It’s a gas, gas, gas….

17 September 2020

Looking in the rear view mirror to some earlier posts, it is becoming even harder to separate the market from economics and politics.

I used to think “poor old politicians” dealing with these literal life and death decisions on a daily basis. But I’m getting a sense that some (maybe ego driven) actually thrive on moments when the spotlight is centred on their performance. You could apply that theory across State, National and International lines.

The problem is they have the weapons and power to make a difference – for either good or evil. At present the power in the dark side is strong.

Where would you start? Rather than solve identified issues, we look to divide into traditional tribes, with absolutely no middle ground.

- Border closures are either entirely appropriate (especially if you are in the bubble) or destroying business and life as we know it.

- Climate change is either the greatest global challenge, or complete bullshit (Trump says scientists are wrong and the world will get cooler)

- Energy policy in the Lucky Country should be all about renewable’s, or we should benefit from the massive fossil riches beneath us.

I have a view on all three – but equally acknowledge that the best answer may lie in the middle, baby steps, transition or decisions that make logical economic sense.

ScoMo’s latest push down this path is the threat that the “energy market” needs to pick up its game, and produce more juice, or the Government will build a gas fired power station to fill the void. Take a step back here – this is a CONSERVATIVE government looking to semi re-nationalise an industry, when free market forces don’t see value in spending there. Don’t get me wrong – I like my lights to come on when I flip a switch, but this step comes straight from a left/labour government playbook. And don’t even start me on the fact that we export our own gas overseas at a price cheaper than we pay domestically. However, maybe Big Matt has more influence than many believe.

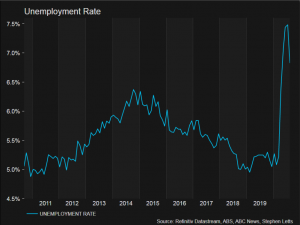

Anyway – back to the markets. Fresh off the press is Aussie employment (read unemployment) numbers released this morning. Last month was 7.5% with higher expected to come in August. Instead it has fallen o 6.8%. Time to pop the champagne, except as we all know the figures are bullshit and mean stuff all. Everyone knows the real figure is much higher and hours worked remain well down. Time will tell, but for broad confidence it is a good result.

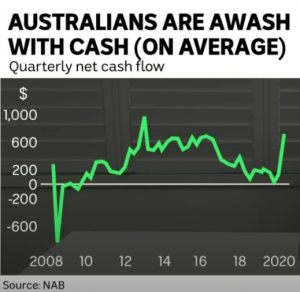

Distortions are everywhere, and the splash of cash is not hitting everyone’s bank account (certainly not mine) but NAB did some work on cash balances in savings accounts and, as mentioned in our previous blogs, Banks appear to be sitting on piles of cash.

Both the US Federal Reserve and the RBA seem to be in broad agreement on a number of things:

- Cash Rates will stay low for a long, long time. US Fed are suggesting near zero rates till possibly the end of 2023. RBA minutes this week suggest they may work to keep bond rates low further out along “the curve” – the end effect would be to take any pressure (although none evident) off higher rates for the next couple of years.

- Both are suggesting however, that the recession will not be as deep as first thought possible. Big bounces are however not predicted.

- Both see no risks what so ever of inflation (other than the risk of deflation) on the horizon. Given the Globe has never experienced what we are going through, and have NEVER responded with such massive $$ stimulus this is, in itself, a key black swan risk.

The net effect has been to keep rates low (of course) but the AUD still looks prone to explore 73 cents as the USD remains relatively weak.

Tech stocks were clearly overbought, but now seem to be maybe “over sold” – next few weeks will reveal. Tesla share price recovering well, but Black Swan’s accounts are far from “awash with cash” – equity tips not going well and bank shares seem to be struggling for that kick higher. Maybe buy the dip….?

A lot still rests on a working vaccine. Trump may end up relying on the Russian product, if time to the election gets short.

My song this week is a tribute to Deputy of the NSW Coalition ruling party, John Barilaro. Apart from looking to shoot those pesky Koala’s from their trees, he managed to shoot himself in the foot – quite a trick given he had it in his mouth at the time….

Love song with a twist.

THOUGHT OF THE WEEK

Since departing the murky world of finance, I cannot count how often I get asked my thoughts on Banks. Many feel that the level of service, support and care has been massively eroded in recent years.

Post Royal Commission and years of “restructuring to meet the ever changing needs of our customers” (aka cutting front line staff out), what is the vibe in Big Banks?

To set the scene, watch this 3 minute clip…

OK – tongue in cheek, but just perhaps…

Up front can I tell you what I really think? With very few exceptions, front line bankers care about their customers and generally want to do the right thing. 2020 sees them facing incredible challenges that pull them in different directions:

- Less support staff than ever – technology is supposed to feel the gap, but doesn’t.

- Customer sets (groups/portfolios) that number too many to deliver a satisfactory outcome, so squeaky wheels and favourites get preferential treatment and others are ignored.

- Credit decisions in challenging times – and their authority to make a decision is usually limited and risks attached if they get it wrong

- Massive increase in regulatory/compliance requirements

- Budgets, targets and KPI’s that are unachievable or worse, unclear.

So if you are thinking about quitting your role as a cleaner to take on banking – think again.

Bank CEO’s earn good coin, true enough – but departing Rio Tinto chief earned more. Would I take on a CEO role maybe? Well should some idiotic Bank offer that, I would grab it in a heartbeat, hoping they may take 6 months to work out I’m an idiot, but by then I have $10 “large” in my Swiss bank account. Would I enjoy it? Hell no.

Over the years I had a very select few clients that realised that they themselves had become very wealthy individuals, based on two things:

- Their astute business acumen, and not some small amount of luck

- Leverage to buy more assets than they otherwise could have based on capital borrowed from a Bank. Yes they paid interest, but they made small fortunes much larger than otherwise possible.

So with that as a background, should we feel sorry for the Big 4 Banks that made in excess of $30B in profits in 2018?

There is another layer of Bank staff that rarely gets “reviewed”. Below the Board and the CEO you have very well paid senior executives that own their leafy Harbour-side mansion and holiday home in Bowral, both with enough room to garage their array of latest model cars. They have heard of customers, but never actually meet any.

I have worked with this layer in the past and I can tell you their main motivation each working day is not to make life as easy as possible for you, their customer. They only have two motivations. Firstly to hit and beat revenue targets so that this years bonus will allow a family ski holiday in Aspen rather than Falls Creek. Secondly it is how they can make their competitors look as bad as possible…and here is the kicker…. Their competitors are not the other Banks, but internal colleagues that they see as a threat to their next promotion.

In summary, do I think this layer sets up to do bad to customers? No I do not, but their success should be closer aligned to what the CEO spiels and what front line staff need to be more effective.

Will it happen? Doubt it.

In line with lack of cash, I have gone down market this week, but the good AUD giving imported wine a chance. Romanian sangiovese, at a mere $15 odd a bottle. Might be anti-freeze, but slides down OK.

This blog was set up to allow anyone (well, anyone interesting) to “speak” anonymously to shed a candlelight into some dark corners.

Excitingly we may have a contributor or two to share with you shortly.

One area that we would love to dig into is the role of media and housing (construction, prices and demand). Talk about vested interests and bias….

Cheers

BS