2021 Edition #9 – Happy (St. Pat’s) days are here

20 March 2021

Follow the rainbow…

Shorter report this week. For some years now I have felt time (like water) is under-valued. These reports were getting too long, so time to shorten.

What has been difficult is to separate “the markets” from politics….and to a degree politics from society. More than ever, politicians influence the markets, and political decision making is less than pure.

Domestically the Federal parliament is a shambles. Even a few of my friends that are ardent Liberal supporters are not pleased with the performance over recent months. Whilst I take the barbs of “your mob” poorly often, it is a badge I am happy to wear if it means I am a Centerist. I am as quick to say the Labor party has performed no better. Either because they are inept, don’t have the cattle or they are frightened of the large bag of skeletons in their cupboard. May be a combination of all three.

The issues are not unique to Australia either. Democrat (read Labor) Governor of New York, Andrew Cuomo is fighting a similar battle. Cartoon fits….sound familiar?

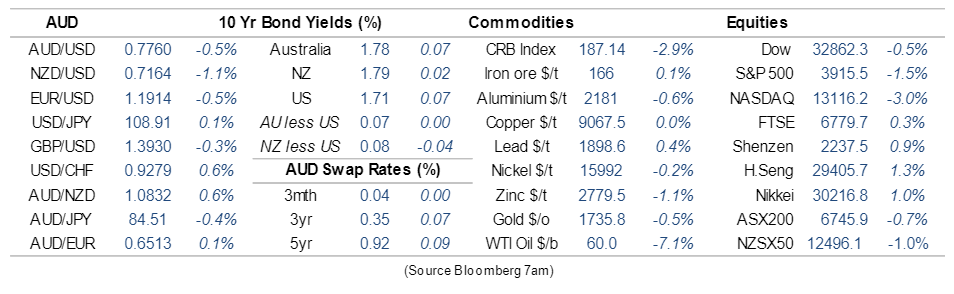

Speaking of lying, internationally the big news was the FOMC meeting. I don’t know why anyone was expecting anything different, but they stuck solid to the steady as she goes story. Much like our own RBA, they believe any evident inflation is transitory and the long run should see the inflation genie back in it’s bottle. And if it does poke its head out, they have the tools to whack it. Equities sort of liked the candy offered, but the broader market is starting to question WTF.

Not sure FOMC’s Jerome Powell was around then…but then again …

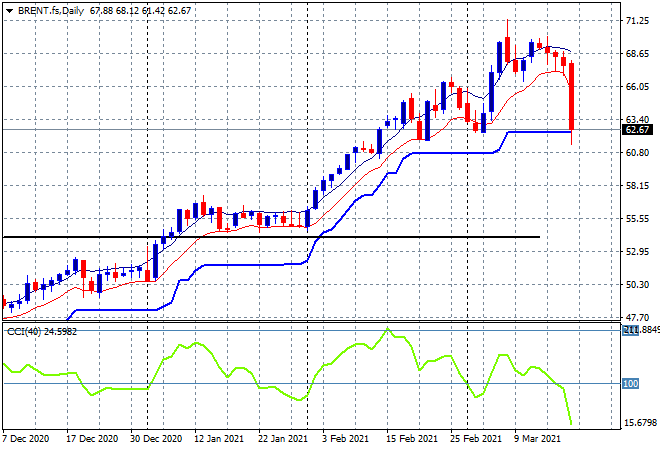

Oil price has been rising steadily on a weaker USD and expectations on a faster economic recovery leading to higher demand. That theory took a breather overnight when oil prices fell by 7%. Another French Covid lockdown helped the pull back. As an aside, I read that Shell has recently called “peak oil production”. This phrase was taught to me in school – but in the context of oil supply running out. Shell actually believe their peak production was back in 2019 and budget on production falling between 1% and 2% a year from here on.

Oil trend may have changed.

As an aside, the Victorian State Government are the latest one to flag the idea of taxing electric vehicles on a per kilometre basis. Discussed this last week, but absolute madness, FFS.

