Edition #25 – Seek and ye shall find…

13 December 2020

Getting harder to find the light

Quick Links

Second to last edition for the year

What is Black Swan listening to?

Social media is awash with meme’s and gags about Trump, so I won’t burden you with any more. Whilst his departure next month is a done deal, the way the broader Republican party is behaving and the undermining of the broader democratic political system is incredible to watch. That overlaid with the complete lack of leadership from the big chair as the US spirals towards 300k+ Covid deaths. He drained the swamp, but replaced it with cockroaches.

As an aside, it actually worries me that Australia seem to be going down the USA political path. Well manicured releases of in-house embedded photographer shots of sCO2Mo banging out stationery bike miles, or hanging Christmas decorations is one thing, but Peter “Nude Nut” Dutton called Adam Brandt an “enemy of the State” this week. Very USA approach and frankly crap. Brandt may be an annoying noise that Dutton disagrees with, but this approach usually only ever ends in one destination. Substitute Greens below.

Market wise, the surprise index (data releases that are better/worse than expectations) is at very high levels for Australia – and I suspect identical in most western economies. Great reset/ Bounce back / Snap Back / Cracker Jack , what can go wrong from here. Vaccine (s) are being rolled out and the pent up demand around the globe is huge.

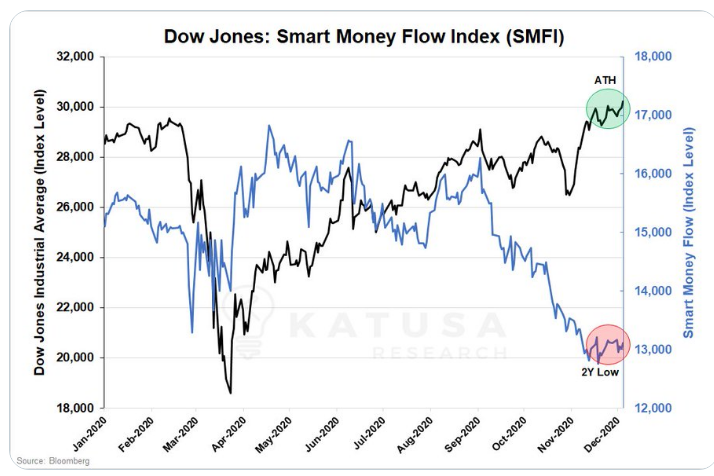

Share market is on a big run. As a bit of a bear, I am always on the look out for the hidden hole in the road, that will trip me up. Can 2021 be as good as everybody expects?

The more you read, the more you can find to scare you. I saw today a report on the Smart Money Index. This seems to have a formula that would confuse Confucius, but it judges when buyers buy and sellers sell. The chart below claims to highlight that smart sellers are tipping out of the Dow now and dumb-arse money is tipping in to push the DJI to all time highs.

The same may well said for the All Ords, but these are unprecedented times in an unprecedented year…so precedents count for Jack All.

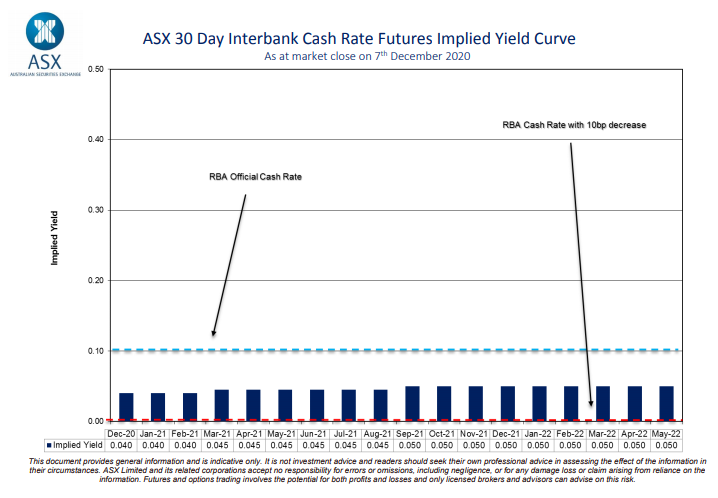

Swaps levels remain low, but the premium to pay fixed versus floating is pretty wide considering the near term future expectations for rates. Take a look at the ASX 30 day futures implied yield out to mid 2022. The only thing flatter at the moment is wage increases, CPI and Barry White.

30 Day BBSW is expected to race from current 0.04% to a mighty 0.05% into mid 2022.

We looked at a large borrower in recent weeks who sought our thoughts on covering their risk out to 2030. Their thinking was, with rates never this low in history, why wouldn’t you cover your funding costs well inside their yield return.

The challenge was the premium of circa 130 bps to pull the trigger. Decision made was to incorporate some degree of optionality (just in case) whilst entering a cap and step up rate strategy – the rate they pay starts low but ratchets up in the tail. So they enjoy the fruits of current rates and if their view over the horizon is correct, the slightly higher rates ahead will not hurt. You could consider it courageous but to me makes good sense for them.

The Aussie dollar continues its upward push.

I got called a sophist rhetoric by a reader last week. Must confess I had to look it up. Not sure if it is in relation to our AUD call, but anyway…stuff you. We called it higher and it is higher.

Over 75 cents today and even well up on the crosses. Especially so against the Euro that fell after the market was disappointed in the last .5 trillion euro cash splash. Not enough. That said, the German economy is set to fall by 5.5% this year and climb by virtually the same amount next year. Good ya ?

