2021 Edition #35 – Opening Pandora’s Box

9 October 2021

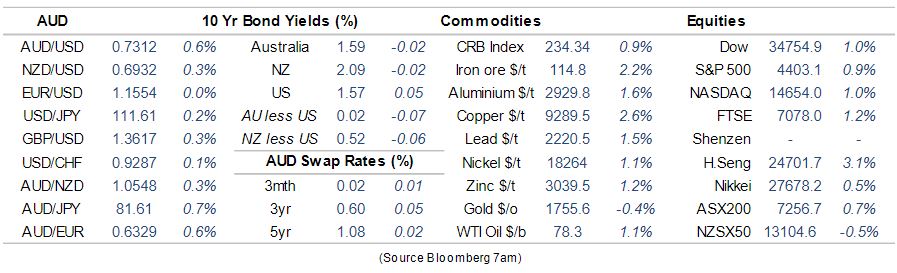

Too late

Late issue again – like a brown bear at the height of the salmon spawning… it is a target rich environment. Where do I swipe my big paw?

Big Picture

Let’s start with the big dog… US of A.

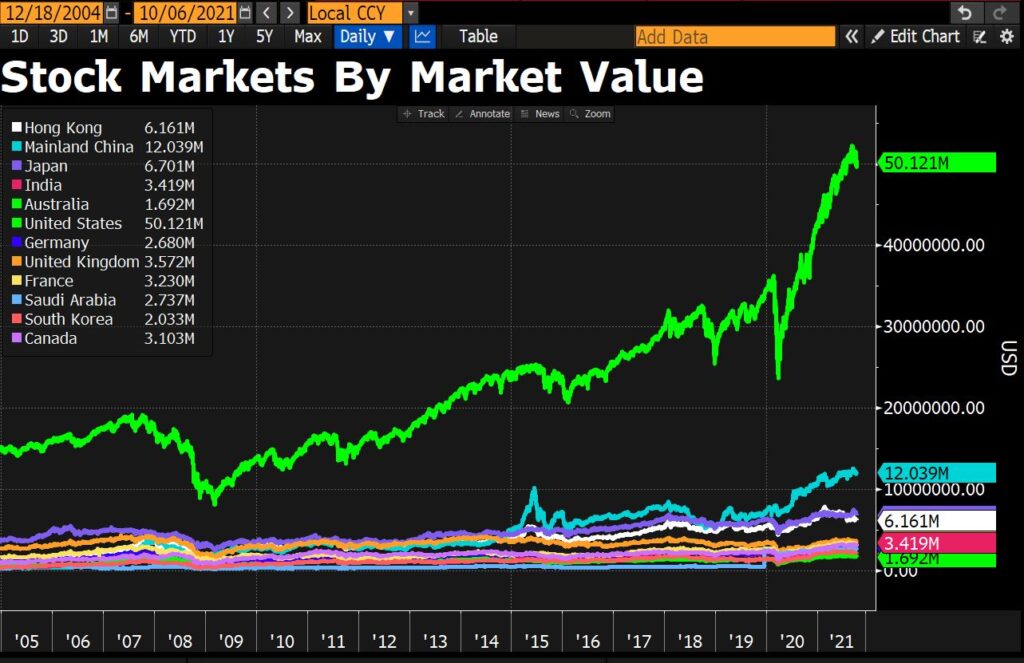

Sorry to harp on about USA – frankly their economics and politics frustrate the shit out of me. But as I often point out, they truly are the big dog. China is growing from puppy Chihuahua to nasty junkyard Rottweiler, but two charts to support me. First is the USA stock market – the same size as the next 11 markets combined.

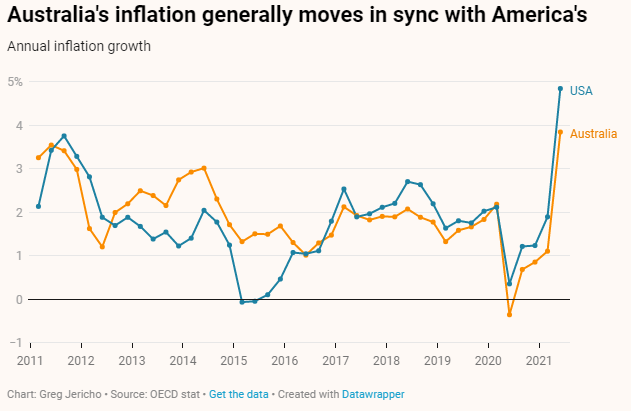

The second is USA inflation and the correlation to us.