Maybe Fox News’ (no pun intended) Alan Jones’ plan to parachute Peta Credlin into the Vic Liberal Party to take on Chairman Dan at the next election is not that crazy after all. Of course her credentials on supporting carbon reduction may not be all that flash either.

Whilst on politics, the WA State election saw the annihilation of the Liberal party ending up with only two seats (but a perfect 50/50 gender balance target achieved). The then State Liberal leader included in his campaign a desire to do more on carbon reduction. Despite the thumping loss, Federal Coalition member Matt Canavan found a spin on the disaster that was unique. Sent after 11pm, perhaps a shandy or two consumed.

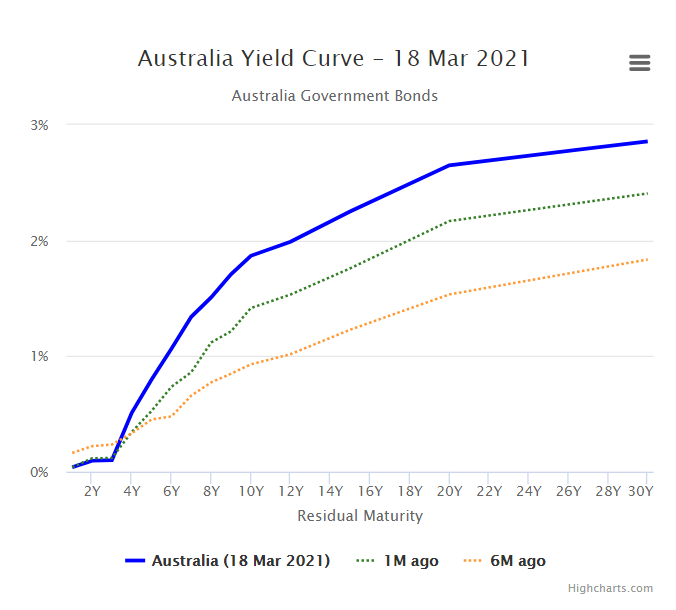

Noise about rising bond yields almost matches the hysteria of Bitcoin. The tech heavy Nasdaq needs cheap long term funding to prop up all those non-profit making companies.

Australian 10 year yields have DOUBLED in the last 6 months and look like passing through 2% in coming weeks.

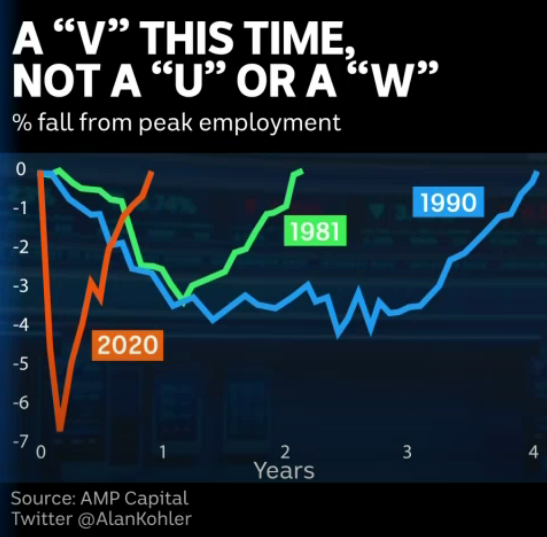

Of course the BIG news locally this week, was employment. The market expected an increase of 30K odd, but the figure was 88k. Very strong. Unemployment back to 5.8%

As we approach the end of JobKeeper, there are more people employed now than pre-pandemic. Quite stunning really.

Alan Kohler presented the data as confirmation that, unlike the last two recessions, we achieved a V.

RBA has said a number of times that unemployment needs to fall to circa 4.5% before it will have appetite for higher rates. They base this figure on their calculations of NAIRU (non-accelerating rate of unemployment). This is the magic pudding figure where everything is in balance. It does move and used to be 5%. I did read a snippet this week that RBA may have got this wrong. With international borders shut for some time ahead, 70% of Australia’s immigration was for skilled workers. With these not coming now or possibly until 2023, Australia may face a skills shortage that could see wages rise. Of course some wage increases would be warmly welcomed by many.

