2021 Edition #5 – Did we nail it?

19 February 2021

Wait..Valentine’s Day – better check with Jenn….

I bought my Valentine a balloon as a present. Unfortunately I lost it as I stopped to pick some flowers.

Potentially the last update from Black Swan. Call to my mobile twice this week indicated that my tax file number had been frozen, and a warrant has been issued for my arrest. Surely these scams don’t catch anyone anymore? Better scams out there anyway. Eg Bitcoin.

Apparently I had a bet that Bitcoin wouldn’t hit $50k USD by year end. Not sure it was offer and acceptance, but a 80% increase in 6 weeks, saw that barrier broken.

Reuters reported that Anthony Scaramucci, founder and managing partner of hedge fund SkyBridge Capital and former communications director under the Donald Trump administration, also told CNBC in Wednesday he sees bitcoin hitting $100,000 per unit before the year ends, citing supply and demand. If you saw “The Mooch” on TV recently you would surely take that as a strong sell signal.

More on that later in the thought of the week.

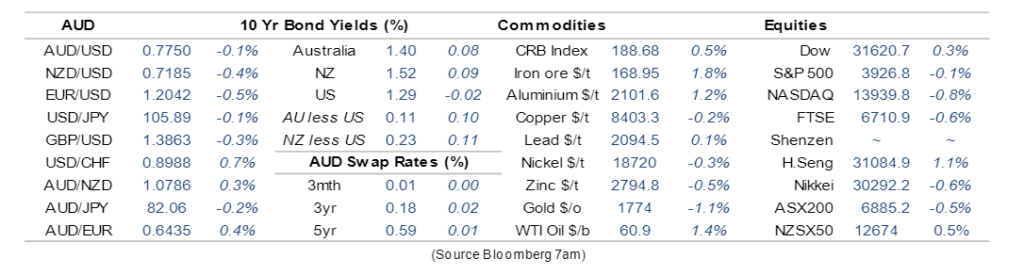

Markets wise it was another solid week.

Westpac had a huge Q1 with cash earnings up over 50% and beating the matching quarter last year pre pandemic. Major driver was increased home lending activity. Shares up 5% on the news. Some may remind me that I sold bank shares last week because they were “toppy”. Hate the player not the game. As was written by W B Yeats – “…The best lack all conviction, while the worst are full of passionate intensity.”

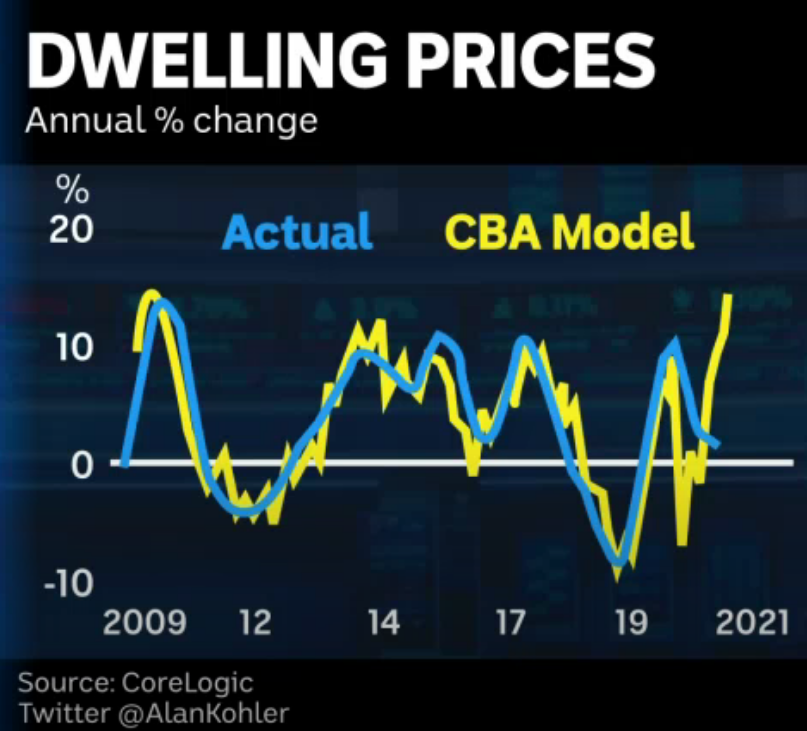

Wetpatch was not the only bank to flag big mortgage growth. All are seeing it, and my insider at AMP Capital reports they are bullish on future house price. They join a long queue, with CBA long term modelling telling a picture:

RBA are now spinning concern about future housing affordability and household debt levels, albiet you could argue they are the main protagonist. IGA are doing their bit for affordability though:

IGA smashing it.

