Are we there yet? Edition#19

30 October 2020

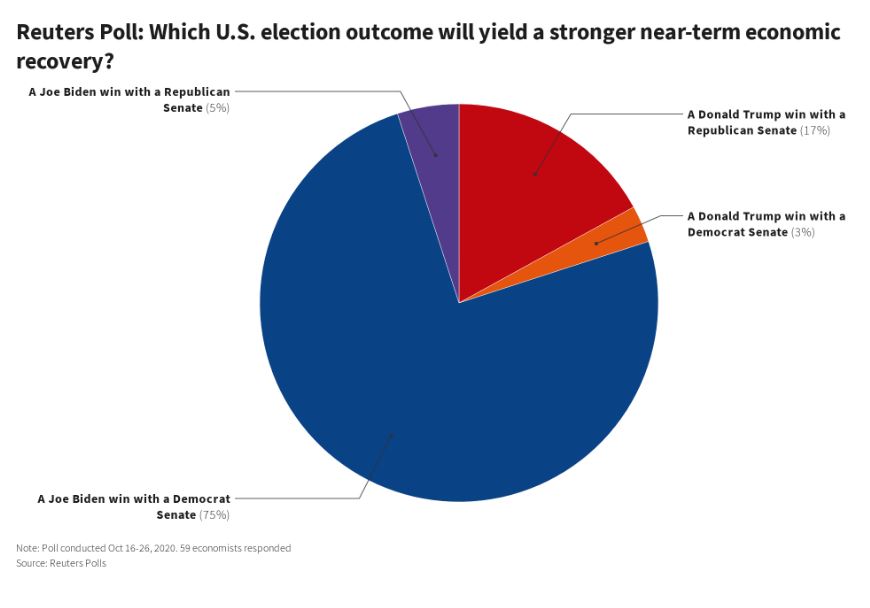

A week out from US Election. Sportsbet have Trump at $2.70. Yep, I know polls and bookies are no reliable signal, and Trump had a better week. Almost Presidential in the last debate, he does make Biden seem well…sleepy. Not helped when Biden actually forgot Donald J Trump’s name in a 60 Minutes interview. But this is not 2016. Covid is rampant over there and Trump is seen as inept and ineffective in handling it. The economy is on its knees as a result. Overlay that with racial tensions and to me the people are seeking some peace and quiet. Biden (unlike Hillary) appears to be in the right place at the right time. A blind, three legged cat would also be hard to back against. Almost half of the entire 2016 voters numbers have already cast a vote – and would be overwhelmingly blue.

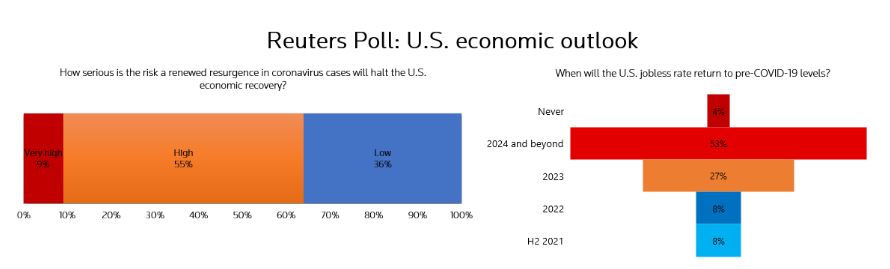

Regardless of what we each think – the market has spoken. The money overwhelmingly wants Biden in the Oval Office to help splash the cash.

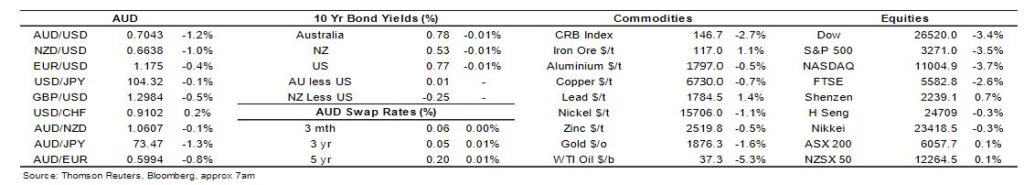

US Share market has had a shocking week, based on Covid surge and potential stimulus delays.

