2021 Edition #2 – Make sure you Reddit

31 January 2021

“Are you on Reddit now?”

Never Interfere With an Enemy While He’s in the Process of Destroying Himself – Napoleon Bonaparte

Clever quote above from the old French fella in a funny hat. Could be applied to many things, but I sense Joe Biden is of that opinion re the Republican Party and thus sees little upside in uniting his adversaries with an impeachment trial. I think that is smart, but as someone else put it, “if you don’t impeach a President for inciting violent sedition against the House and Constitution, then when would you?”

Weekend at Bernies.

A short week for us Antipodeans. So after last weeks bumper edition, this will be much shorter.

Financial media are going wild over Reddit group #WallStreetBets. If it is all too complicated for you, then I understand. Best you younger brigade can do is download the movie Trading Places and follow the fortunes of frozen orange juice concentrate. Apart from being very funny, it explains the joys and pains of being either long or selling short.

My take is a large number of younger American people have got their $600 stimulus cheque and decided to follow some semi educated rabbit down his warren. But enough cash has flowed into a few targeted stocks that the effect has been to burn a few hedge funds and send some fundamentally shitty stocks to the moon. GameStop share price rose by 1,700% in a week. Forget Bitcoin, if you want volatility get on this platform.

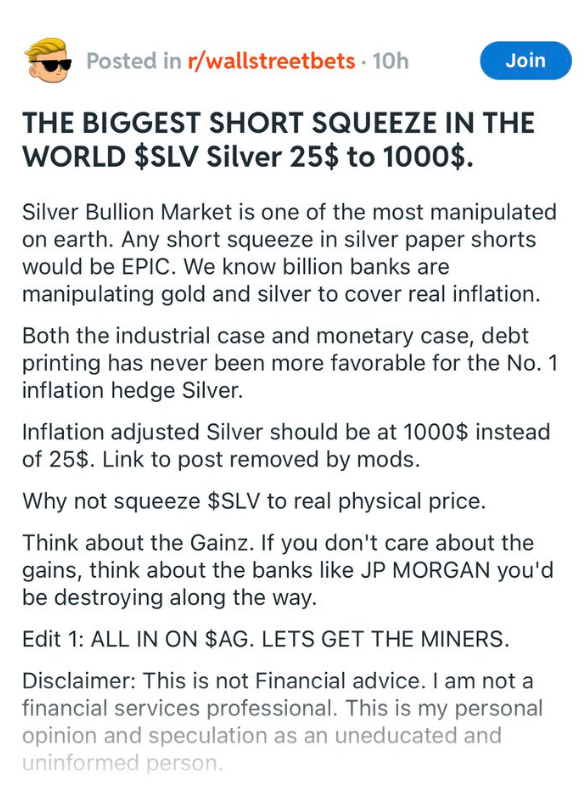

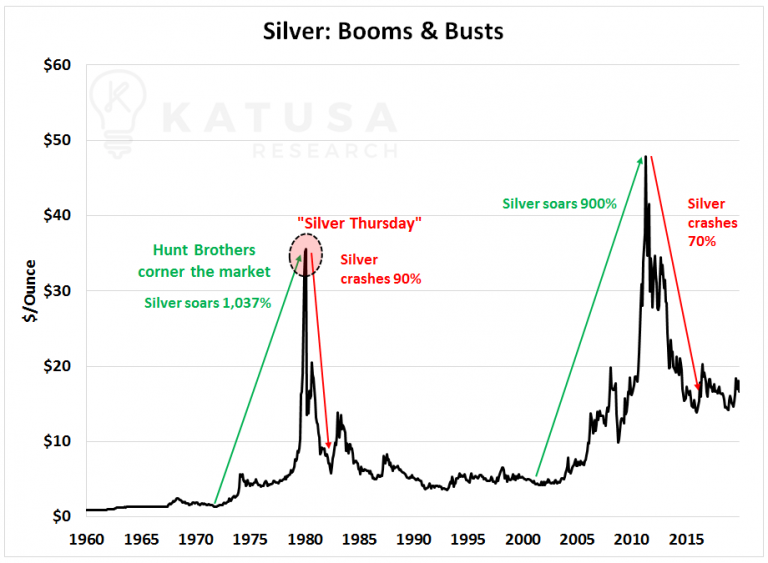

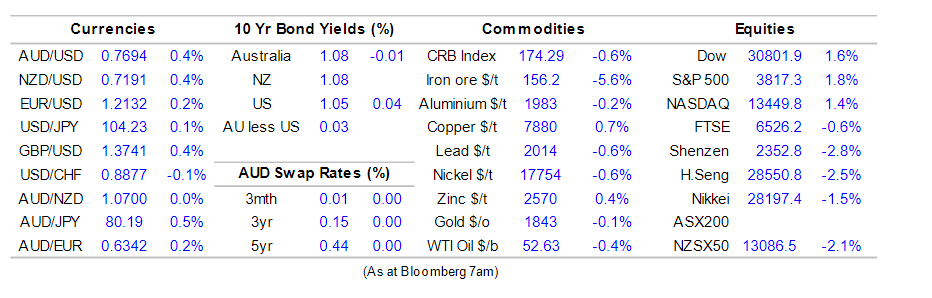

Not being a Reddit user, I have gained a recent post by the group that looks to be targeting silver next. Interesting, because the right hand chart came to my Inbox via an actual fund manager. Both seem to have the same view….

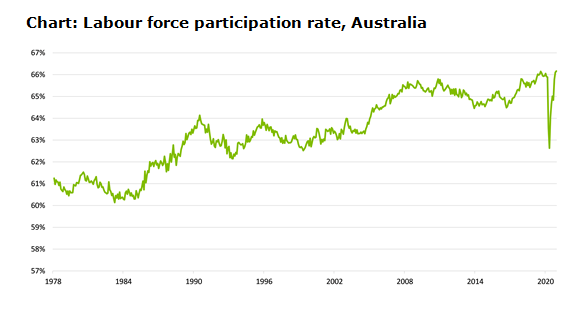

