Beware….The Cliff is comin’

2 July 2020

In footy parlance it is half time.

Near enough 100 days in and 100 days to go. When I say “to go” that is not assuming a miracle vaccine appears – although I have a mate close to the UK Government that tells me Oxford Uni are very confident they are on a winner for late 2020 delivery.

“To go” relates to:

- JobKeeper wage subsidy

- JobSeeker supplement

- SME Loan Guarantees

- Support for Domestic Airlines (Virgin aside..)

- Ban on rental evictions

- Large chunk of personal and commercial loan 6 months deferments expiring.

So are we in a fools paradise at the moment?

A few senior bankers I know think we are are are preparing the bunkers for war.

It would be easy to jump on that bandwagon, and as a perennial pessimist, it takes all of my fibre to not do so. Australia’s run of nearly three decades of economic growth is over. But where to from here…

Firstly – as I have said to a number of friends (well people that hate me less), “this is certainly weird shit times”. Albeit we are under a Liberal Coalition Government, we are for now anyway a communist country.

Wikapedia classifies Communism as “the state of being of or for the community”. Prior to becoming associated with its more modern conception of an economic and political organisation, the term was initially used in designating various social situations.

For appropriate concern for its citizens, the Government has effectively closed down the free market/capitalist system for now. In doing so it has had no choice but become “provider” for the masses – particularly the unwashed masses it previously did it best not to recognise.

Thus it knows only too well, that either the Australian economy is re-opened to a significant degree by September or it is one mighty poo poo dilemma – open up the economy (refer the US experiment on that one) or dip into the pocket again and fork out the dosh.

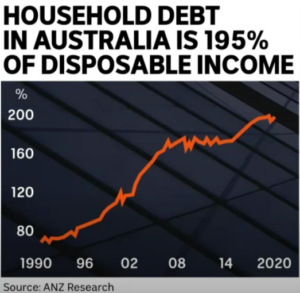

Secondly – I am often told how “we are stuffed” because household debt is through the roof. The chart below certainly seems to support the concept. The threat is of course partially real – muppets with leverage and belief (hope) that assets always go up in value are extremely exposed.

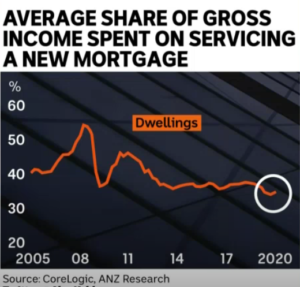

But, the BIG BUT is that assets are costing bugger all at the moment. A $250k housing loan is probably costing you less than $200 a week to service. If you have a rental property, then provided you have a tenant – and they are paying rent, you should be sweet. Even your own digs are costing you less to service than ever before. The second chart shows this very clearly. Just as well, since wages have done bugger all for years now, and even the fat cat bankers are doing it tough with bonuses looking like they will be lower than Trump’s ratings. Maybe…just maybe we are collectively smarter than we think we are, are if you are going to borrow, why wouldn’t you do it now? Shit, even the Federal Government is getting the picture. At least borrowing $100 billion at the moment is costing them less than a good sports rort. Better still, the RBA have effectively capped term rates for at least the next 2 or 3 years.

RBA’s Deputy Governor made it clear in his speech yesterday that he expected ScoMo and Josh to spend the dosh.

Recent research is showing that RBA’s actions over the last few months are equivalent to having RBA cash rates at a negative 1.0%. Makes sense to me, and I remain convinced RBA would prefer to rachet QE style up rather than corrupt markets by actually going negative.

Thus with capital so cheap maybe (just maybe) assets can hold up in value. Yes, artificially propped up like a dead man at Bernie’s for a weekend.

Banks are saying that bank balances are increasing. Certainly that is partly a response to fear. But we all know the nephew that was doing two casual shifts a week, earning $300 a fortnight, suddenly getting $1,500. Good “work” if you can not get it…

We get absorbed into our own backyard, but it is important to remember that we are not an island…well yes we are, but no we are not.

The time frame for the cliff is pretty much the same around the world. Pete Townsend, the head of The Who is totally different from Dr Tedros Adhanom the head of WHO. I won’t get fooled again. Teddie, is crapping himself that globally we are not on top of this Covid thing. USA, Russia and Brazil’s issues are well known, but what is happening in the emerging and third worlds are not getting the same air-play. Speaking of Russia and the USA they are having a bit of a spat at present, but humour is always not far away…:

If anything highlights the differences between Oz and US of A the two photo’s below explain.

First one is Average Joe telling our Prime Minister to get off his newly seeded lawn. Fair ’nuff I say. The second is a Missouri home owner and her husband also asking protesters to get off their lawn – the man with the red bag is wielding a very dangerous microphone. That would explain the need for a semi automatic machine gun response…

Any which ways…back to the markets.

AUD sitting at 69 cents and seems to still be in no hurry to move in either direction. Gut feeling is that the USD may weaken in the next few weeks and thus the AUD could head a few cents higher.

5 Year swaps at under 0.40% plus any execution margin.

90 day BBSY 0.15%

Let Black Swan know if you want a focus on any specific market – our aim is to please or offend.