Edition #26 – Time to surface or batten down the hatches…?

20 December 2020

Dive…dive…dive…

Quick Links

What is Black Swan listening to?

Some symmetry today – 26th edition and exactly 6 months since Incognito Markets emerged from the depths. Last for the year, but we will back back bigger and bolder in 2021.

It has been some kind of year. Certainly one to remember. It is almost impossible to guess what the year may have been like without Rona visiting.

Black Swan believes it was going to be a transformational year regardless. The markets needed a reset, so called zombie businesses were everywhere and fundamental demand/supply equation was out of whack already.

Like the whole of 2020, I have vacillated between optimism and fear. I am not sure it has been a successful reset and the machine is still actually faulty. Especially over in the USA.

But as a whole, and largely because cheap capital will be abundant, I don’t see 2021 and even 2022 as disaster years. But the globe has embarked on a unified central bank spending spree, the likes of which has NEVER been seen before. The way most markets (especially equities) seem so sanguine about the future is, to me, the BIGGEST worry. I think central banks feel they have the levers to control spending and inflation. But they have lost sight of the fact that politicians are now in charge of purse strings. You only need to look at the second Sydney airport land deal to see how well politicians handle such.

So are we in a bubble? We touch on that below.

Anyway – first, onto the week that has been.

The Trump Show continues. Still enjoying the show, but the damage to a democratic system that was supposed to be best in class, may be permanent.

Even if the Democrats grab the Senate in January, it hard to see the USA pulling together quickly. Masks and vaccinations even seem like a task beyond delivery in 2021.

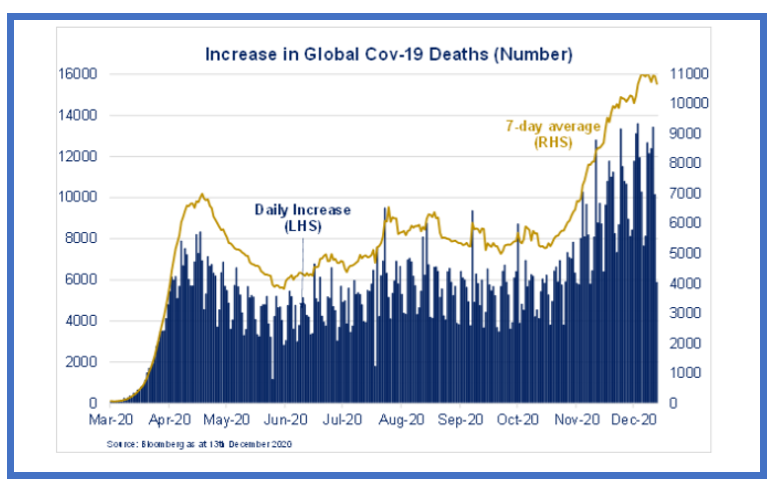

The death rate from Covid is falling as we get better at understanding and dealing with the virus, but at 2.23% it is clearly a bit more than a common cold. Over 300,000 US citizens confirm that. India also doing it tough, and Germany in hard lockdown for Christmas. A reminder that Jan 1, 2021 is just a date.

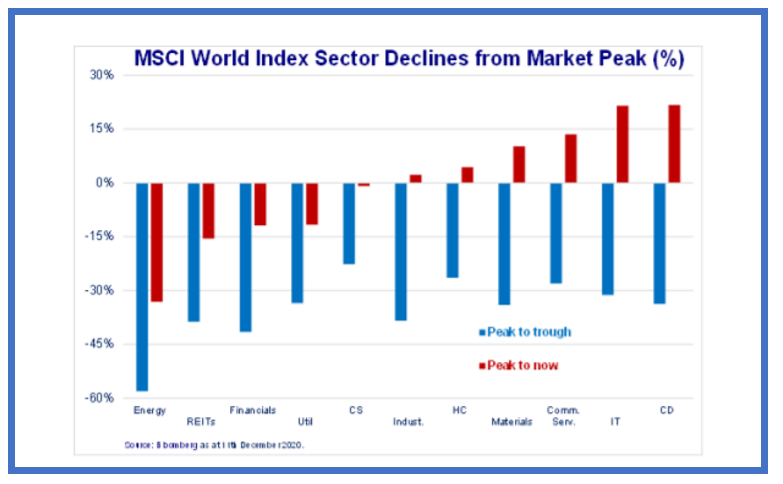

Aussie equities on track to finish 2020 higher than they started. You would have had long odds of that in March this year. We are in comparatively better shape than many countries, State and Federal governments are upholding their fiscal spending, so maybe ok.

