2021 Edition #23 – Deer oh deer

3 July 2021

At least no deer’s getting off Scott free.

It has been that sort of week. Crazy stuff happening.

“Follow the money” is the axiom, and that is what they are doing in the USA. Donald Trump’s money man has been arrested over alleged tax fraud. He wasn’t one that Trump pardoned before he left (even though these are State charges). At 73 years old, authorities are hoping he will roll over and incriminate the big guy. A lot at stake.

Of course much like here the middle ground has been hollowed out. Either you are 100% convinced that D J Trump is evil incarnate, or he can do no wrong and these are politically motivated witch hunts.

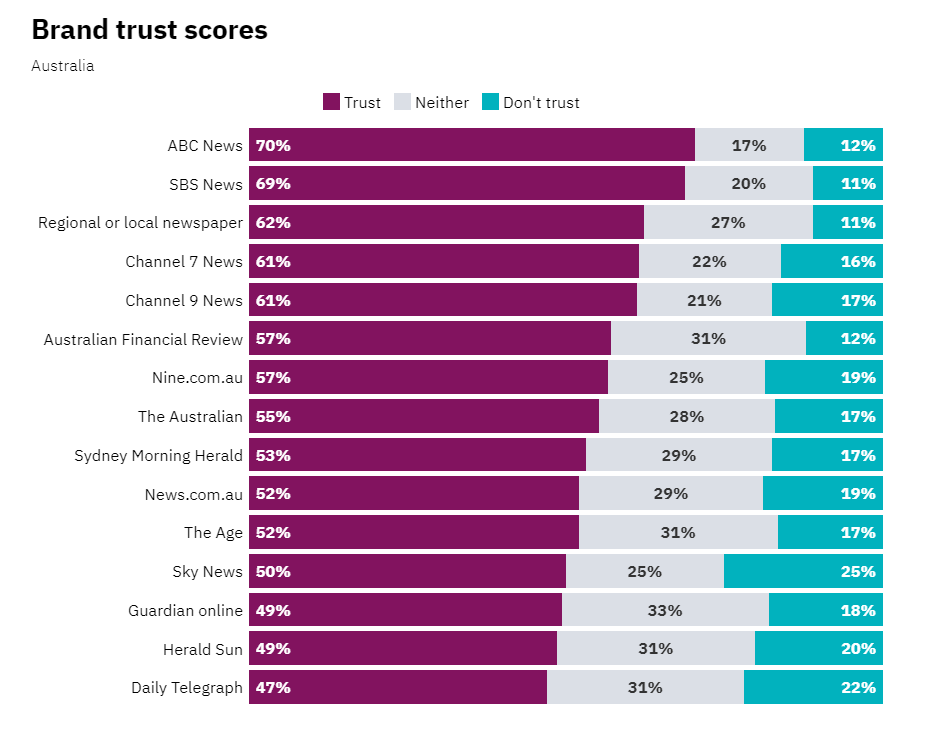

For an interesting side snippet…: Reuters did a survey of 49 countries into trust in news. USA came LAST – only 29% trusted media. We are travelling a little better at 43% – still staggeringly low.

Who do we trust?