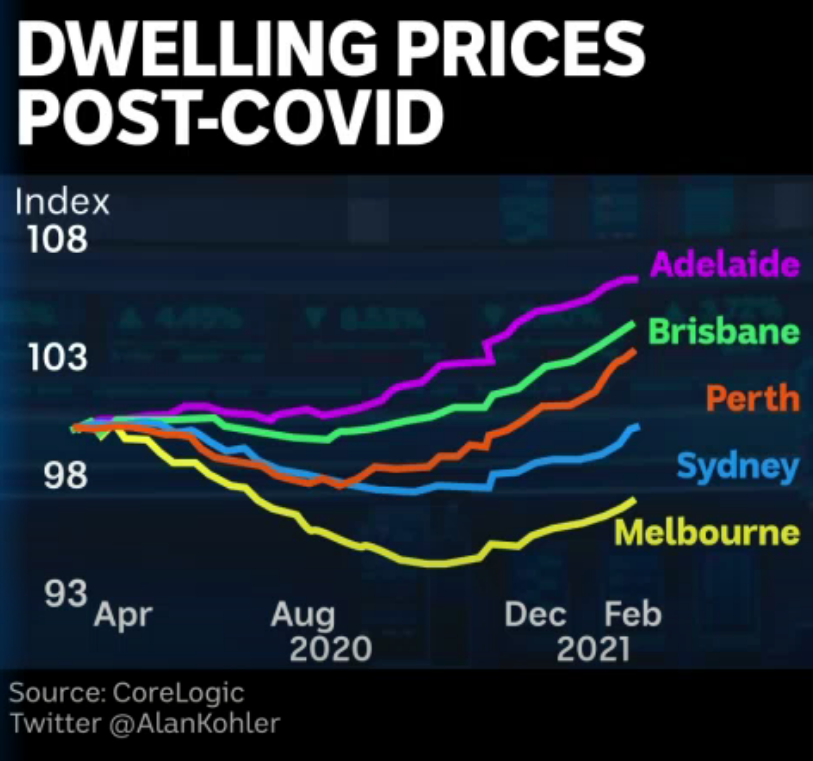

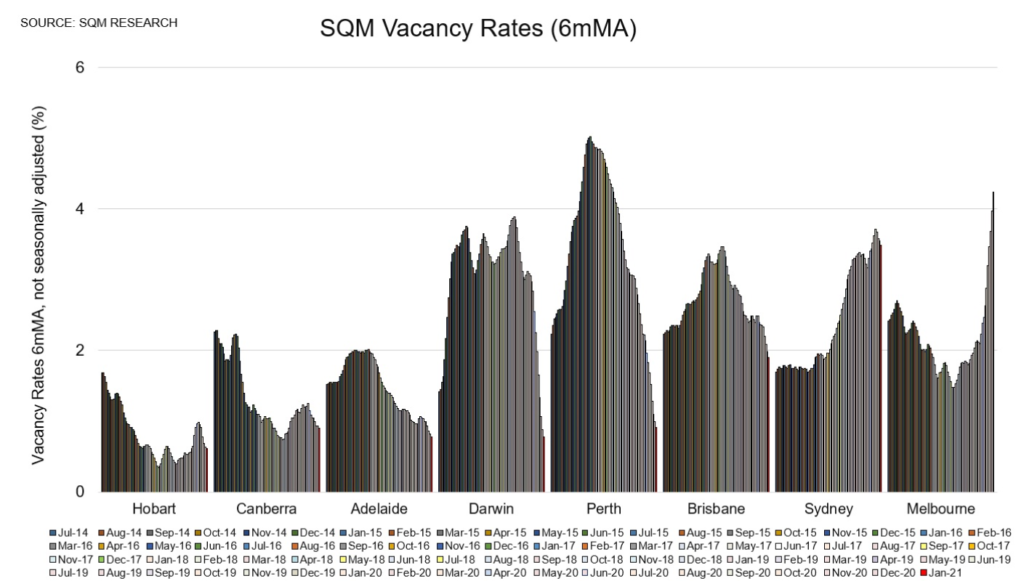

Certainly low rates are playing a part, but the pandemic has seen an interesting structural change with former cellar dwellers now outperforming the glamour cities. That may be sustainable for some time if you look at SQM’s recent survey into residential vacancy rates around the States. Note fringe States falling whilst Sydney and Melbourne rising. Rents are climbing too to reflect. Lack of migration and decline in overseas students may also be contributors.

Unemployment levels fell again in January – down from 6.6% to 6.4%. More pleasing was that most of the jobs created were full time (part time fell) and the all important under employment level is lower now than pre pandemic.

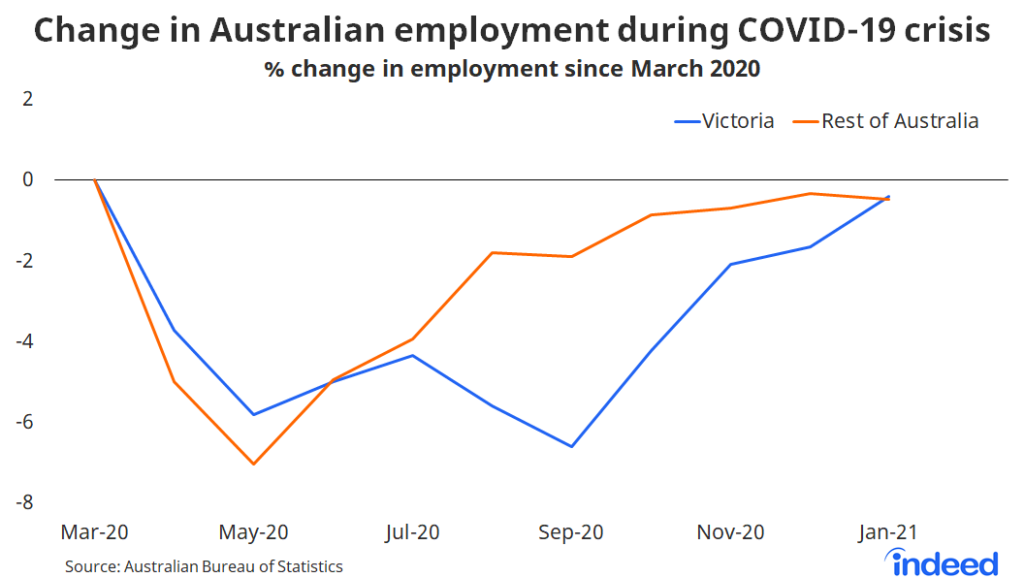

A number of my associates in Victoria are, shall we say, not huge fans of Chairman Dan. Lockdown #3 is now finished and the damage will be notable but recoverable. In fact Victoria generally are now on par.

So equities going well, property booming, commodities being shipped to China in bigger quantities than ever. As Moby would say, “why does my heart feel so bad” ?

Mainly because I fear the dark. I fear what I can not see. I fear what I can not yet feel. What I do know is there are unknowns. The VIX index is sometimes called the “fear” index. US based, it tracks volatility and spikes high when risks appear and falls when all is calm. You can see the hiccups during the GFC and initial Covid outbreak. We are now well back towards “calm” territory. And it is the times of calm that I get most concerned. Black Swan is the nature of expecting the unexpected.