Interesting snippet – between 1950 and 2019, October 28th was the best performing day of the year for the S&P500. It fell by 3.5% on Wednesday. But as Warren Buffet said…”if past history was all that there was to the game, the richest people would be librarians.”

They want the blind, three legged cat to win both houses.

You reckon Fauci might be having a chat to Trump next week?

Bizarrely, as often happens, the wild market ride sees a rush to buy USD. With the USD higher the Aussie dollar dropped a cent to mid 70 cents and remains there today.

The kick higher in USD didn’t help the gold price though and it dropped a bit. It has fallen though a 100 day technical support level – one to watch.

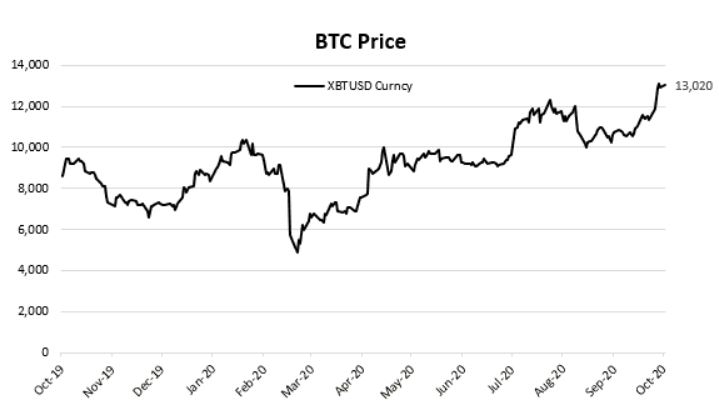

Black Swan is old school and wants to own the shit I buy. Thus Bitcoin remains a folly to me. But real money is in it, so need to cover it occasionally.

Like vegan’s, anyone that has one will tell you…price has more than doubled since February. The future looks bright…doesn’t it?

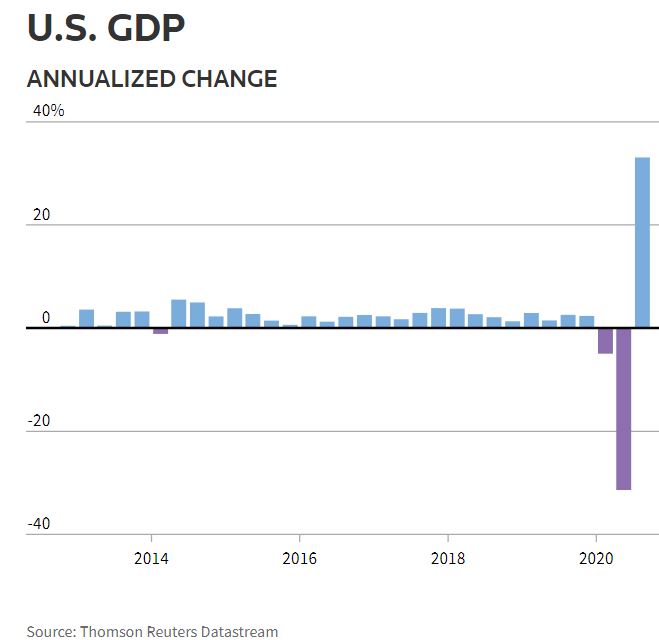

US GDP figures grew by a record annualised 33% last night for Q3. A jump that Trump will no doubt highlight, as against the historic dip in Q2. Markets finally saw a equities kick higher though, albeit smallish.

Our yields remain comatose. Big jump higher in Aussie Headline Inflation this week has been largely discounted as against the more stable Trimmed Mean (0.7%). Petrol and Childcare the main drivers here – pun intended.

As flagged last week, next weeks RBA meeting will most likely see a rate cut to 0.10%. And as flagged last week, it will do dick all.