So equities there and here had a mixed bag to start October after a bad September.

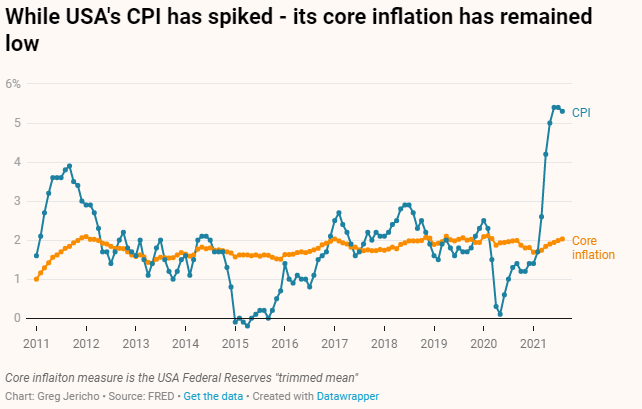

Various reasons for the pullback that we have covered already, but this week the market commentators seemed stuck on US inflation. The US Fed (our RBA) has been sprouting for months that the higher inflation reads are just transitory and mainly related to Covid logistics rather than fundamental longer term supply/demand.

That said, they have increased the timing and severity of their Quantitative Easing tapering, and 9 members (formerly 7) see rate rises next year. Forward guidance “dot plots” for future rates have moved higher.

So… did they get it wrong, and is this an admission of failure?

Those that think they know who Black Swan is may think I am always the first to jump on the “sky is falling” bandwagon. But for a reason that is not yet fully clear to me, I am quite sanguine about inflation there and here. More to the point, the smoothed or RBA equivalent of trimmed inflation in the USA is only moderate (as seen below).

So, after US 10 year yields hitting 1.57% this week, I strongly suspect it may fall in coming weeks. As it did in March and April of this year.

Part of the higher rates story is a risk premium that those idiots in Washington don’t get their act together and increase the debt ceiling for government funding. This has now been kicked down the road to December, but how hard ball do the Democrats and Republicans want to play? Recent history would indicate, very hard.

Try this approach when you next apply for a loan:

The Aussie Dollar and Commodities:

The Greed/Fear index for the broader market seems to be strongly on the Fear side of the equation. As such, the US dollar (again, as the big dog) is strengthening. This has kept the AUD lower than it otherwise should be. The Aussie finishes on the up the week, however, in the low 73 cents.

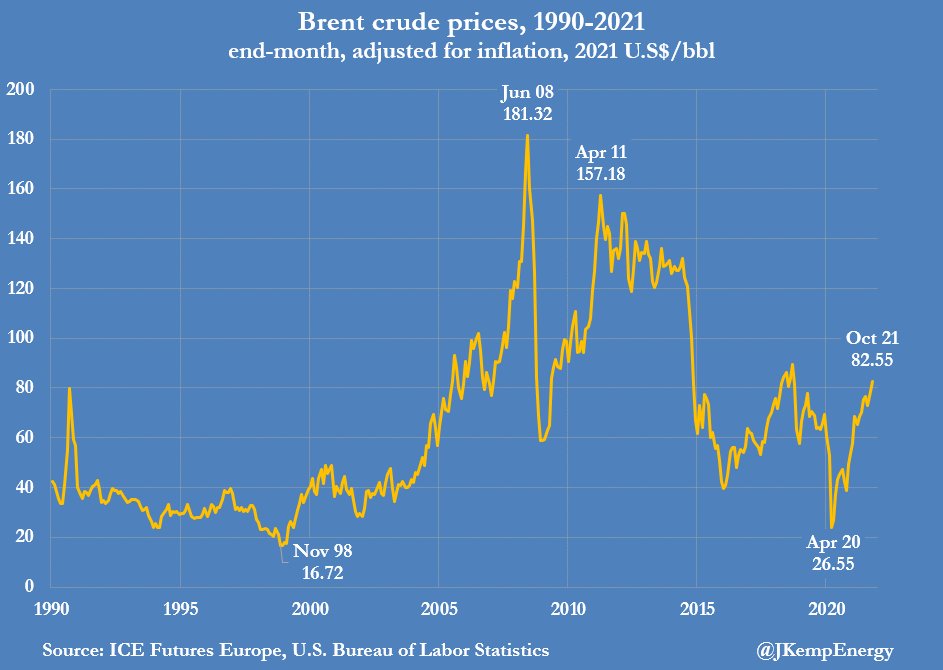

Silver prices are not looking good. Gas and oil still rising, though.