CBA released a pretty upbeat report today. They remain of the opinion that Aussie GDP can climb around 4% this year and next, with unemployment to fall to 5.7% by year end. All the signals, including hours worked, under employment and participation rates support the view.

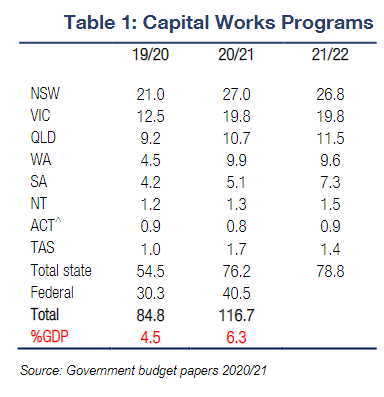

The other data that took my eye is the increase in State and Federal capital works this year. Over $30B more than last year which, if spent, will see GDP higher by 1.8% just on that spending. K..boom…

Much credit for our good “shape” (relative to others) remains with the State and Federal response to Covid. Australia came in 8th best in the world for our handling. I think maybe the Kiwis deserve the #1 spot, but I thought we should have perhaps been a touch higher.

Equities had a bad Thursday but Aussie banks share prices are back not too far from pre pandemic levels. A long running court case against a NAB employee reached sentencing today. Not sure I would put her as a NAB “boss”, but certainly helped in the demise of the then CEO. I did enjoy the Tweet below.

She is thinking “I need a holiday”. Good news – you will be living away from home for a while.

Whilst speaking of banks…and with the standard caveat that I was “one of them” for most of my life….. a short gripe if I may. With such massive technological advancements such that we can create a new vaccine in 9 months, how is it that it takes almost the same length of time to transfer money from one bank to another? All this hoopla about instant transfer seems bullshit. It comes out instantly but rarely goes in to my account with such pace! And whilst on the theme, it also pisses me off when you book something online and they take credit card details to hold the booking. When you subsequently pay with either cash or another card, it takes DAYS before the hold comes off your account. It never bothered me as a banker, but now as a blogger with no income, it is a thing.

To finish banks, below is a picture of a “bank” in Haiti. It actually only sells lottery tickets, but in Haiti, that is close enough.

Winners are grinners.

