2021 Edition #8 – It’s not pear.

13 March 2021

RBA Lowe?…

I’ve had a week on the tools. Proper tools. Crowbar, spade, mattock stuff. Two things emerged. Firstly an absolute admiration for those that labour for a living, and secondly it was good planning and luck that I ended up in a white collar job.

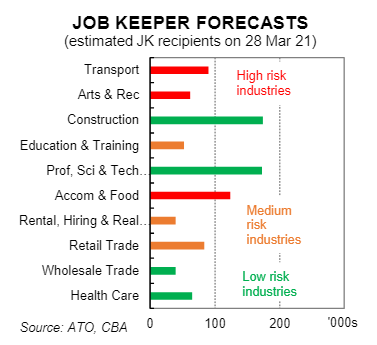

We are inching closer to the precipice of the removal of JobKeeper. It has been identified as a key hurdle that Australia needs to clear before we can be confident that recent positive economic events are not a dead cat bounce.

CBA has done some research this week on likely effect. They believe the number still on JobKeeper has fallen from 3.6M in April last year to 900k at present. They further estimate that circa 10-15% of these may be at risk come month end. Adding 100k+ to April unemployment figures would clearly be nasty. The big BUT though, is that some of these recipients may step away from employment for some time, and others will get snapped up quickly as businesses continue to expand, as shown in a very healthy NAB Business and Conditions survey just out. ANZ believe we could be back to pre-pandemic employment within the next 24 months. Sectors at risk come month end are seen as transport, arts and pubs/restaurants. Perhaps supporting the federal government’s latest travel initiative.

Westpac dropped their 2 year fixed home loan rate this week to 1.79%. Many readers here with substantial $5m+ loans are probably raising their eyebrows at this point. Their commercial/corporate loan margins are probably at that level. So the part time car detailer from West Shitzville getting this as an all up rate could annoy you. Of course, home loans are the sacred cow of Australia, and defaults are historically minimal. Thus the portfolio risk is much lower, and APRA allow banks to allocate much less capital to that risk…..meaning cheaper money.

All asset prices continue their merry run. Alan Kohler highlighted that Sydney prices are back above the 2017/18 dip. The story of houses being sold at auction well above reserve seems to be nationwide.

I was asked last week, if you were “short” the housing market now, would you buy in quickly, or wait for a “pull back”. Bloody tough question, and to be honest I’m not sure. Houses certainly are not Bitcoin, but a run higher seems likely in the short medium term. After that????

Whilst talking banks and home loans, the below is all via thoughts of Martin Conlon, Head of Equities for Schroders. Sometimes someone can just put it better than you.

“In attempting objectivity across all sectors from a sustainability standpoint, we have no idea why pumping another $100 billion of additional lending each year almost solely into unproductive house price gains to foster increasing inequality should be considered differently to fossil fuel usage.

Our thinking and valuations have always been premised on the assumption the periodic losses which banks suffer as a result of making poor loans are the primary deterrent to poor lending behaviour.

Removing the losses removes the deterrent. Bank share prices have become ever more dependent on house price direction given the heightening proportion of loans deployed against the sector. Rising house prices equals safer loans. Depositors, via the RBA, are effectively being forced to provide free capital to enable borrowers to purchase some of the world’s most expensive houses. This assumes that ridiculously low mortgage rates will permit borrowers to service the debts, with resale offering the only realistic prospect of repayment. In this scenario, it seems unwise to extrapolate these current circumstances into perpetuity. As a strategy for sustainable policymaking, this seems to resemble the abandonment of renewable energy in favour of large-scale coal-fired power stations.

The ever-greater doses of manipulation that will be justified in holding together a financial system that has lost most connection with the real economy (the bit that actually matters) seem likely to create ongoing, not to mention potentially violent, mood swings. It is always useful to remember that ongoing RBA bond purchases are just turning the bonds someone used to own into cash. In turn, this cash floods the banking system and is mostly redeployed into investment assets such as equities and property, not taken down to Bunnings. “

I did once work with a State General Manager of a big4 bank who whispered in hushed tones to me that bank lending to housing was indeed the biggest Ponzi scheme of them all. Banks lend $100k for a house build in 1990. The house gets sold in 1995 and the buyer borrows $250k to buy it. In 2010 they sell it and someone borrows $750k and again in 2020 a loan is written out for $1m on the same house (with maybe an extension added…). The bank (s) have lent 9 times as much as original loan, on exactly the same asset.