Politics

Half of me wants to ignore politics this week – too much shit and not enough clay. Makes me want to climb a mountain and get away from it all…

Months ago I did a brief on politicians that left parliament for relatively minor infractions – but integrity needed to be seen.

These days, short of a smoking gun and a corpse, it would appear you can get away with anything.

SloMo and his team are outraged that such a wonderful person should lose a Premier position through a “star chamber”. No mention of it as a resignation.

The NSW ICAC has the following as their mission statement:

• advance the public interest

• act ethically and with integrity

• be objective, fair, impartial and accountable

• strive for excellence

I would challenge anyone anywhere that any of our current politicians (from either side) work towards that same set of criteria… but they should.

Incredible matching quotes to consider here:

- “To leave office before my term is completed is opposed to every instinct in my body.” Richard Nixon, 1974

- “Resigning at this time is against every instinct in my being and something which I do not want to do.” Gladys Berejiklian, 2021

So, the Prime Minister takes the chance to roll out his equivalent of Carlton Zero beer via a version of ICAC Light. Every legal professional so far has said it actually protects MP’s more than threatens them, and would be worse than no ICAC at all.

So NSW get’s a new Premier. Time for statesmanship and diplomacy. Instead we get DoPe.

Last week, we showed how three of the four Aussie major banks are rapidly pulling out of funding for fossil fuel projects. Given our earlier piece on BHP willing to pay $250M to get a Hunter Valley coal mine off their books, it makes good risk and economic sense to me. But Federal National Party numpties roll out their great plan for tax payers to underwrite a quarter of a billion dollar lending facility for present and future fossil emitters. The coal industry must have some sensational footage of the last National Party knees up to get such preferential treatment – given the National Party’s other major constituents (farmers) are now demanding action on climate change.

The inner city latte sipping Liberal Party appear to poo-poo the idea as poo-poo.

You wouldn’t want to be SloMo or Angus Taylor heading to Glasgow with that as your key plank. Especially so when in the same week, the IMF released a report that the fossil fuel industry gets global subsidies of $11 million every minute. The annual figure of $5.9 trillion is both direct and indirect.

Imagine how the global energy mix could be innovated and improved if that coin went towards renewable storage.

The IMF conclude that without such subsidies, the cost of fossil fuels would be such that it would drive CO2 emissions down by over a third.

This is not some hippy tree hugger ranting. It is pure market economics. Australia is backing the wrong horse. We will be left absolutely screwed in 20 years.

We have a chance to transition now – and still pick up two decades of mineral wealth. Instead… we have Barnaby.

Housing

APRA finally acted this week to slow a white hot housing market. That said, I use the word “cosmetic” this week to describe the changes.