My friends at Mutual Ltd supplied this counter in their morning report : “Relative to the fundamental back drop, valuations remain extreme by traditional standards. Forward PE’s are at 22.4x vs 18.3x a year ago with forward EPS down -20.3%.” So maybe not.

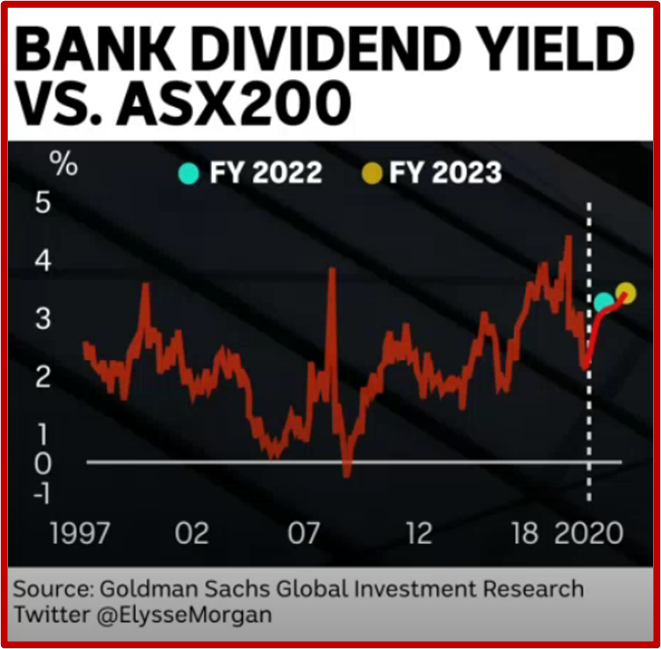

Banking stocks though still doing well. APRA have removed their dividend hold back restrictions. Goldman Sachs see pretty solid dividends ahead (circa 3-4%) in next 2 years, so owning the bank maybe better value than putting your cash in it. That said, Black Swan sold some bank stocks out last week.

In another little interesting snippet, so called neobank, Xinja recently entered the Aussie market to take deposits and lend to borrowers. But raising capital proved beyond them so they never got to lend anything. Money back to the depositors and virtual doors closed. Only one example, but to me proves again that the oligopoly that is Australian Banking is a hard nut to crack.

Coal miners took a black dust bath this week when China confirmed their “up yours” to our major export. It is not as simple as just sending the ships elsewhere and collect the cash. The shit is getting real now, and there is absolutely no doubt that this is political. As such the Federal Government is left holding the can. Not a job that I would want though. If they blink or backdown to China it would not be domestically popular with voters and a hard line approach will get nowhere. Now more than ever, the Federal Government needs those royalties and tax incomes.

When relationships go wrong.

Whilst on the broad subject, the Coalition “plan” for energy has to date been spectacularly shit. Not that Labor’s is much better. A number of State Governments have proposed initiatives to tax electric cars 2.5 cents per kilometre usage. Then this week, the federal government announced , a tax payer funded 1 cent a litre subsidy to Aussie oil refiners. Expected total cost at circa $2.3 billion over the next decade. I get the idea of self sufficiency, but is this the right vehicle (pun intended)?

And we wonder why a dickhead like Boris Johnson thinks we are even bigger dickheads. If fossil fuels really are the cigarettes of the 21st century, then we are acting like Philip Morris.

Gold has not pushed ahead over the year as many expected. Sitting at circa $1,860 USD an ounce some speculators have tipped out their holdings in disappointment.