Thought of the week. Gold…gold…gold

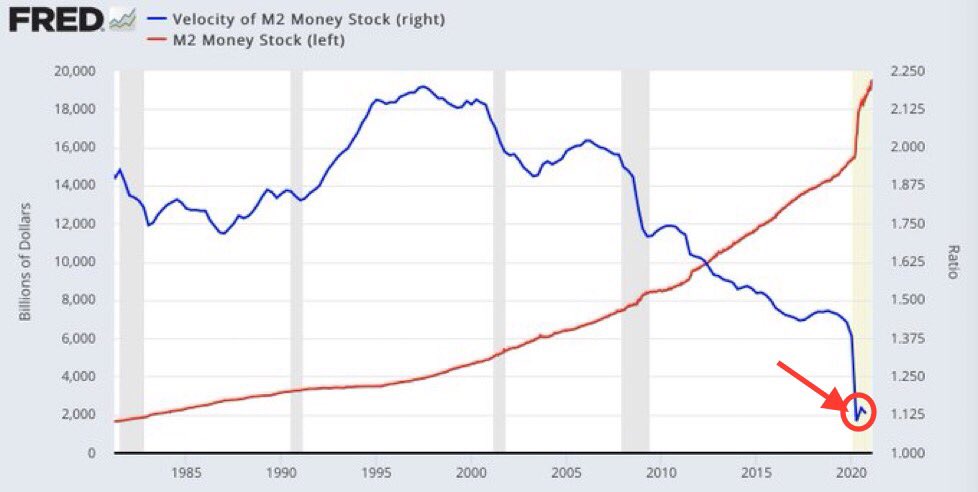

The nature of unexpected is in the words itself. That said, if I was to channel the vibe of “we the few surviving bears” it is the massive amount of cash being injected into global markets. Much of this is just ending up in the pockets of those that least need it, thus is not being spent. That is measured under velocity of money, that I have talked about previously.

Simple economics then prevail. If you have more units of anything being produced, the value of those units will fall. My understanding is that the maximum Bitcoins that will ever be made is 11m. Imagine if it was announced tomorrow, that the number will now be 22m. You would expect their price to fall by half.

Well that is exactly what is happening to the USD (and the AUD). We are printing more of them, which makes them less valuable. When that happens to a currency it is called inflation.

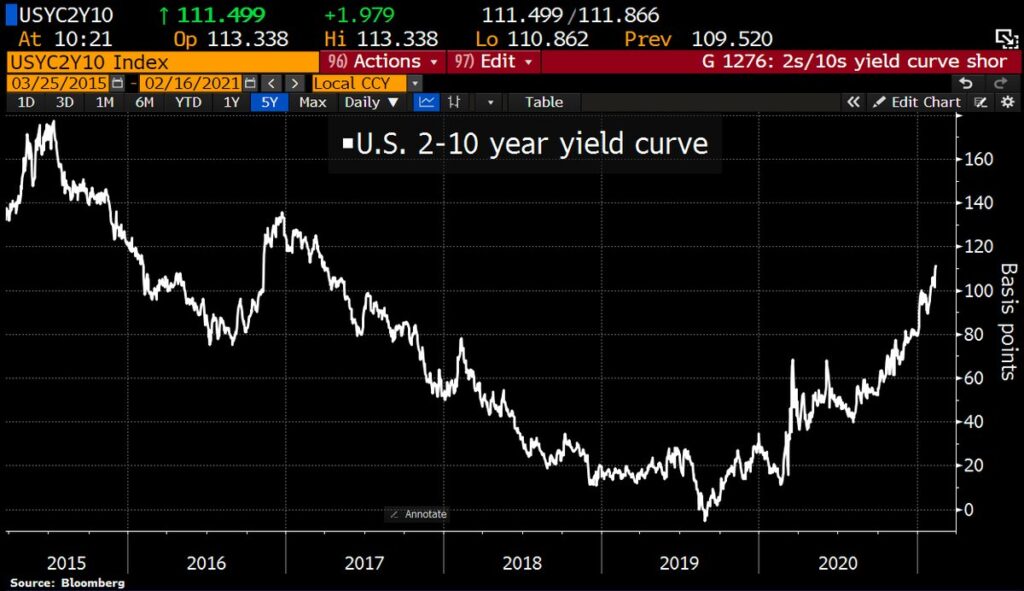

Now many are talking about the death of inflation as we know it – or even worse, predicting stagflation (no inflation + no growth). But there is real thing already happening. The “gap” between US 2 year rates and 10 year rates moves according to two related things – the official cash rate predicted ahead and inflation. When the market expects the Fed (or RBA) to do nothing for an expected period of time, then that gap falls and remains flat. This calendar year it has been consistently rising and is now well over 110 basis points (1.1%). No big deal?