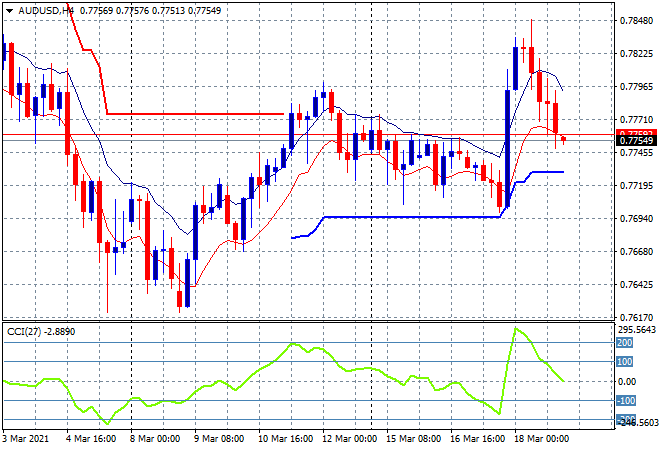

The strong employment data saw the AUD jump a cent, but it has been unable to hold the gain and ended the week but in the mid 77 cents. Same/same really.

One of my stock market nemesis, AfterPay took a hit to their share price this week, when CBA announced it would be launching their own in house Buy Now/Pay Later scheme. They will undercut AfterPay on fees and charges. Credit Suisse analysts believe the younger demographics of the AfterPay customer base will protect it to a degree. I agree, but their BIG issue is the other three big banks will probably follow. If you bought at $60 six months ago, I reckon it might be time to take profit and cash in your chips.

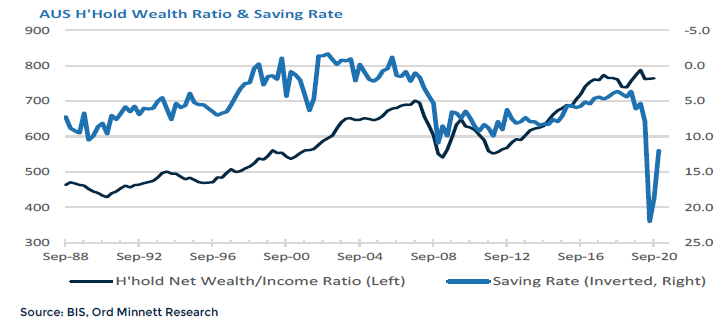

And finally, Ords had a chart that explained why we all feel so good. Net wealth has never been better (housing up, stock market up, superannuation up). So we are starting to eat our nuts…that we stored just in case. Savings ratio was well up mid last year, but our pockets are open and we are keen to spend. Friday’s retail spending data was soft, but that included WA and Vic lockdown. Should bounce next month.

Thought of the week. Tik Tok, what’s the time?

With such good economic news, you would question why I’m still cautious on the broader market.

A confession – I have always “understood” interest rates better than many other asset classes. And the bond market is telling a story.