Black Swan believes in gold still. I don’t own the stuff outright, but via miners. Investors need to understand how profitable the Gold mining business is at $1800+. The “all-in-sustaining cost” is below $1,000. At no time in the 2001-2011 bull market did miners have margins over 75%.

The Aussie dollar looking towards 76 cents. Time to have a punt.

We started the year at .6930. Lets assume we finish at .7600. Where will we be at the end of 2021? I’m saying .8050. More chance of winning with a lottery ticket though….

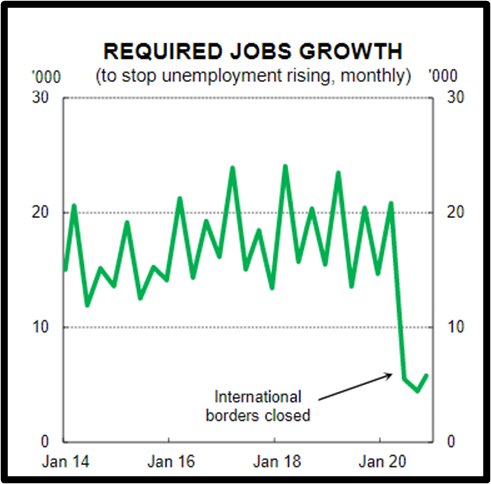

Employment data out for November. Above expectations at 90K, this followed an upwardly revised October figure of 180k – very strong. Unemployment has fallen to 6.8% and would be even lower if not for a rise in participation rates to record levels.

CBA economics made a good point in their report. Last year we needed to generate about 22k a month just to keep unemployment from rising. This is large part due to our strong immigration of workers. With borders closed internationally for some time, we only need about 6k a month now to keep it falling. Chart below highlights.

Swap rates moved higher post the employment number. It will be harder for RBA to keep pumping the cash into 2021/22 if unemployment moves quickly lower. Already reports of skilled staff shortages in some areas…although not seen in wage increases yet.

Thought of the week.

Bubbles….bubbles everywhere.

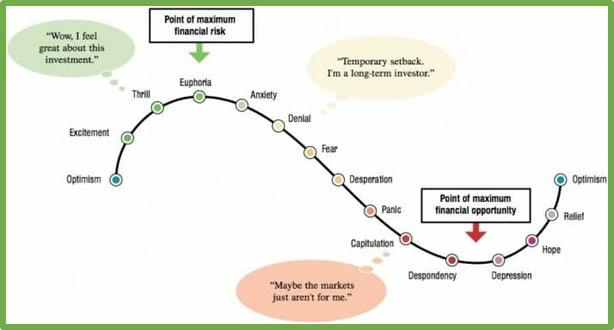

I have thought, read and listened recently to the theory of bubbles.

First of all – this is not Black Swan taking a crack at Tulips, Bitcoin, Gold, the Share market or real estate. It is more the concept of asset bubbles here and abroad. We have all seen them.

Charles Kindleberger, a historian of financial bubbles quoted : “There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich.” That seems unfair to us all, but deep down you know its unfortunately true.

I saw this chart that is supposed to explain it all. It probably does, but also tracks very nicely the process of boy meeting girl, first date, first night and then marriage, mother in law, mortgage and children.

The USA has a particularly strong history with real estate bubbles. Podcaster The Jolly Swagman asked his Harvard economist why. The answer is blindingly simple – best bubbles need capital. Banks really like real estate (or bricks and mortar as they put it). You go bust ( as bubbles often lead to) and the Bank gets the house. Simple.

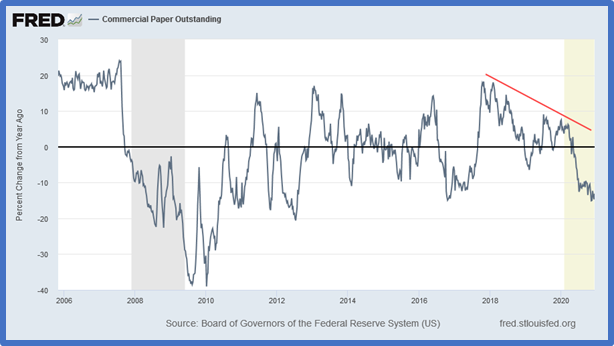

But if availability of credit is key to creating a bubble, then its removal can pop it. Below is a possible canary in the coal mine – commercial paper is getting harder to get for US corporates. Red flag warning for US equities.