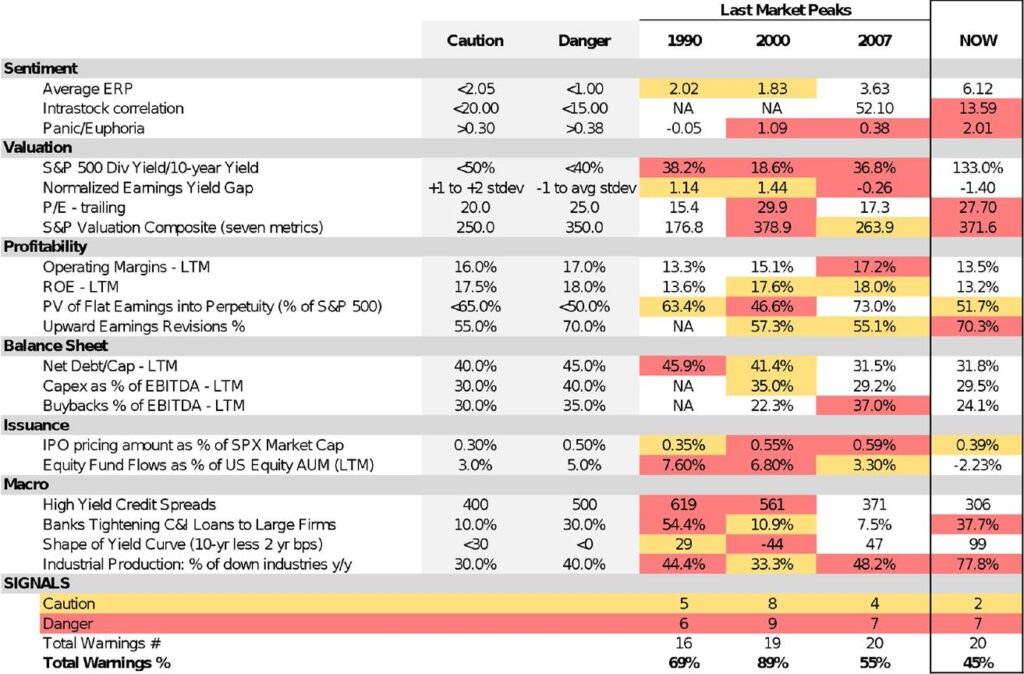

They then looked at the chances of a large fall. To do so they used a CitiBank guide for the US equity market. Of the 20 signs, 7 are red and two are amber. I refer to John M Keynes again.

US long end yields back through 1% again. The Aussie dollar tipped down yesterday in the broad Aussie sell off, but trend lines hold firm for higher in the medium term.

Thought of the week.

Black Swan often remains confused that people are happy to read his musings. Largely because Black Swan is not immune to being confused often himself – and lacks solid convictions as to the cause or indeed the cure.

So the following may well alienate a few readers in the older age bracket, but fuck it.

Australian superannuation policy is the holy cow. Any political party that tries to tinker significantly with it, will surely die on the pole/polls.

It is the envy of many countries though and positions our aging population nicely to fend for themselves in their post working lives. This saves government expense and thus compensates at least to some degree the preferential tax treatment people get on their investment into the fund.

The RBA is inundated at present with letters from irate retirees claiming that the low rates of interest on their investments are “killing them”. Real interest rates (nominal interest – inflation) are indeed negative at present and they have an argument. Personally I would be more worried if inflation was tracking at 16% and rates were at 18%…but that is for another day.

But what gets up my goat is how we Aussies think about retirement.

Beware of the goat attack

You scratch and you save and get (lets say) $800,000 in your superannuation – pretty good result given how shithouse most super funds run their ship. In your last few working years you salary sacrificed and threw in at a bit more than at a tax rate of 15%. All just hunky dory.

Your financial advisor scares the hell out of you though – you should be either frugal or terminally ill. Your kids are older and start circling like vultures. You can’t even blow some of it on an overseas holiday due to Covid. Worse still, you may even be healthy till 100 years old these days.

But you expect to die in 10, 20 or 30 years time and still have that same $800k (or more) in the kitty.

It makes no sense. Super Funds Australia reckon a couple need $62k pa to be comfortable. So you will be taking out nearly 8% a year and earning say 2%? Simple maths does not work in your favour there. But of course behind all that is the big chance that you are sitting on an unencumbered property worth say $1m.

From the outset let me say that my plan is to shuffle off this mortal coil leaving equity enough for a mars bar and a can of coke. If that means my super runs dry, and the house is either sold or under negative equity, so be it.

But my whacky thoughts aside, I get the feeling that both sides of government are also starting to wake up to the issue. Given (effective) tax subsidies to people that ultimately don’t use the superannuation balances accrued is a problem. Franking credits just exasperates the issue, but readers will leave in droves if I espouse a failed Labor policy.