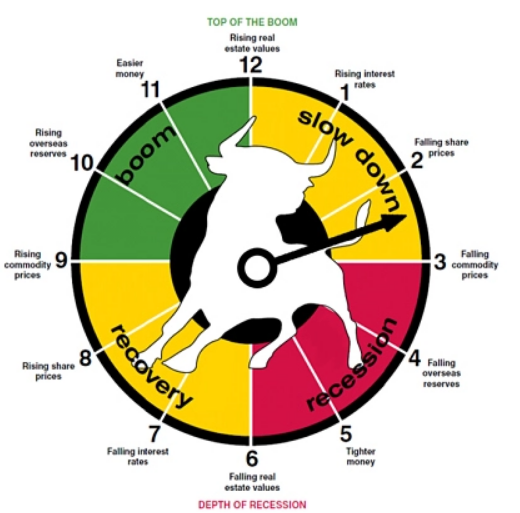

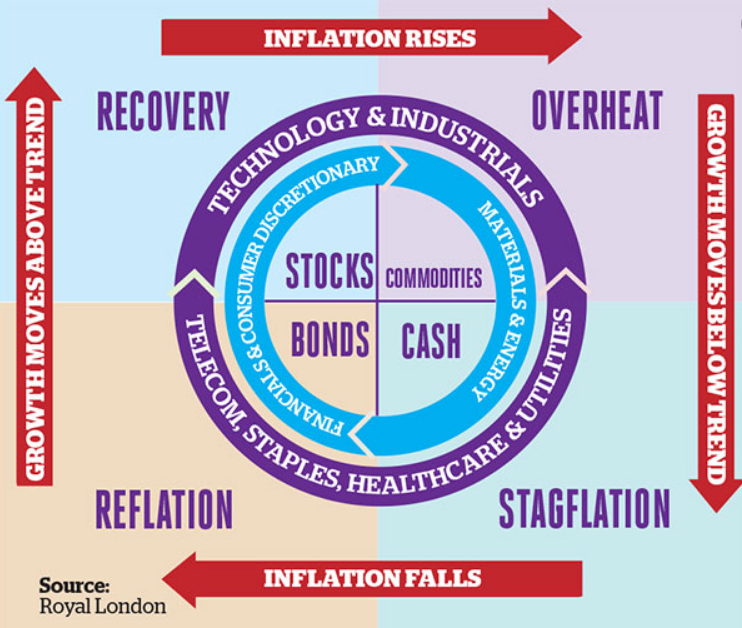

I have been thinking about the age old “investment clock” this week. What time is it Mr Wolf?

Firstly – I had an epiphany this week. Unlike home clocks that usually rotate at a very even 360 degrees twice a day, I have realised that the investment clock can speed up, slow down and even stop for a while. Recovery can take decades (1920’/1930’s) and booms can last longer than many predict.

So what time are we at? You can probably read time as well as I can, but based on the two models below, I am calling it bloody close to midnight. Pull the punchbowl away from the drunkards and send the pissheads home.

From the equities perspective, the good news is that you may have until 2am before the ambulance is called.

So what date is 2am in the real world? If I knew that I would searching for my private island in the Bahama’s now and getting the staff ready to look after my every whim.

But here goes : Like the real world, often the difference between midnight and 2am goes quickly. As my mother used to say “nothing good happens after midnight”. I see November 2021 as the time of reckoning.

Many things could happen between now and then to make that prediction look lunacy.

Happy to hear your counter views and perspectives.

Paris may be in Covid lockdown again, but the fashion week went on anyway. Not sure that they all kept 1.5 metres apart. Looks to me like they are wearing people this year – must be a cold snap expected. Anyway, that fashion is old hat.

On the political scandal front, a no contest this week.

You think of the Dutch, and you think of wooden clogs and windmills yah?

Well anyone that read the historical account about the wreck of the Dutch vessel Batavia off the WA coast, know that they are hard buggers, especially in the 17th century.

It was a Dutch Republic in 1672, and Johan de Witt was Prime Minister. They were under the pump from France and England. The public thought de Witt was not handling the role well.

A militant mob shot and wounded de Witt and left him to the crowd. He was stripped naked, mutilated and his liver removed and eaten. Many say the House of Orange (the royal family) was instrumental in inciting the mob but never proven. How ironical were the similarities with Jan 6 in Washington and the Trump House of Orange…

What is Black Swan drinking?

To be fair, this one was on the back of a few Mismatch Lagers, so the palate may not have been what it should have been.

Mate bought it, and on research it appeared to be a $100+ bottle. Only that was the Volnay cru, not this dodgy generic version…

Critics say “Attractive nose with lots of bright red fruits. Plush and juicy on the palate. This is quite tasty and gulpable. 86-88 points.”

Gulpable or gullible, it was “free” so the score goes up a notch or two.

8/10

And listening?

New release from Melbourne band Big Scary. Nice beat. Band title in tune with my market view.

I’m so looking forward to this argument again in the near future…

Cheers BS