Years ago I investigated how the Aussie market might make a derivative market in housing, where you could buy or sell $100,000 units in residential property. Got some interest, but the key sticking point was how you homogenise housing. A three bedroom one bathroom house in Hobart will appreciate/depreciate at vastly different rates than a two bedroom two bathroom terrace house at Paddington. If anyone can get something to solve that problem, they will have a winner.

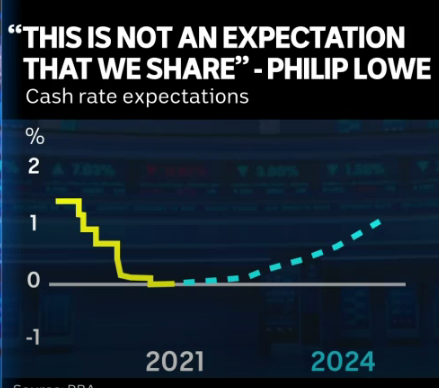

As has been highlighted often here recently, asset price will hold up as long as rates remain at current levels. Think for a moment what house and share prices would do if RBA highlighted a likely rise in cash rates to 4.5% over the next 12-18 months. Remembering that rate was until recently deemed the neutral (Goldilocks) rate. We all agree carnage?

Thus, much like the US Federal Reserve, the RBA find themselves either deluded or trying to delude the public. Bond markets here and abroad are saying that cash rates need to rise well before central banks are signalling. RBA speech this week, our Reserve Bank governor Lowe strongly re-iterated that he believes his boffins are right, and those investing their real money are wrong. I hope with all my heart and superannuation policy that he and the Federal Reserve are right. The alternative scares the hell out of me.

A growing number of smart investors I follow though are tipping out of investments and heading into cash, expecting a massive correction. I know they are right – but in 2021 or 2024 ??

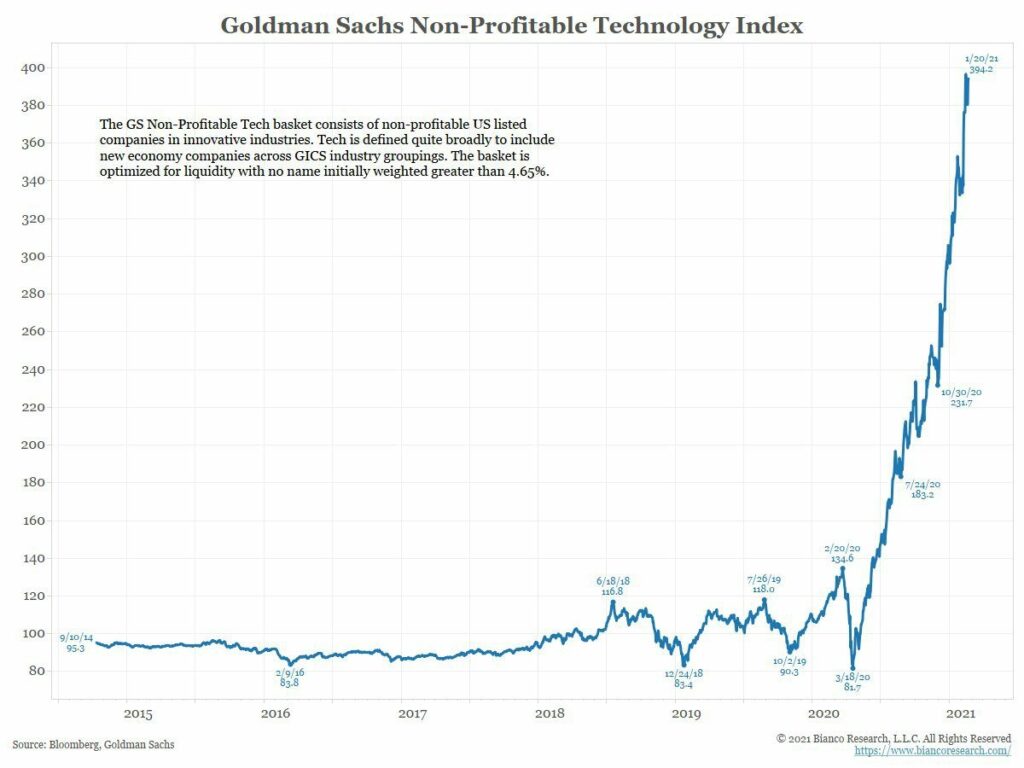

Chart below is not Bitcoin, but well could be. It is the share value of US listed tech stocks that (as yet) have not turned profit. Locally, an example may be Afterpay.

Fly me to the moon…

If we quickly jump back to the USA again, this chart is THE one that really scares me. “This time is different” must come into play, or we are all on borrowed time. Historical cycles show that as interest rates go higher – or are expected to go higher in the future (represented by red), the business cycle falls, represented by US share market in blue. Usually one goes down as the other goes up…..both are climbing in sync now.