What that chart says to me is that real money is expecting the US Federal Reserve to stick to their word – i.e. keep cash rates low for the next few year. BUT what it then says is the Fed will be chasing the tail of the inflation tiger after that and will need to hike rates. Then the pain begins, and especially so for those with high debt or leverage.

You may say, well that is years away and also could be well wrong. True enough. Or it could be the start of a better understanding and reckoning of the current global position – and what you see is just the tip of a kick arse iceberg.

So – being true to me word, if I truly believed that, then what would I do?

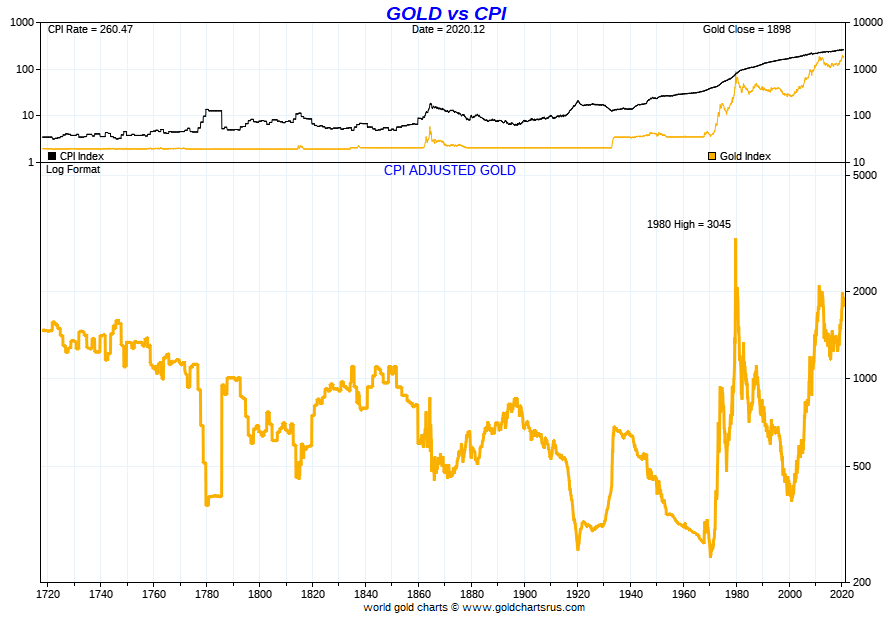

The destruction of the US dollar would then need an inflation hedge – a store of value that does not depreciate when the currency is worth less. Two assets come to mind to fit that bill.

- Bitcoin/crypto

- Gold

No surprise that I reviewed the first very quickly and dismissed.

The second is an interesting one. Throughout my markets career I never really appreciated gold as an asset. Yep, you can wear it, you can bung it in your teeth, but I never thought it lead to a better world.

The other aspect is, how would you buy it (outside of buying gold miner stocks) and what would you do with it?

Lastly – is it a good “time” to buy? If gold is an inflation hedge, best we strip out inflation to measure. It it has had a big run in the last two decades, but is not that much above 1720 levels. Good enough for me.

Not wanting to hold gold under the bed, this week I bought some via an Exchange Traded Fund. Of course there is some residual risk that there is actually gold “behind” the investment to support. My investment is via the Perth Mint, so I assume that is well covered, but they have had swindles and scandals dating back to the 1980’s. Buyer beware. It could drop like this dunny.

I think I would $hit myself….

As an aside, if you believe that the USD currency is going to tank in the medium term, by default you should be expecting a resultant higher AUD. Parity or beyond is possible in a few years.

What is Black Swan drinking?

Warm weather hitting SE Australia this week – maybe the last gasp. Bit different in Texas at present. Real photo:

Given our heat though, I chose to knock off the last of my “special” beers.

It is a very clear and well filtered refreshing golden ale. Apparently top and warm fermented which is unusual for a german style beer.

Classy bottle that the girls love. Regional brewery – hard to find. 9/10 Goes well with food – but not cats or rice.

Not here, kitty kitty kitty

And listening?

The Killers latest release. Usual Killer beat that gets you up and about. Maybe be appropriate for the advice above….

Have a good one (in case the warrant is real). There is space enough for everyone.

Cheers BS