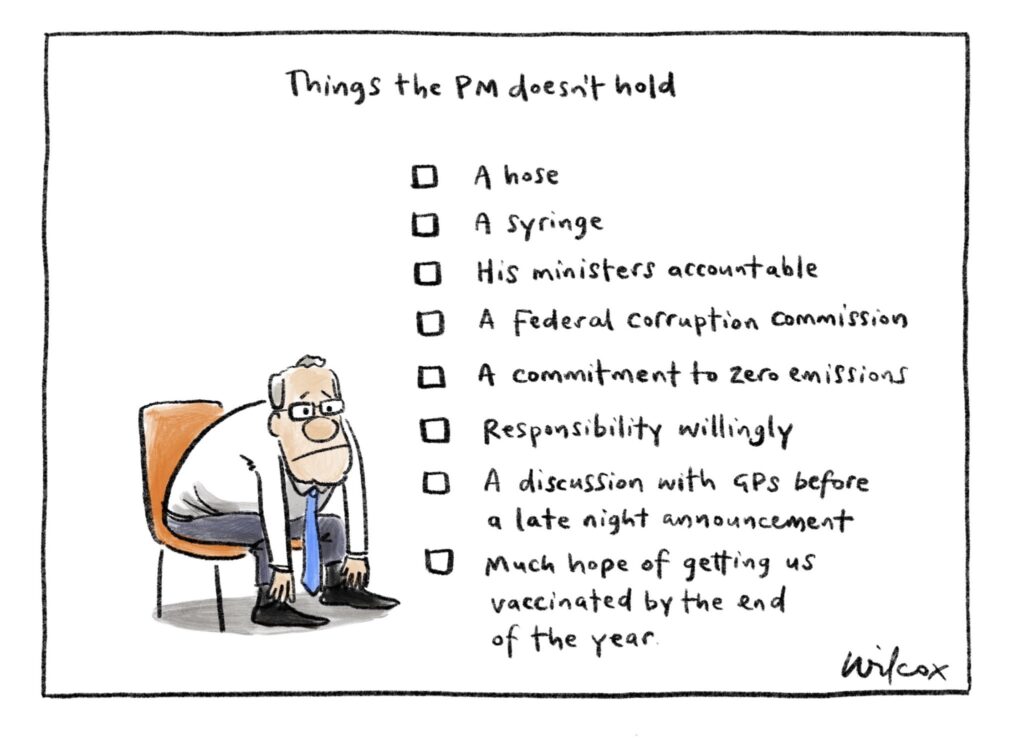

Domestically ScoMo has returned to work, as either the hero or the villain. “It is not a race” is clearly a phrase he wishes he could take back. Most of Australia back in lockdown, and the State’s getting very miffed at vaccine rollout and quarantine.

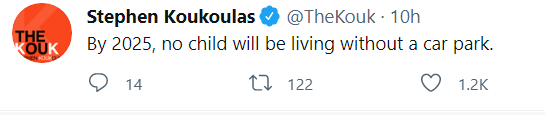

Yet another scandal unveiled this week – Car Park rorts. A $600m cock-up that was supposed to be co-funded by States that were never included or consulted.

And yet Sportbet still has the Coalition as favourite for the next election. Labor – you must be crap.

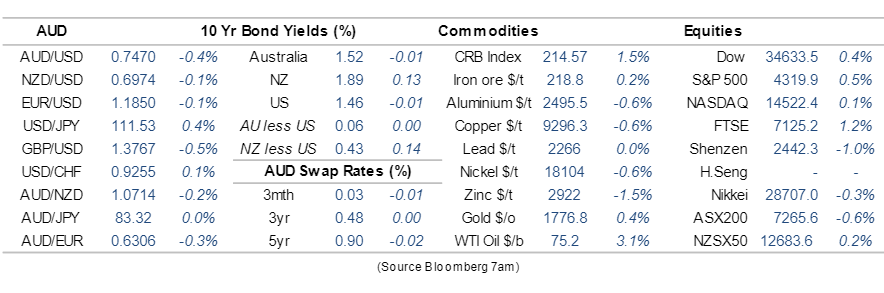

The end of the financial year. ASX200 went up 11 of the 12 months for a staggering 24% gain. Not sure my portfolio matched that result, but you need to work REALLY hard to lose money with this momentum.

