Just the recipe…

20 August 2020

Victoria seem to be finally getting on top of its cluster.

I don’t follow Vic politics closely, but the stick that Dan gets seems pretty tough. The Dockers blamed him for the bum umpire call last weekend…

RBA Board minutes released yesterday. The rub is no further cash cuts likely (still) and whilst a recovery “of sorts” is underway, it will be slower than they had originally been hoped/planned. The economy will stay on a plasma drip for some time. But who is the doctor? That is today’s theme…

Before that a quick markets review:

US S&P hit all times high this week. If, like me, you think this is ridiculous you would have a good argument. But the big tech companies are having a good profit run and no one is calling the end as nigh.

Yields had a bit of dead cat bounce early this week, but have died in the arse towards week end. Chart below is not that difficult but needs some explanation. The green and blue below are easy enough and highlight the 20 year trend lower in term yields. More to the point, some focus should be on the red line – the difference between 3 year and 10 year yields – some times referred to as yield curve steepness.

Forget that massive jump in March when the market first digested the Covid shock. That aside it is sitting at 2 year highs and appears to have more in it yet.

Why? As the Aussie Government sells more bonds to pay for helicopter cash the effect is to push 10 year yields higher – especially as measured against 3 year yields.

So what? Just maybe the market has not completely forgotten that inflation may not actually be dead yet – just like Brexit… just resting. More on that below in today’s theory session.

Our Aussie dollar is sitting in the mid 72 cents region. Maybe should be higher given the USD greenback is at 2 year lows. No doubt the RBA would like to see our currency lower, but if you take a look at longer time frames, it seems to sit comfortably around here – and was at mid 73 cents five years ago. There maybe a touch more in it higher from here, but gains will be tougher to make.

Japan looking stuffed.

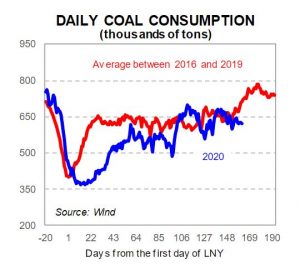

China looking better, but Standard & Poors worried about real interest rates rising. Coal consumption back to tracking near recent averages. Depends on your perspective as to if that is a good thing…or not…

The US have had some pretty good data this week, including housing starts at 4 year highs. We are getting to the pointy end of the US election campaigning. Crump has closed the margin on Amtrack Joe and no one really trusts the polls anyway. The broader market does seem to be positioning itself for either party to get up. No longer do I see a massive sell off if Biden triumphs.

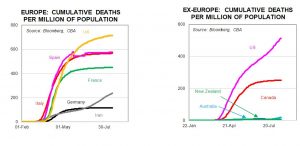

I wonder how the polls would have been now without the effects of the pandemic? Only academic given it is what it is – and the US continues to shoot itself (literally and figuratively) in the foot at every opportunity. The stats can not be argued with though. History will most likely show tough love now (lock-down) economies will bounce back quicker and harder.

Theme of the week – conspiracy theory…

Confession- this is heavily influenced by an article I read from Russell Napier on UK inflation predictions. It is worth noting before we start, that whilst the world called for inflation post QE he predicted deflation (correct) – so whilst past performance is no indicator….he is no loonie.

Whilst the UK is not Oz, many of his findings and expectations can be mirrored into our backyard. His two key thoughts:

- Inflation in most western world countries to hit 4% by 2021

- UK’s Bank of England as Central Bank (read RBA) have been effectively neutered – and Federal Governments are holding the Frisbee

The first point is, in part, due to the second point. With just about all Central Banks largely out of monetary policy bullets, politicians have been given the secret key to the money tree – suddenly you can spend whatever you like on whatever you like. Politicians have a vastly different agenda to Central Banks – and not many of you readers would argue against the premise that their primary agenda item is to get re-elected.

Central Banks have pumped trillions into QE, and thus created inter generational debt to prop up economies, yet inflation has not emerged. Why? A number of reasons, but key is the velocity of money – how quickly a dollar spins around in the economy. A really good pre-Covid explanation here if you have an interest https://www.stlouisfed.org/on-the-economy/2014/september/what-does-money-velocity-tell-us-about-low-inflation-in-the-us

Put simply, a dollar in the US (UK/AUD/EU) is currently spinning around at very low levels. Studies in the US show it to be roughly half of normal. Thus with subdued demand there is constrained supply and stuff all inflation. Given alternate theories in post GFC QE response via the US Fed, inflation should have hit post 30% between 2008 and 2013. Wow…that would have put a cat amongst a few pigeons.

Anyway, so if RBA (read Fed or read BOE) can’t get the economy going, maybe ScoMo and the gang can by spending BIG and putting the pump on commercial banks to lend – called financial repression.

You would need to study post WWII European activity to see this last done in any mass way. The spending piece gets money velocity higher because it goes to Mr & Mrs Punter, not financial institutions. And forcing Banks to lend would see GDP higher.

There is votes in getting GDP higher and spending big – and governments will not want to hand that power up easily. But what about the debt I hear you say….?

But herein lies the nub. Governments will NEED inflation to help wash away the debt and higher GDP will help.

So the Government is pumping bonds out like there is no tomorrow – what will the market do once it realises that inflation may be coming? The answer is clear to all – yields up quickly and with some gusto.

Normal response from Central Banks to the above is raise cash rates. How do they do that when their “partners” have an explicit and stated growth agenda. Will RBA be brave enough to act against its “masters”?

We may not have long to wait to find out.

So – if that makes any sense, what would you do?

- A: Don’t buy bonds (unless inflation linked)

- Hold and add gold into your kit bag

- Add commodities – noting a China Trade Cold War could kick you in the teeth though…aka wine!

- Hold or add equities

If you have borrowings from a Bank of size, maybe also look into taking a fixed rate position out – preferably via a forward starting swap rate.

Finally – Russell Napier warns that this will not be a short term rumble – it could be around for a decade or more.

In honour of the velocity of money, I’ve been listening Mr Irish this week.

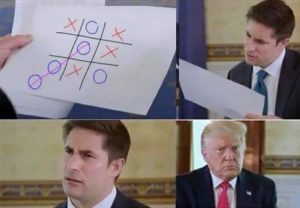

Unlikely Crump will spend big on US Postal Services, but I did like this take on his now famous interview.

Leave your comments below. If we like them we might even respond.

Cheers

BS