There is a possibility that the red line will fall as nervous bond traders relax. If not, the alternate presents.

For the glass half full readers, discount all the above and just focus on cheap and unrestricted capital, pent up consumer demand and abundant labour (with costs not growing). All the ingredients for a long and sustained economic growth cycle.

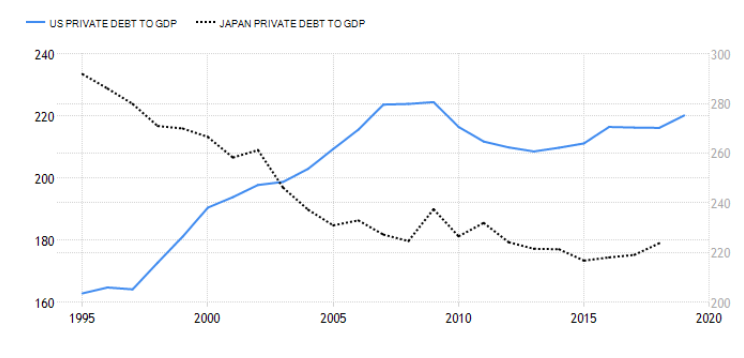

For example, I barely covered Japan over the last 3 decades. It went into a Snow White coma and did stuff all. In fact their share market fell by 40% between 1990 and 2018. That, despite rates being nil or negative. They have however clawed nearly 30% of that loss back since 2019. Some smart money people are saying they may well outperform many western economies over the medium term, if the cycle goes long. That theory is based on the fact that their private sector has managed to deleverage very nicely over many years and will thus be largely immune if (when) higher rates eventuate. Chart below shows that very clearly;

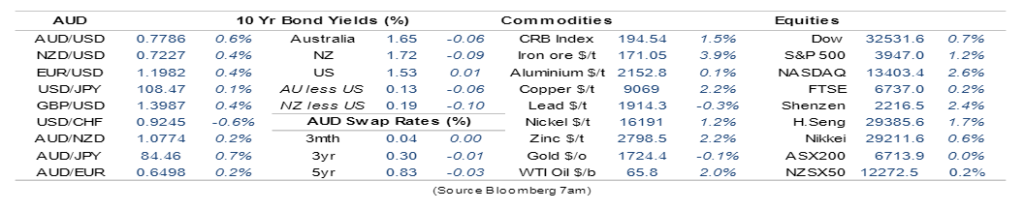

Iron ore had a volatile week, dropping 7% and then staging a recovery.

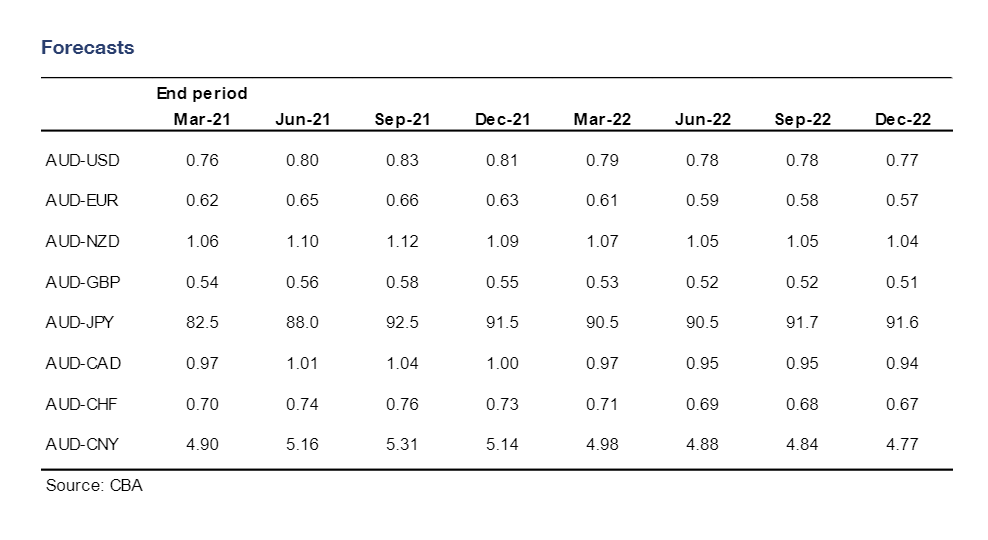

Aussie dollar likewise pulled back a bit before having a hard run into the weekend, back to .7750. CBA updated their forecasts this week on the USD and for the AUD on the crosses. Generally higher. 83 cents by September. Importers remember the age old axiom though….”the Aussie dollar goes up the stairs, but down the elevator”. I’d be starting to average in some hedging now if not already started to do so.