Thought of the week.

The thought of the week is actually a quick look back at simpler, happier times. 2016 and Aussie Bank embroiled in a “rate setting scam” that ultimately cost them millions in fines and settlements.

The BBSW rate scandal got ANZ, Westpac and NAB all in a tonne load of hot water. It looked and sounded bad. So…was it as dodgy as it appeared?

The suggestion was that banks pushed BBSW around (lets assume higher) to make borrowers pay more for their money than they otherwise should. If so, that is pretty dodgy shit.

In and around 2010 when most of this was in full swing, Black Swan was sitting in the main Dealing Room of an Aussie Bank, one desk away from the Trader who was one of 14 across Australia that entered bid/offer rates for the day.

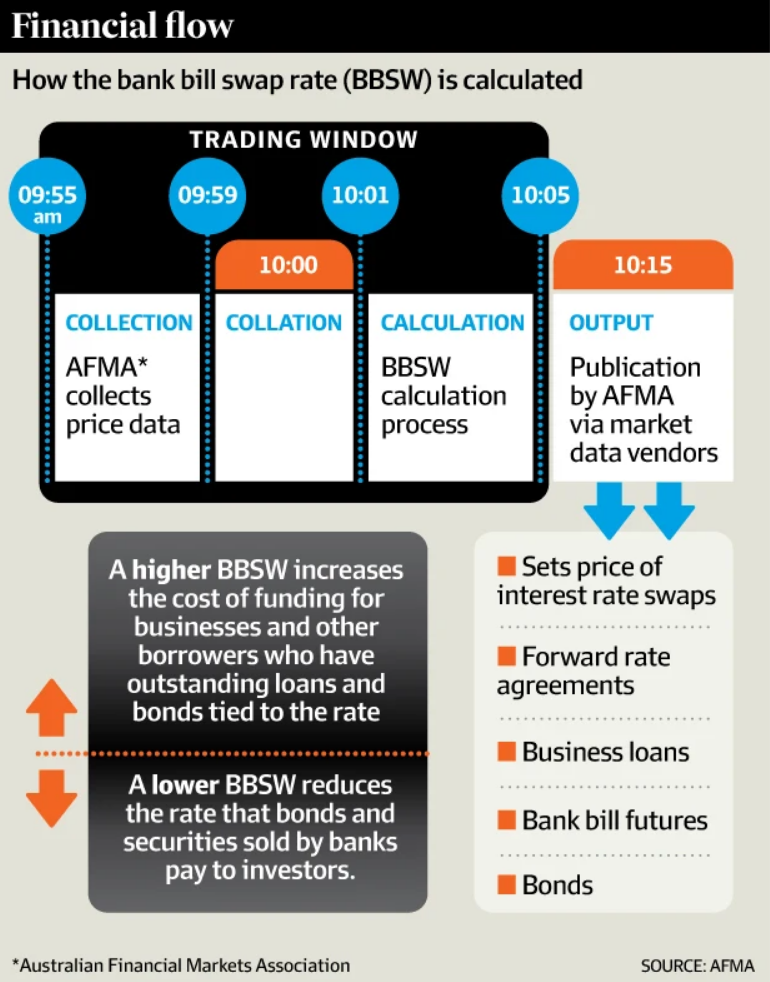

AFMA put out the chart below to explain how it used to work. It has since changed, and ASX now run the show.

So if the theory goes that Traders pushed rates higher to make the Banks more money from borrowers, …..Houston we have a problem. However, like many things in the market it is a two way price – someone buys and someone sells.

I can tell you that the Traders I knew would not have had a clue about the size and position of Business Banking or Corporate borrowers. They just had a spreadsheet that told them they needed to buy money on the day or sell money. If they needed to buy, they wanted to do it as cheaply as possible. Their downfall was in joining forces (often knowingly) we other market players with similar objectives to help their cause. Dodgy? Probably.

From the research I’ve read on the subject since it came to light though, on the “worst” of the days of collusion, more often than not, the direction taken was to push BBSW lower. So in fact borrowers benefitted from the activity. How would it go down if large borrowers’ got an invoice for unpaid interest from 2010?

To me a lot of that activity was a free market place in action. Traders trying to maximise returns and sometimes winning and sometimes getting sand kicked in their face.

The other side of the coin also has to be reviewed. Large fund managers and investors either made a few extra dollars on these days, or investors missed out on some income.

My summary? Traders were stupid for colluding. Even more stupid for colluding and doing it on taped telephones, and archived written communication.

Did they severely negative distort the market and rates? At the margin perhaps, but both for and against borrowers and investors at different times.

Fines appropriate? Yep.

But like drugs in cycling, I suspect the action continues but with smarter weaponry.

What is Black Swan drinking?

At $88 a bottle cellar door, this is not a Tuesday TV night swiller.

I’m usually very much a drinker that aligns his wine to the regional strengths of an area. Shiraz I would usually pick from Grampians, McLaren Vale or the Barossa. The Stud is a cool climate wine from Kangaroo Island SA. It claims to have cherry ripe and plum pudding tones. I would say fair call.

Would cellar well for many years if you had the patience and deep pockets.

Recommend – 7/10

And listening?

Lil Nas X has the more popular version, but who can go past a good old Rambo movie theme, when you feel like blowing shit up.

Finally remember the world is a wonderful place. Great to see this bloke’s luck change so dramatically in just two days. What would the chances be?….

![]()

Until next week.

Cheers BS