maggots in Australia!” Here’s the rub though, Gazza…

Incognito is by name and desire, incognito. Whilst you claim to be raised in Melbourne, you list Adelaide as your home city. So do we…but are we there, or are we on Punt Road, St Kilda, or are we on Manning Road, Double Bay/Double Pay? We are everywhere, we are nowhere…

But more to the point, we refute your attack on maggots. You also list fishing as your sport. Surely these little critters are your friends?

Maggots have been used in antiquity for medicinal therapy – and still are to this day. So we say to you Gazza….Maggots rule…and thanks for your feedback, but get back to tinkering with your Holden – finance might be a bit beyond you.

Before we leave “Adelaide” though, we note that West End Brewery will cease operating next year. Always sad to see breweries under the pump, and lessons learned there for those in Melbourne.

Our message to Dan though, look on the bright side, at least you are not Gladys.

Market wise, unemployment figures out this week. Not too bad, although national unemployment pushed higher by one tick to 6.9% – almost entirely attributed to Gazza’s birth State. Like so many agenda items at present though, the market is looking through data releases. We know unemployment will go higher into the back end of this year, and under-employment is huge and growing.

RBA Governor Lowe spoke and left many convinced that RBA will cut to 0.10% in November and may also buy Government bonds out “along the curve” towards 5 or even 10 years. This will do a number of things:

- Pump even more cash into the system

- Put upward pressure on bond prices…thus keeping yields low.

- Help lower the costs that Josh and ScoMo will have on that now burgeoning budget debt.

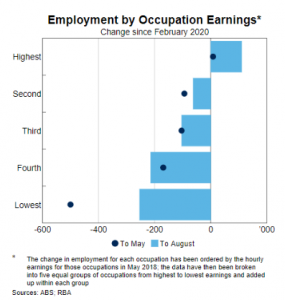

Lowe also produced the chart below. His point was that the pandemic has affected our demographics very differently. Employment at the “top end” of earnings have actually increased whilst the brunt of the negative affects have been felt by the lowest paid job sector.

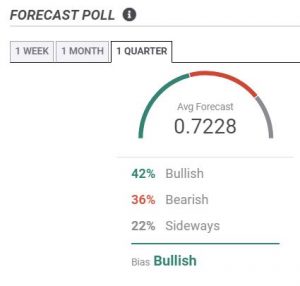

The Aussie dollar is only down a third of a cent since last week (and most of that after Lowe’s speech). But it feels fragile at present, and Wetpatch are calling a potential test of the 70 cent level ahead. We sit at .7070 at present. Westpac aside, most forecasters still are mildly bullish on year end – circa 72 cents.

We don’t often watch the Aussie dollar against the Japanese Yen. Sometimes like copper is for commodities, it is a good gauge of growth and risk – when it is falling, bad times often follow. Delays in the US stimulus package, Covid European hotspots and vaccine set backs, Brexit going nowhere. All are combining to take the wind out.

Perhaps best summarised…

The trash reality show on TV known as the US Presidential Election, is building to a crescendo, but frankly like a lot of these shows, everyone is getting bored with the whole shebang. The wacky stunts that each contestant has to do is so over the top. Biden forgets what it is he is actually campaigning for, and Trump is going from potentially death’s door to Dancing with Stars. Polls and Betting Markets have been crap the last few years on picking local or international election results. Sportsbet currently have Biden on $1.40 and Trump at $2.80. So you can safely safe Trump has this one in the bag.

Thought (s) of the Week

Black Swan has had another week of little thought. Well not entirely true.

1/ First thought was an update on previous comments re Australia and our collective dogs bollocks approach to energy. Instead of being an international powerhouse in new technologies, we have dithered about and struggled to prosecute a coherent strategy forward that gives the capital intensive sector enough confidence to push ahead…in either fossil or non fossil. Consumers follow the short term cheapest outcome, politicians take the well worn path of least resistance and energy providers sit in the middle confused.

As an aside, you may think Australia is still in the grip of the glory years of coal exports. Currently far from the truth. Global demand down on the back of the virus, some markets already starting their transition away from coal, and China are still rumored to be blocking Aussie coal ship access to some ports. New Hope Coal year on year profit is down 70% and Whitehaven down a massive 95%.

Price is also key and at sub $55 USD a tonne, it is estimated that a third of the coal we export is earning’s negative, Ouch. Current price is resting right there.

This week though I reckon Australia has taken a massive step forward in setting a clear direction. It follows on from our piece a few weeks back on ethical investments – and $$ performance.

BlackRock Investments are the worlds alpha fund manager – with a mere $7.3 trillion USD of funds. Putting a dollar bill next to another, this would stretch from Earth to the Sun and back two and a half times. Not allowing for spontaneous combustion.

Anyway, BlackRock fired a shot across the AGL bow this week. Indicating frustration at the time horizon of 2050 for AGL to be coal free, BlackRock supported a fast track resolution, it said, “to encourage the company in its efforts to proactively and ambitiously manage the climate risk in its business model.” Shareholders’ long-term interest would benefit from AGL’s offsetting financial risks and capturing “some of the opportunities of the global energy transition.” The capital spending needed to maintain Loy Yang A was “a significant factor” in BlackRock’s support for the resolution.

BIG money is speaking, and large listed entities are listening – because if they don’t they risk a chunk a shares being sold.

2/

However that wasn’t the main thought. My main thought was along the lines of what if any value investors and borrowers place on economic modelling and forecasts – specifically from the big 4 banks.

What I do know is that in the absence of anything else, forecasts can start a conversation, whilst finding cash flow metrics and risk tolerances. Once you have that then you can decide what you want to do…but more to the point what you NEED to do. As an importer “thinking” that the Aussie dollar should go higher means crap all if the business can’t support/survive a lower dollar. The business has no logical choice but to do something.

The issue that Black Swan sees from many decades in the big banks, is that the economics divisions have a number of issues…

- The are mainly manned by academics that have learnt university standard practices of supply/demand

- Often have a long term fundamental view/conviction that ignores local issues

- Want to be amongst the “pack” and not a massive outlier

- May have that “unconscious bias” that we have written about previously. Banks make money from fear and greed.

- Often are in complete disagreement with their own Traders that bet “real” money in the entirely different direction than house forecasts.

So – should we take any notice of bank forecasts or totally ignore? Most forecasts are not made with any intent to trick or defraud – they are made with good intent. The huge caveat is that forecasts are made with what is known now – not what is known next week/month/year.

I for one believed the Aussie cash rate had bottomed out at 4%…then absolutely convinced that 2.75% was as low as we could possibly get…before I finally settled on the adjusted view that 1.25% HAD to be the bottom. As recently as last month I would have bet that 0.25% was the end. Now that view is again challenged. Those views roughly matched the broader market. As history showed, things changed, then changed again, and again.

Yes, read the forecasts, read the rationale that support the forecasts and build your strategy accordingly. BUT understand that your world will change in days and months ahead, and the world will likewise change. One thing that I value more now than ever is building flexibility into your strategy that allows a get out of jail free option. Even if that get out of jail card costs a few dollars initially by way of structure or premium.

And if all else fails, cross your fingers.

As can be seen from the low neck of this bottle, I have been very much enjoying this Barossa Valley shiraz this week. Great SA fruit that even Gazza might enjoy.

Good grunt that goes with my song of the week.

Forza – Italian for strong.

Another week down.

We welcome your subscription or feedback…except you Gazza.

Cheers

Black Swan