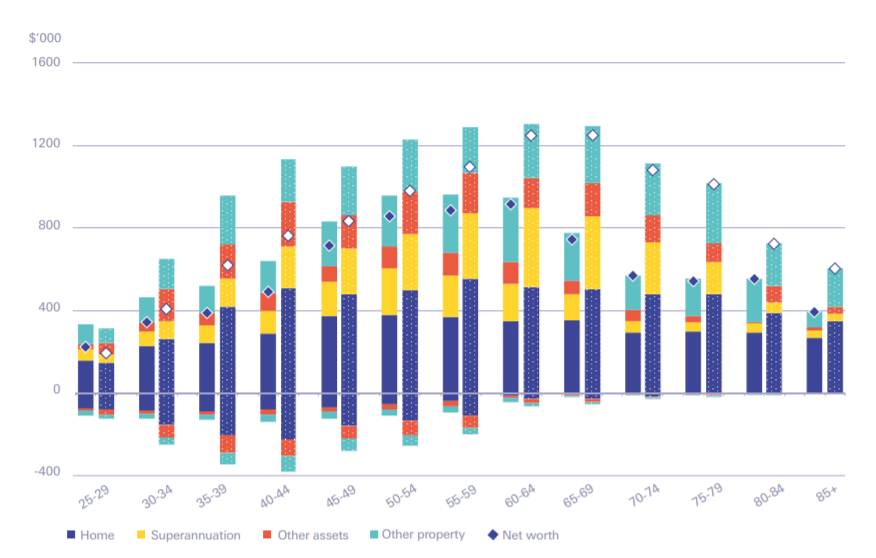

Retirees have never been wealthier. Left hand bars are household wealth 2001 and the right hand bars are the latest survey – 2014.

Rolling in the deep. 2001 to 2014

Summary – we need to change our collective thinking of asset accumulation and spending. Not sure we “can” do that on our own, or we need a change in policy to encourage. Death taxes are not the answer. Maybe it is just as simple as increasing the minimum draw from superannuation from 4% to a much higher figure. Force old people to have a good time….

What is Black Swan drinking?

It has been a quiet week on the drinking front. Even had a couple of AFD’s.

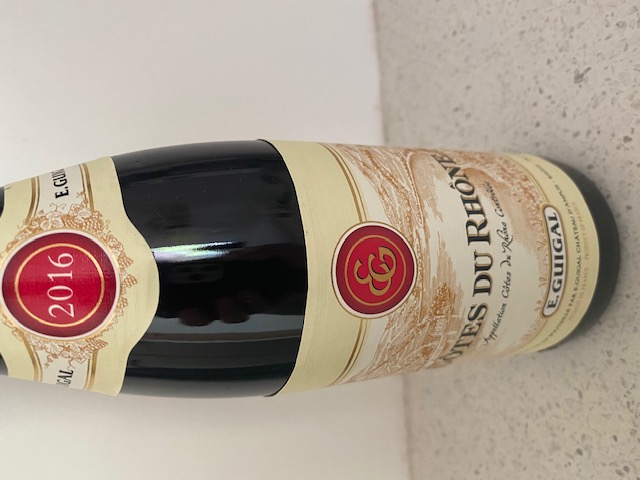

Only a cheapish quaffer but this little number went down well.

It is an SGM, and what I liked about it is it comes in a half bottle – 375 mls. It is something that the French do very well, and we would do well to emulate. The mark up from half to full bottle is minimal. It just means you can have a couple of glasses on your own without the need to knock off the whole bottle. Always a chance you open a second bottle though…

Adequate 7/10

Just a little tipple…

And listening?

As with this entire week, Black Swan is struggling for a stand out.

If you listen to this one, you may think I have indeed gone batshit crazy. But in the back of your ears it will ring a bell. It was the last song in the movie The Accountant.

As per my retiree comment above, I’m happy to leave memories…but not the money.

To sign off I see that SA had a testing time with some Adelaide Hills fires. Photo below says it all. The person that deliberately lit it may well be mentally sick, but this shouldn’t happen and we should give humble thanks to unpaid volunteers that put themselves in harms way for public good.

Everything is on fire.

Schools back for many kids this week. Hat’s off to this dad for supporting the education system.

The lens goes where the eyes go….

Cheers BS