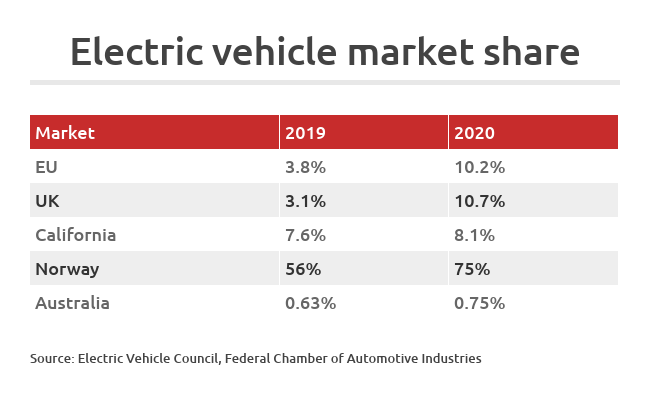

Saw the chart below that is worthy of sharing. Michaelia Cash’s election rant (“their coming for your tradies utes’) was entertaining, but she must have known the tide is changing despite her nonsensical claims. Norway is full whacky, so maybe disregard them, but you can see the massive swing in Europe and the UK. Would love to have seen China’s take up as well.

Vroom vroom

Thought of the week. Who is Greensill? What is Greensill?

As a short lead in, I have long been a fan of Julie Bishop. Smart, articulate and well balanced are words that come to mind. Her thoughts on recent events in Canberra seem on point…..

She said the events in federal politics of the past few weeks made her feel “very empty” as an important opportunity for Canberra to reinvent itself was lost.

“If Canberra is where the laws are made, surely Parliament House should be the model workplace and clearly it is not..”

All good, but I’m not as convinced she knows a shitload about supply-chain finance. Decades in finance and banking and most of that is a mystery to me. Yet until this week, she was a high paid consultant to Greensill Capital.

I do subscribe to the theory that if we paid our top politicians more salary, we may get better candidates, than the stream of muppets we seem to be getting from both sides. But how I feel about ex-politicians selling out and collecting big coin as lobbyists is mixed. Especially when the company they are lobbying goes arse over tit.

Greensill Capital is (was) a global giant, started from humble Bundaberg beginnings by Lex Greensill. Their business model from what I can gather is a “reverse factoring” cash flow. Rather than the supplier selling their invoices for early payment, it is the customer that originates the transaction. It is a relatively new model…that appears to be not ageing well.

Unfortunately Australia’s steel industry is now right in the mix, given Whyalla’s Sanjeev Gupta’s GFG’s liability to Greensill which filed for insolvency this week in London.

The sums involved are mind blowing. John Hempton from Bronte Capital here in Australia wrote to APRA late last year, inquiring (warning) about the risks that he saw.

It all ticked along nicely, but the reverse factoring wheels rely on oil supplied via insurance policies to under pin the transaction.

The insurance company gets a small clip on the way through (if all goes well) and should have re-insurance in place for larger exposures. Hempton believes Insurance Australia Ltd had an exposure of AUD $4.4 Billion. No chump change. And that is just one.

Credit Suisse are knee deep in it courtesy of letters of credit advanced to a Greensill owned German bank, and ultimately the courts will decide who owns the risk/loss. I hope you are as confused as I by now.

I always thought that if you owed a truck load of debt (like GFG) and the financier went belly up, then all is good? Debt forgiven/forgotten…

Apparently that is not the case legally, and GFG need to find a “proper” financier quickly or they will be tested as well, and dominoes may start to fall. Confusing but important to watch.

No political scandals to match off this week. Time is up.

I will leave with a couple of memes from the Royal interview…which I didn’t watch…

What is Black Swan drinking?

Back to my McLaren Vale grenaches….well Blewett Springs to be exact. They say : “Big, rich, sinewy this old vine Grenache offers bright, bold fruits and a fine weave of tannin along with excellent acidity. The result is a red and blue fruited beauty which is mouth watering and persistent.”

I shared the 2016 with a winemaker friend of mine. He thought the fruit shone through very well and noted the tannins were very much reduced into the background. Just the way I like it. Bought a 1/2 dozen at circa $50 a bottle.

9/10

And listening?

Probably not appropriate, and the band definitely not politically correct for 2021. Released in 1979, it radomly appeared on my playlist this week, and I just immediately thought of Christian Porter.

Cheers BS

Cheers BS