Only half good..get yer teeth into that

3 September 2020

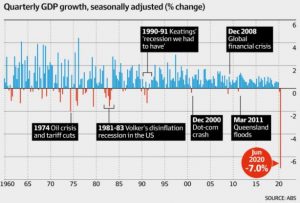

Forget the hope story of last week – like my hair, it is all receding. The worst kept secret was confirmed today. It wasn’t that the AFL Grand Final will be at the Gabba, but that a recession is where Australia finds itself in. June quarter GDP was expected to be circa 6% down, but in came in at -7%.

The biggest drop since the series started in 1959.

Time to get the razor blades out, but Joshy Frydenberg found a spin – we are performing a LOT better than the UK, so we should be grateful.

A few snippets that may be interesting to you:

SME earnings are up 20%+ on the back of the various government packages.

The national savings rate increased to 19.8 per cent from 6 per cent in the previous quarter – driven partially by fear but also a $35.2 billion fall in household spending. Retail sector is clearly doing it tough, especially in Victoria. As has been pointed out though, with spending well down, and savings well up, you would think there is a fat chunk of demand pent up. Whilst a “snap back” is looking unlikely, once we are over the Covid hump there could be some good GDP growth in 2021.

The Advertiser ignored it all today, with the edition sold out with front and back page leads, on Crows winning a crunch match against Hawthorn in September. Onward and upwards…..

Yesterday RBA left cash rates unchanged, but tossed a very dovish spin on the after-chat. It has expanded and extended its low-cost funding scheme for lenders. What that means is that Aussie Banks can get a piece of a $200 Billion pie out to June 2024 at a fixed rate of .25%. A huge amount for sure, but in the scheme of the whole banking system, well short of banks overall “needs”. It should help push Bank’s cost of funding lower though – which should also take some pressure off lending margins.

Yesterday has become the day before last, as a Barossa grenache got between Black Swan and any serious thinking. Worth a look and well priced…

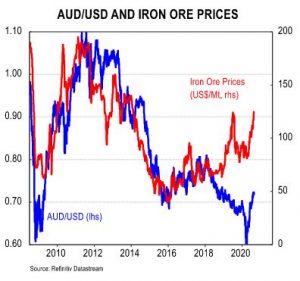

The Aussie Battler aka AUD seems happy to grind higher, and has sat above 73 cents for most of the week. RBA made no mention of it in their statement on Tuesday – taken by most to mean they are comfortable at least for now. Last week I mentioned it was hard for them to enter the market (called intervention) – it is a bit like hissing against the wind, or in Covid times:

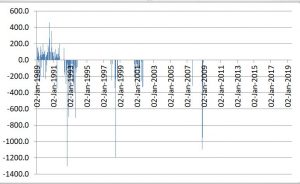

Out of interest I went back to the RBA to take a look at how often the RBA bought or sold our currency. The answer is not very often.

The issue is that the global FX “market” is just too big even for RBA to swing it. But when RBA does have a go, it is usually buying the AUD when its cheap and selling it when it is expensive. As a general strategy, that approach can’t be questioned – and the reason why the RBA is actually the most profitable business in Australia. It’s only shareholder is the Federal Government, so in essence you own a piece of it.

Anyway – charting how often the RBA intervened, looks like this:

And what caused them to play – AUD levels usually at well over 80 cents or well below 60 cents.

Finally, we have been calling the AUD higher for some time. If you (like me) believe that commodity prices have a major influence on our dollar, then it has plenty of room to move higher still. Iron ore went 12% higher in August. Apparently China, doesn’t like our wine, universities or beef…but more than happy to take our coal and ore.

Short end (BBSW/BBSY) rates fell a bit on the week, whilst longer dated yields rose by pipteenth.

This weeks song is a little slow starting, a bit like the US Presidential election campaigns, but builds nicely…Same album includes New York, I love you, but you are bringing me down.

Until next week.

When we ask you to share, then please subscribe to get it delivered right to your door, at $4 a week cheaper than The Weekend Australian. We even know that Dan Andrews is Premier of Victoria.

I finally found the guy we modelled our chap from:

Cheers

BS