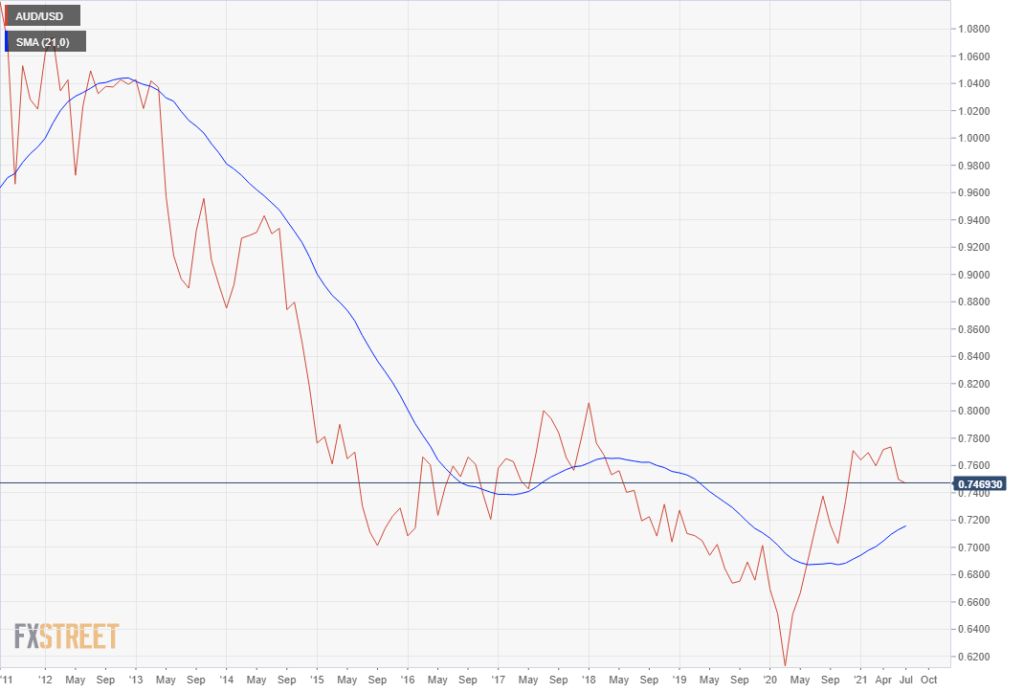

With a longer term view, the AUD still looks ok, and the moving average (blue) is on the up.

Mid 74 cents.

In the short term it is prone to have a look at the downside though. US employment data out tonight. If it is stronger than the 700k+ expectation then there is some confirmation that they are winning the Covid race ….that is not a race….

Long term interest rates here and in the States do not reflect any fear of inflation of rampant cash rate rises.

CBA did some research this week on what happens to Aussie mortgage holders when rates start to rise in 2022/23. Bear in mind they have a fair chunk of skin in the game…and it is unlikely that they would call out potential disaster even if it was their base case. They think all will be well though based on:

- Ultimate “neutral” cash rate will be circa 1.25% (seems low to me)

- Employment strong and wage rises coming

- Plenty of fat held via deposits, pre payments and set-off facilities

Let’s all hope so.

Latest CBA data:

Crypto Land

Crypto Land

Same same really. A mere 20% swing for the week in Bitcoin is not enough fun.

An interesting snippet from Cape Town. Two Bitcoin veterans ( at 17 and 21 yo) have been missing since April – along with their $5 billion worth of clients bitcoin investments. Worse – they sold their Lamborghini. Police are investigating. Maybe a small custodian fee is sometimes worthwhile?

Whilst looking at bad people doing bad things…

I had to look up what ‘OG’ meant – ‘old guard”. Apparently anyone that survived the 2013/14 Bitcoin clear out, gets a gong.

Surely someone that holds a truck load of BTC would have a Plan B established for such things?

Anyway …here it is….

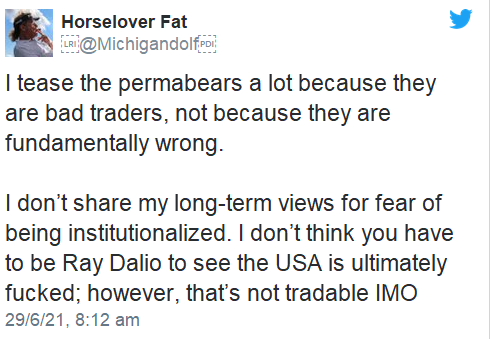

Good tweet below…it follows my oft quoted line….”the market can stay irrational for longer than you can stay solvent”.