One to watch might be BBSW if it heads negative, then Black Swan has lost a few bets – again.

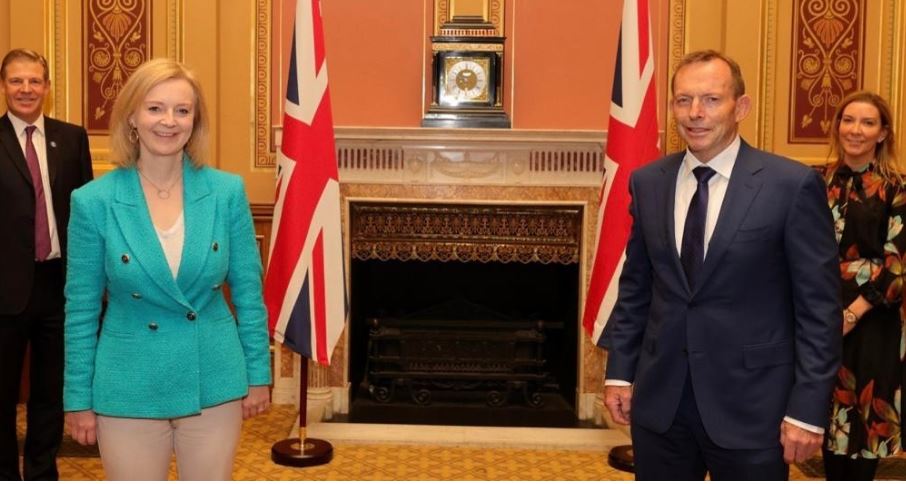

The UK Board of Trade formally introduced their two key experts that joined this week. Seeing old wing-nuts in a picture was just good for the soul – oh how I missed him. He looks so relaxed and loose.

In the roll out they announced “the UK push new frontiers in a range of areas and take advantage of new patterns of trade. For example, we can take advantage of the global shift towards low carbon economies – estimates show that UK exports of low carbon goods and services could be worth £60-170 billion and support around 2 million jobs by 2030.” Interesting since Tony left the country with the tenth highest sunshine hours per year globally, but had no interest in low carbon at the time. God no. Also wonder if he closed his ANZ account before he left? ANZ have announced they will be out of thermal coal by 2030.

ANZ also reported a 42% fall in profits to $3.6B, but within that bad headline number there is a lot to like about their result. They also have a truckload of provisions set aside for future bad debts. With Victoria on the recovery at last, there maybe some good upside in banks. ANZ shares down 2% odd – broadly in line with market.

Apparently Boris Johnson had a chat with ScoMo this week, confirming that he joined the 2050 zero emission camp for the UK, and asked ScoMo to get on-board. ScoMo faked a bad line and hung up.

Thought of the week – Who can it be now?

I worked for many years where trust was key to your success. Yet phones were taped and all deals reviewed for shenanigans.

Ethics have always intrigued me – yet I was far from a goodie goodie. My record keeping was often very poor. Mainly a factor of lethargy than apathy.

I heard Ken Henry speak this week on ethics. Ex senior Federal Public Servant, he gave it to politicians for diminishing public trust in government. Particularly interesting given Ken was rissoled from his NAB Chair position in the Banking Royal Commission when he consistently gave the finger to Black Swan’s dream date, the wonderful Rowena Orr QC.

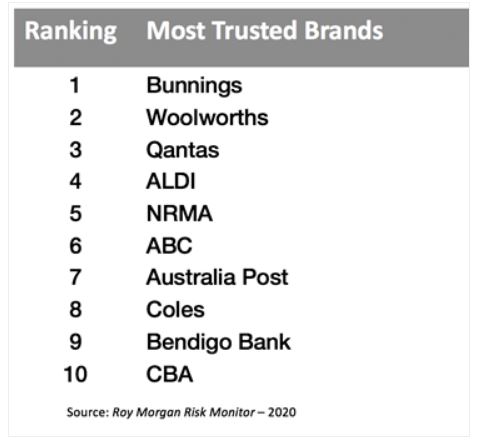

What is beyond doubt, is that Australians trust media less know than anytime in history. We equally don’t trust our politicians (and thus the system they work in) nor many brands we use. Roy Morgan have the top10 brands as follows:

Black Swan must be different, because I’m not really a fan of too many of those either.