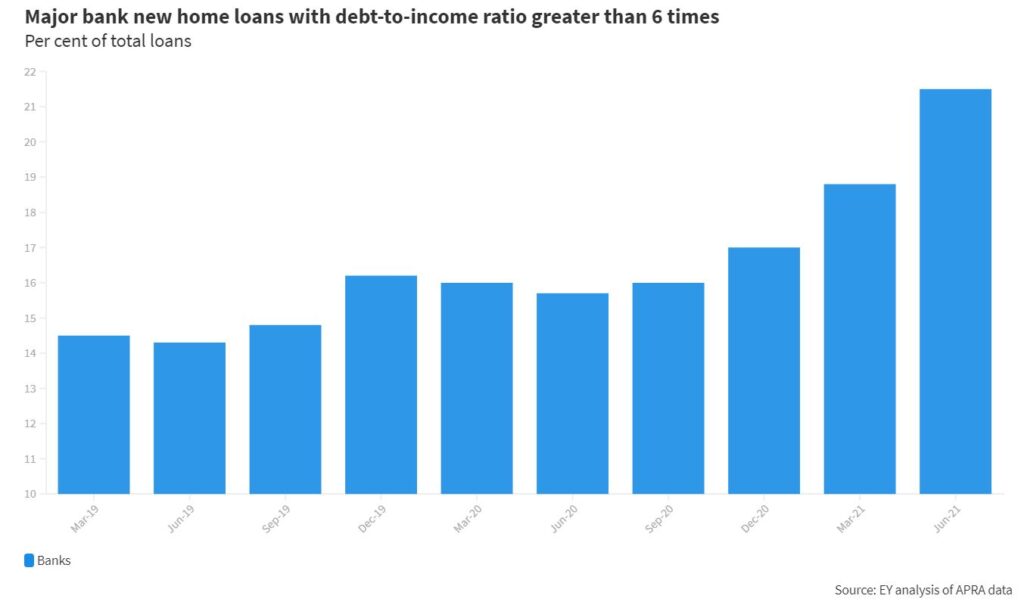

Banks will need to increase the buffer for interest calculations by 0.5% starting in November. EY did some good analysis on the subject. RBA are concerned about lending that is more than 6 times borrowings to income. Seen below, this has been climbing steadily as we touched on last week.

Some have predicted that it may cool house prices and lending by 5% over the year. I had lunch with a bank CEO this week (and yes I paid…) who did not think it was important at all.

Reserve Bank of New Zealand doubled their cash rate this week… from 0.25% to 0.50% – many say to also slow rising house prices.

A contender for tweet of the week is instead a news headline.:

CBA data:

Crypto and Gold land

My Ripple (XRP) purchase is exactly back to purchase price three weeks ago – zzzzzzzzzzzzzzzzzz

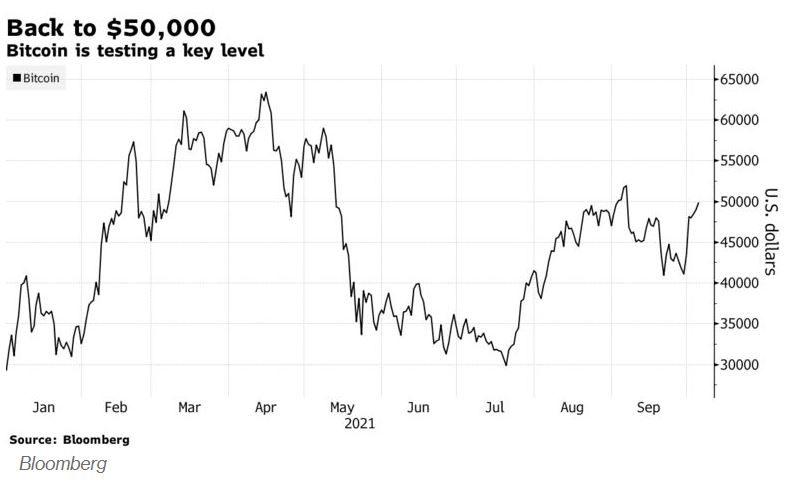

Their battle with the US Securities & Exchange Commission seems to be going well, but other crypto’s are getting the advantage of the case. BTC up and Bank of America said this week, it was “too big to ignore”.

The blockchain technology took an interesting turn (at least for me) this week. Colnago, the Lamborghini of bicycles, is proposing to sell their new top end bikes with an included NFT (Non Fungible Token) to the new owner. If and when the owner sells the bike second hand, they will pass on the digital token as proof of original purchase. It is hoped it may slow or eliminate stolen bikes being hawked. Interesting theory.

The riders in last weekend’s Paris Roubaix looked very fungible:

Gold going up a little.