One reason why I was never a great trader – I never had the ability to quit early and sell/take my pain.

Like USA, the market will have a massive correction – it is a when not an if. The when is hard to back when all money is on the other horse.

With above as background and my belief in crypto technology but long time sceptic in millennial momentum movement, an update….. I WILL BUY BTC if it hits 25k USD. Plan then to sell out at $30k and at least say I was “there” !

My gold purchase in AUD terms has drifted back down.

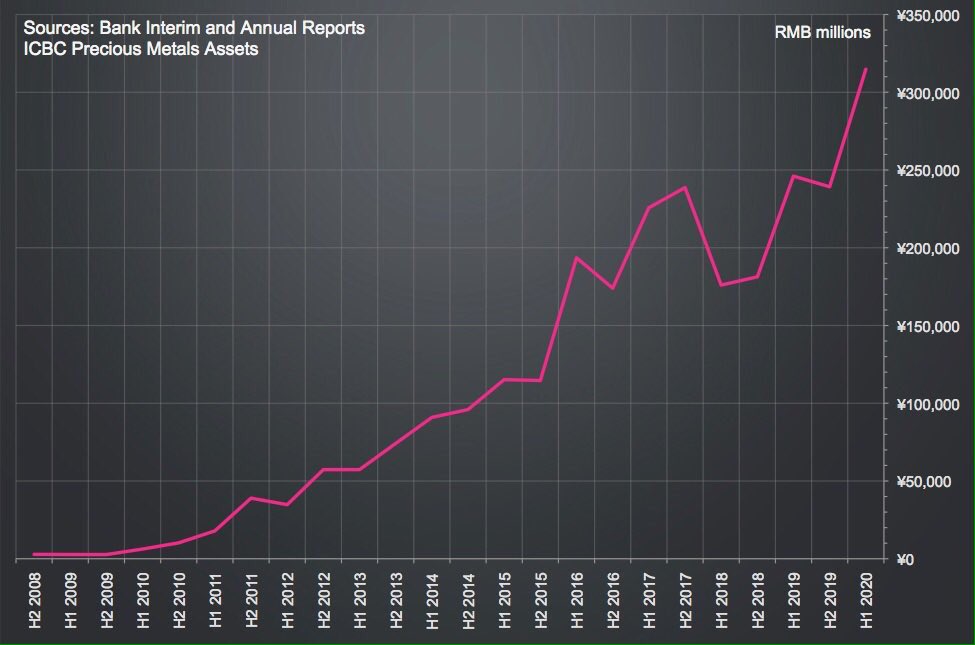

This is despite China’s Central Bank clearly boosting their gold holdings. Whilst still relatively low in the sense of their balance sheet size, you might think that this is yet another step towards claiming #1 status in everything. If they ultimately want the RMB to take over the USD as world currency benchmark, they will need some hard backing for their currency.

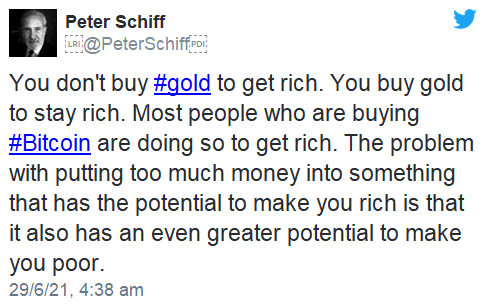

For a small personal investor though, I also liked this Tweet:

Thought of the week. Get that Inter ya…

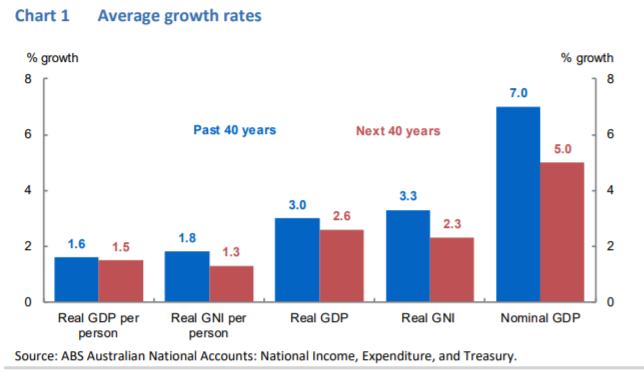

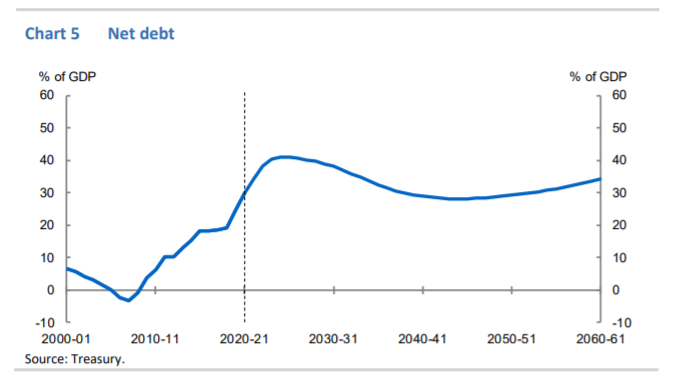

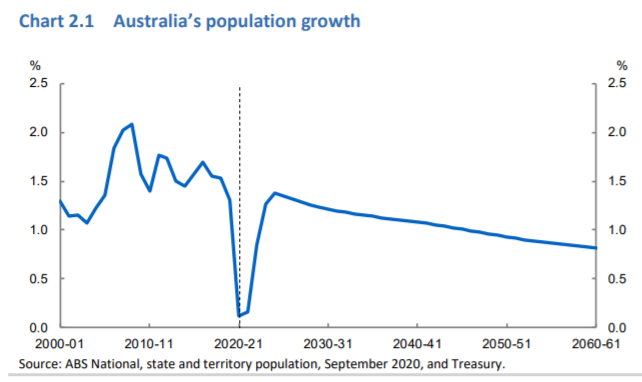

The Intergenerational Report was released by Federal Treasury. It pulls out a dart-board and guesses how Australia will look in 2060. Released every five years, it can easily be dismissed as irrelevant. To me it highlights three things…:

- Our best years might be behind us

- Debt will be Australia’s constant companion from now on

- Migration will not save us this time around (at least for a while)

You can argue a scenario that Australia does not have the capacity or resources to support 45 million people – and you would get a lot of support from Melbourne car commuters. Albeit we are in better shape than many countries.

Covid though has effectively halted our population growth via migration. That hiatus is not just a temporary hiccup. The ongoing effects will be felt for the next decade, even with the expected 2022 re-opening of international borders.

Much of the expected growth in the first chart relies on our productivity growth reverting to 1.5% p.a. The last 10 years it has been just over 1%. Perhaps Treasury is not banking on a government which is hell bent on energy policies that take us back to 1950’s…..

Drinking favourite…

Something different this week. From time to time I have been known to have a penchant for a sweet liquor.

Strega hits the mark.

Saffron gives it a cats piss yellow colour.

The story of the witches brew from Benevento goes back 160 years Witches brew

Usually full as a Pommie complaint box when I drink it, but 9/10

Listening to…

I saw Tex Perkins years ago when he headed Cruel Sea as backing band for the Rolling Stones tour.

He had swagger in plenty.

New single just out.

Polished.

A mate saw this sign this week in outback NT.

Feedback always appreciated….

Cheers BS