The next common feature is a mismatch in supply and demand…which can distort valuations. In the USA 1830’s cotton bubble, price rises seemed in line with a growing demand base. Market went batshit crazy. Growers geared themselves up like racing cars (had they actually existed at that time), Banks were happy to lend and investors were plenty. Issues of slavery aside, the crisis was not caused by falling demand. Cotton is not a hard crop to grow, given right conditions. As the price rose, new players in the USA and abroad planted cotton. Supply rapidly increased and prices fell sharply. Leveraged Mississippi growers, bankers and investors lost the cotton shirt off their back. I wasn’t around in 1830 to verify, but the story sounds familiar enough to me.

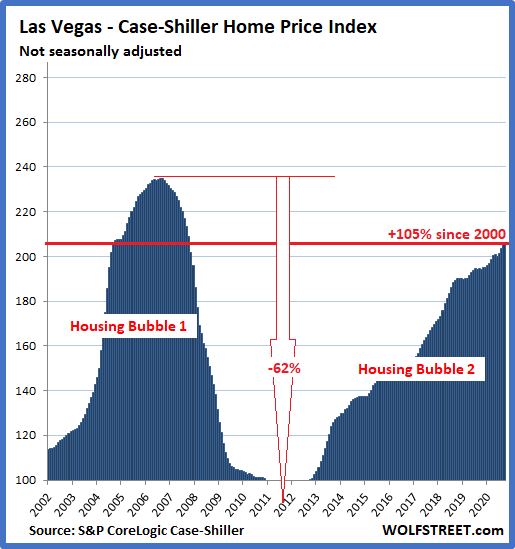

In Las Vegas pre GFC, house prices were running hot. The problem is that building houses in Las Vegas is pretty simple. Lots of houses built, supply exceeds demand and bang… Chart below is only a few week old, so some are saying they are set to blow again.

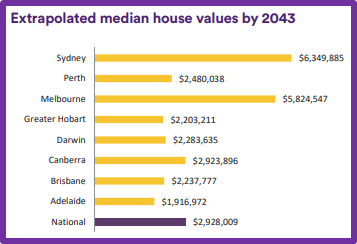

The last warning sign of bubbles is often extrapolation. The Jolly Swagman points as a prime example, this page from Aussie Home loans : https://www.aussie.com.au/plan-compare/property-reports/25-years-of-housing-trends-property-market-report.html

Like all good grifts and Ponzi schemes, there is some element of mathematical truths behind the story. Why wouldn’t you buy a house now if it is going to be worth $6+ big dollars in 2043. You don’t even have to work…just sit back and watch the value grow. No one can say with certainty that the biggest housing price rise in Australian history can not be repeated in the next period. But I wouldn’t bet the house on it….

So why do rationale people sometimes do irrational things? If you do something foolish but believe someone in the future will be more foolish than you…are you in fact foolish? I know a number of Bitcoin owners that bought in “early” sold their initial stake, and are now just playing with “house money”. To me that makes good sense. But can they explain the fundamentals behind Bitcoin, or what supports current “valuations? No way.

Traditionally though, I have been the buyer at Euphoria State in the bubble chart above – and there is no one more foolish than I.

What is Black Swan drinking?

2016 vintage.

Strange orange hues.

Full of tannin and quite bitter

Lay it down for 4 years and it might get better but I doubt it.

Really our last chance to take the Micky out of him. Hopefully removed from the bottle shop by the time we resume in 2021.

Can not recommend – 0/10

And listening?

Well it is Christmas, so Paul Kelly needs to feature – albeit a cover version. They do treat the song with respect and give it a good crack.

Thanks for your time and support. Please let us know what you are thinking.

As my White Swan frenchie mates would say, Joyeux Noël

Until Late January.

Cheers BS