Anyway – back to trust. Deloiite’s is a name most would trust. They have just released a 76 page report on the economic and social benefits of ethics in Australia.

It is a dry read so I will save you the trouble. They presented a thesis that improving Australia’s ethics by 10% would see individual, business and economic value increase by $1,800 per capita – a massive $45 Billion….well a massive number pre-Covid.

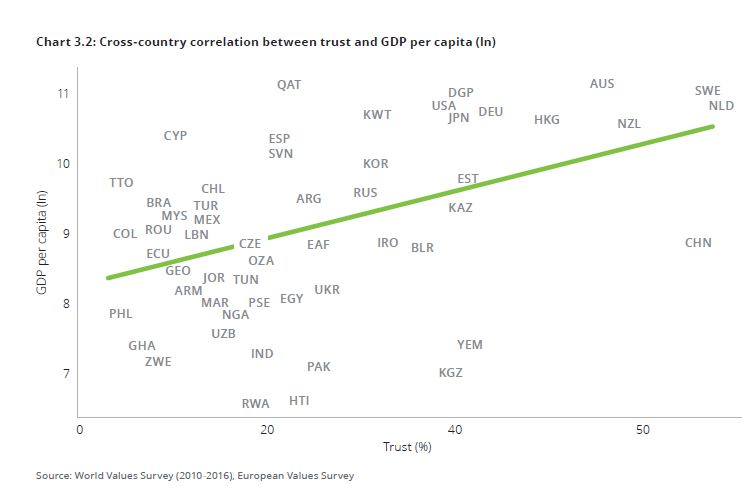

At present only 56% of us think most people can be trusted.

So we need to be more Sweden and less Qatar.

The outlier below to me is China – very high in trust. Must be because they get shot if they say otherwise.

At 2016 we were at 54% vs USA at 38% – but I suggest USA will have dipped massively in the last 4 years.

My personal view on all this from ex Banking/Finance perspective? The “easy” approach has been to demand more regulatory oversight. More rules = more compliance. Governments and CEO’s jump on this easy one…albeit with notable exclusion on a Federal ICAC!

From what I saw over many years, was extremely smart people with a large financial reward available are smart enough to work “under, over and around” regulation to an end result…and often at the cost of truly ethical delivery.

The biggest ethical police force available is your work mates and peers. If they are doing dodgy deals then it becomes almost inevitable that you get drawn into that mire. If they scorn or castigate wrong doing, good chance most will stay on the straight and narrow. For that to happen remuneration must be tied to broader delivery measures and higher management need to actually behave like they preach.

Sweden maybe a step too far in the short term, but surely New Zealand must be in our sights?

Speaking of New Zealand, I heard this one last night:

Q: How did the Kiwi farmer find his ewes in the long grass?

A: Very satisfying

What is BS drinking?

I haven’t pulled the cork out of this puppy yet, but have definite plans to sample the joys tonight. Given to me by one of the cygnets it is young, and the winemakers haven’t been around long either – winners of the Young Gun award last year .

A blend of interesting varieties from Watervale SA. 35% Sangiovese, 34% Grenache (from 85 yo vines), 17% Malbec, 9% Sciacarello & 5% Carignan.

Looks light, but should have good flavour to match a pizza post Friday night beers.

Listening?

Actually been listening to some podcasts the last few weeks – as I said to someone last week…”its like reading a book for lazy people”.

I always thought Jealous Guy was a Roxy Music original, but alas not apparently. The Melbourne Group, The Teskey Brothers covered it this year. Lead vocals drip liquorice.

In emergency…subscribe….

Until Next week.

BS