All you need is love, love….love

8 October 2020

Black Swan has a wedding anniversary this weekend. The care is there.

Speaking of care, what a week for our special needs friend, D J Trump. Ratings for “Who wants to be a President” reality TV were falling, so he generated another twist to the saga. Initially it looked like he was going to behave like a chastened child, but he has lurched back to “normal” pretty quickly with claims that Covid is nothing more than a mild flu. I reckon there is 200,000 ex-Americans that might disagree with him…but wont be voting next month anyway.

The initial contraction of the disease seems to stem back to the Rose Garden event, with no masks evident anywhere. Picture below is a few days old now (a couple more to add), but clearly getting front row seats to that event would have been less than desirable.

Remarkably the US share market coped with all this with only a minor drop, even allowing for Trump shutting down the Democrat supported stimulus package. He has come up with his own better/improved version last night.

It was put to me last week, that the upcoming election may well be closer than many think – and don’t be surprised if Trump gets over the line in a last minute snatch n grab. What I do concede is that the polls are worth jack all, and Trump is if nothing else a fighter. Below are the latest poll figures – not Trump’s vitals…

His Achilles heel may be the growing inequality in the States. I read a very interesting article this week. It was focusing on two concepts, the first being that long term structural economic stagnation may be avoided given the massive fiscal stimulus that is heading out the door. That assumes that Trump supports – or he gets rolled in November and Democrats start pumping.

The second is the counter argument against the first. Covid highlights that human input can be just as effective from remote sites. Why not relocate such work to countries with cheaper workforces? In essence the ultimate out-sourcing.

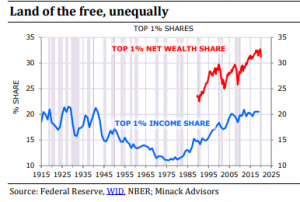

But between both concepts, were two interesting charts. The one on the left highlights the massive increase in inequality in the States that continues into the current post pandemic world. The top 1% of Americans have doubled their share of wealth (to a staggering 33% of the total pie) in the last 3 decades with only slightly lesser results to income share. How the rank and file US voters accept this is staggering.

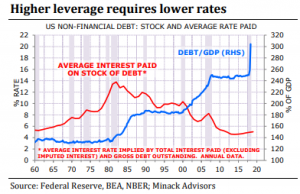

The right hand chart highlights two significant structural changes – to which I would think Australia would track very close to. The red line shows just how much and how long interest rates have been falling. The blue line is debt (government and private) to US GDP. Chart goes back to 1860 and frankly scares me. If the GFC was a debt crunch, what lies ahead?

Of course everything stays honky dory…provided interest rates stay at 2,000 year lows.

Related but separate was the release of the Aussie Federal Budget this week. The share market liked the big spend nature of it and pushed equity prices higher. No great issues against anything proposed and accept that you can’t hit every target. It appears they have taken a weighted view that throwing money at those with jobs may see a better return via the multiplier spending pattern.

From limited study though it is disappointing that a few more dollars could not have been found for social housing in this rare time. Once health care, policing and government benefits are allowed for, my understanding is that you get at least $1.30 back for every $1 spent.

A lot of focus on the budget deficit – and our children’s, children’s, children that will need to pay this back. Here again, Black Swan gets a tad confused.

With the deficit at an “eye watering” level of four times as high as per Australia’s response in the GFC, you would rightly be concerned. And yet the interest payments required to service this debt is actually less than the debt from 2008/2009. Reason being of course is the low rates at present. That is great and (refer above) provided that stays unchanged, whilst the economy recovers then Houdini really has pulled an elephant out of the hat. More likely this debt will be “inflated away” – when a few billion here and there gets lost in a much bigger picture (think 2050+) .But for that to happen CPI will need to go on a run…and with that interest rates. We end up again in a squeeze that will be unpleasant for some time. Best guess is that will be 2025 so we stay with wagyu and shiraz for now.

Thought of the week

I want to just quickly cover off on what I see as a potential “black swan” event…albeit it is hiding in plain sight for now. The political hot potato in Australia since Cook landed in Botany Bay, has been immigration.

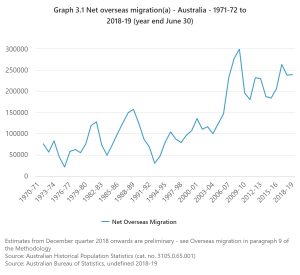

But like it or not it has been the major driver in economic growth, and no more so than in recent years.

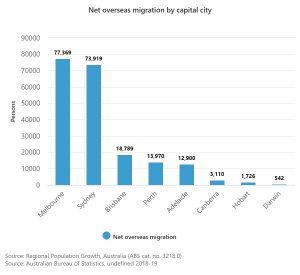

Let’s try and put it in perspective. Victoria has had net immigration intake that averages pretty close to 100k per annum. Some of these are on temporary visas, some are not. Each one however needs resources to survive here – housing/transport/healthcare/education/food. Simple maths puts this growth in Victoria at circa 1 million people in the last decade. Given the vast majority elected Melbourne (why wouldn’t you) – the city has added another “Adelaide” to its girth since 2010.

Figures from ABS support this broad calculation, and many say, this alone has been responsible for around 60% of Victoria economic growth over this period.

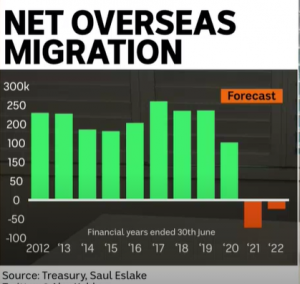

The chart below highlights that this gravy train is over – at least for a couple of years to come. How will Victoria – or Australia for that matter handle this setback?

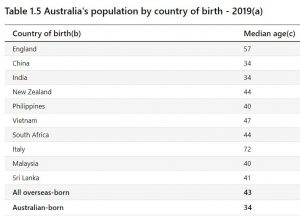

PS – The median age chart above has no relevance other than the constant search for the outlier. Take a look at Italy – median age of the average immigrant is 72. I am hoping/assuming that is current and not on arrival.

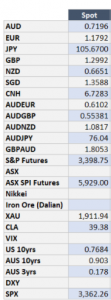

Markets

Oil has lost a bit this week. Inventory build up in the USA, and the assumed low future demand both worked against the price.

Gold has been steady enough.

Yields on long dated debt a little higher yet again, as the market expects Trump to get some stimulus through. Lots of reasons why yields should stay low for a long, long time…but watch for the boiling frog syndrome.

Has the chart above showed, our equity markets are stuck in a rut for now and will need something big to shake them out of current range.

Likewise the AUD tucked up in it’s doona going nowhere. .7140 as we write. Took a dip lower when RBA met on Tuesday but bounced back when they did nothing. Chance of a small cut on Melbourne Cup Day, but they are really just pissin’ against the wind now.

Big releases week just gone, so a quieter week expected.

Drinking a Toscana Sangiovese this week. Nice soft, low tannin red.

Very mellow to go with Van Halen’s departure from this mortal coil.

Jump…

Until next week – just remember

Black Swan