Time for a reboot – or just a boot.

25 September 2020

I want so much to keep away from politics this week. But just when you think you are out….they pull you back in…

Of course Donald Trump takes the cake. Firstly by being so gracious with the passing of Ruth Bader Ginsberg, but his “mourning” lasted as long as the time between tweets. It would appear he needs all hands on deck post November – as like any emerging despot he has indicated he may not take the umpire’s call come the November election. Further, (or Fuhrer as the case maybe) despite not having the appropriate Constitutional power, he has claimed that to save America he may make an Executive Order to bar Biden from the Presidency. Of course this was a joke, the same as the insinuation that Biden is taking performance enhancing drugs via needles in his arse. Classy bloke. He actually makes Peter Dutton seem quite normal. Then again, the wicked part of Black Swan says how much fun would it be to be the most powerful person in the world and not give a flying f.

Anyway – back to the land of Oz.

Whilst Victoria seems to be getting ahead of that curve, you would think there is good reason for optimism. Alas, it has all gone to the shizenhousen for the market.

As far as I can tell this is on the back of two issues:

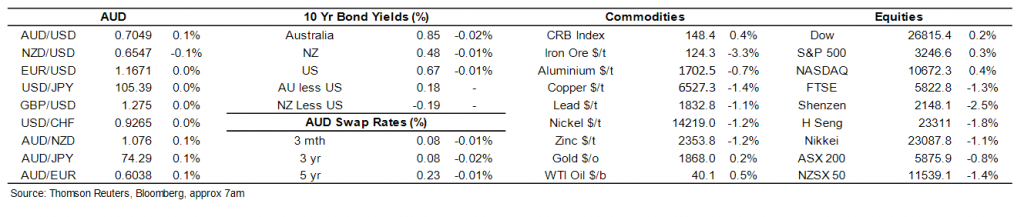

The Rona virus appears to be getting a second (third) burst in the northern hemisphere – driving bond yields, commodities and equities lower. Strangely the USD found some friends though.

The Reserve Bank (or Reverse Bank as called by Paul Keating) put out a pretty scary policy speech on Tuesday.

Guy Debelle presented four possible bullets left in his gun – but gave no real clue as to which trigger he may pull, if any. The bullets and my summary below:

- Lower cash rates. I reckon it will make dick all difference, but Wetpatch and NAB are calling a cut from 0.25% to 0.10% at next meeting. Note that BBSY has consistently been below 25 bps for some months, so “savings” to borrowers may be limited. It would hurt the Banks bottom lines though.

- RBA buying bonds out along “the curve”. They have done that already out to 3 years. May help give borrowers term certainty, but only at the edges.

- Push rates into negative territory. Even he struggled to articulate how that would really help, or worse, not harm the overall economy.

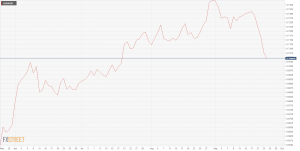

- FX Intervention to push the AUD lower and help Australia become more competitive. We did a chart on how often RBA did enter the FX market just a week or two ago. Almost as rare as a Gold Coast Suns premiership. But just talking about it has seen significant effects – the AUD has semi-tanked…

AUD has dropped from .7380 at the end of August to .7040 today – and further drops seen ahead. So much for our recent currency calls – and why we always claim that FX punting is for mugs or millionaires looking to give something back to the next guy.

Aussie dollar even down against the plagued English Pound. Brexit divorce not going well and Boris is busy addressing Rona V2.

Trump has sent his lad over to help sort things out….

Gold is down too.

Only a hunch, but I get the sense that the big Banks have stopped filling sandbags for their bunkers and are starting to think about how they tackle business and retail customers that have been given a lifeline – but like the unfortunate Tassie pilot whales, some may not survive. CBA chief declared this week that loan deferrals can only last for so long.

Treasurer Josh Frydenberg has proposed new insolvency regulation for smaller businesses, and Treasury Secretary Kennedy also wants Banks to show more love. Nice gesture, but have you ever seen a more miserable looking bloke?

Not much on the data horizon to talk of.

Thought of the week

More a case of actual thoughts rather than abstract. Black Swan being brilliant of mind but slow of courage, has been sitting on cash for some time now. Not that I want to be long cash, but just can’t hit the buy button for equities with any great courage.

But the time has come – I reckon low rates are here for some time and equities will hold up (and go higher) for longer than in a more “normal” cycle. So where will I direct my hard earnt? If gold pulls back a bit more, I might see that as a good entry point, albeit I already have some exposure.

Part of my thoughts was maybe to hand over responsibility to a Fund Manager to run with a chunk. Then you need to narrow down which sector, which manager and under what management fee structure.

I recently read the five precepts of Buddhism.

- Refrain from taking life. Not killing any living being.

- Refrain from taking what is not given. Not stealing from anyone.

- Refrain from the misuse of the senses. Not having too much sensual pleasure.

- Refrain from wrong speech. Not lying or gossiping about other people.

- Refrain from intoxicants that cloud the mind.

I reckon I’m shooting 0%. It may be too late, but the road to nirvana might start if I invest in an Ethical Fund, right?

Then again, how much should I “donate” to cleanse my soul via reduced returns?

So I dug a bit further. That great financial charity known as Morgan Stanley did a podcast only this week on that very subject. I was keen to find out just how big that sector is, and how it is performing over the journey.

I was surprised to find out the answers to both.

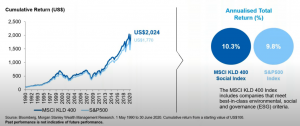

Firstly they covered both the USA and here in Oz. Returns in both have been solid:

The US has been growing that market since 1990 and returns have been higher than the non ethical/sustainable returns.

Here in Oz, the result is similar.

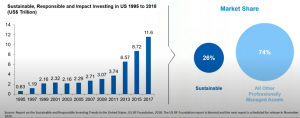

So how big is this “new” industry? In the USA it accounts for more than one in every four dollars invested. In Australia it has been growing annually at 19% since 2015 and is circa 37% of new funds these days.

So my image of Nimbin pot smokers and fixie bike riding baristas (vs barristers) being the only ones investing their spare coin is probably not quite on the money so to speak. There is some noise around exactly what qualifies as an ethical and responsible/sustainable company that is allowed to be included in this niche – I see for example that Apple, Toyota and a raft of Banks are included in many…. but that will evolve.

Summary – I’m in and have invested. I can now sleep like a baby and continue with intoxicants that cloud the mind.

Which is the perfect lead in to what I have been drinking this week. To celebrate some magnificent chateaux seen over Le Tour de France I went French. No idea how much they cost – bought a dozen at auction years ago. From Provence it is easy drinking….too easy. Only in my research today, did I find out it is a Syrah. Up ’til now I thought it was a Grenache/Syrah blend.

My listening is a bit more upbeat this week, like my general mood.

Til next week – stay safe. Not like this Thai tourist in the petting zoo, who took a “selfie” and posted it on social media. Not sure how it ended, but badly for her I hope.

Black Swan