Thought of the week. Portfolio Review. (China gets a loose look next week)

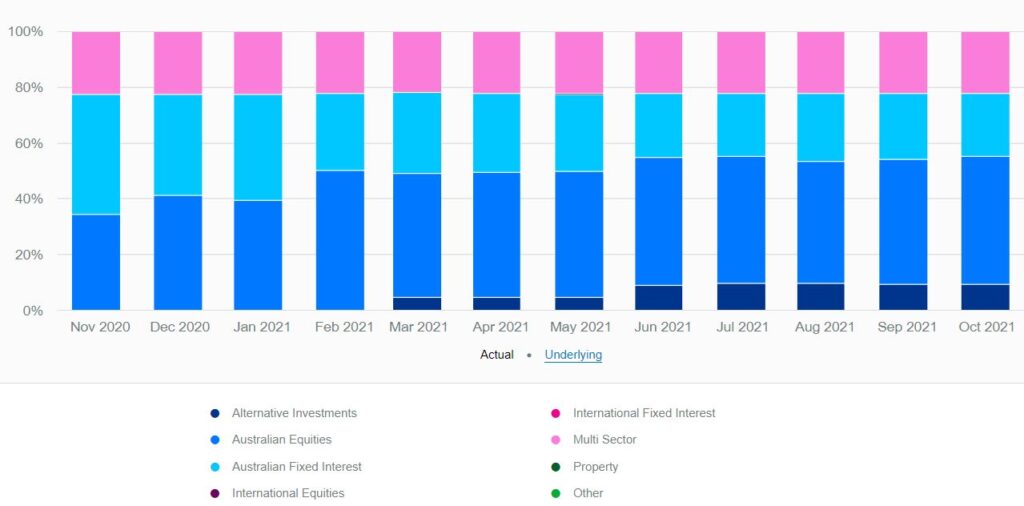

Outside of my silly crypto punt, I did a bit of personal portfolio review this week. Happy to share with you, and happy to take questions/feedback and criticisms.

To break it down:

Aim:

- Diversify portfolio

- Position portfolio so that it benefits from bull run, but has some protection against sharp pull back

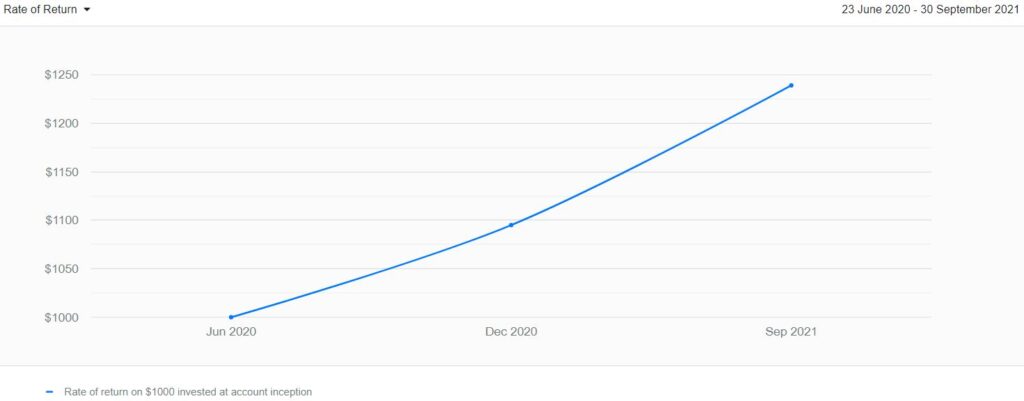

Result to date:

23% rate of return (15 mths)

A few specifics:

Defensive:

- 5% holdings in strong conviction bear fund (EFT) – understandably giving a negative 10% return

- 5% in gold EFT – positive 4% return

Equities:

- 10% holding in ESG share fund (as mentioned in earlier blog) – a 10% return since January

- 30% holding in banks – up from 2020 lows.

- 10% holdings in small caps (give it a crack) – mixed results.

Fixed Interest:

- 20% in capital notes and Managed Income Fund – both performing well in income/dividends

Multi:

- 20% in Growth Multi Fund. Purchased a large tranche just pre Covid, but 19% return since.

Summary:

Pretty happy with results and allocations. May have benefited more by being more aggressive and less defensive. That said, I sleep soundly at night.

Drinking favourite…

I was stitched up this week. I have been drinking a few dark ales this winter, and even bought a carton of Guinness.

But a dodgy mate bought me a chocolate and chilli stout. All three do appeal (stout/chocolate/chilli) in various ways… but some marriages should never happen.

Listening to…

I was thinking of some old school music…

Can anyone not like Radiohead? Latest single “If you say the word” just washes over you like a warm waterfall. Brilliant.

Next week we want to look at global wealth with an interesting focus on China and India.

Have a good week (end)

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers BS