2021 Edition #18 – The short edition…calm down

19 May 2021

Short edition – Mrs Swan and I are travelling interstate for the first time in what seems like years. Not without some trepidation – always a chance that you may not get home. Of course first world problem compared to those stuck in India at present.

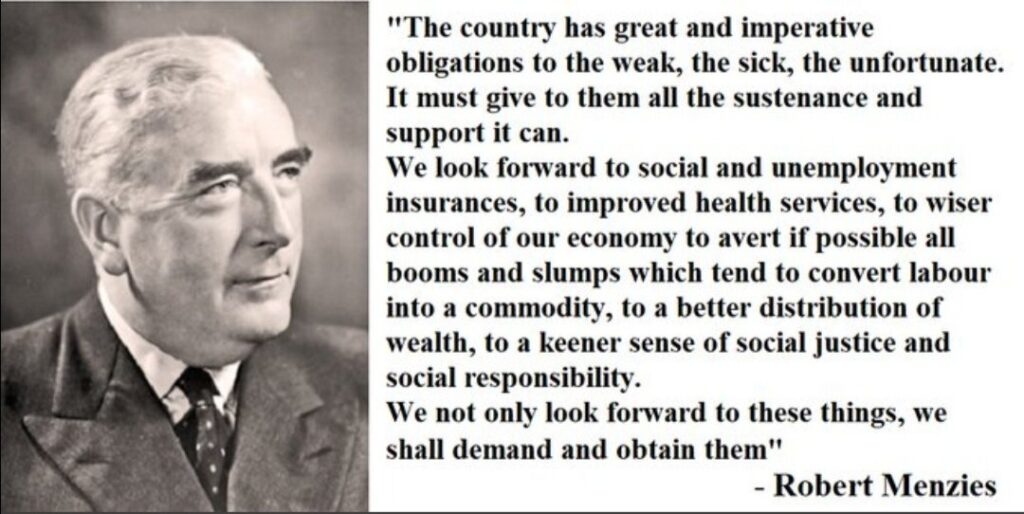

I’m a proud Aussie. As much as it sends my mates into a spin, we are indeed a lucky country. No clearer sign of that than the last 18 months. Lucky that our collective State politicians saw votes in the safety approach and locked us up nicely. And of course we are as a nation largely a mixture of compliant and apathetic people. Stuff all to do with the current Federal cabinet that want to pat themselves on the back.

We have also been historically lucky with large fertile lands that produced abundant food and wool to export. Then we found high grade mineral commodities we could dig out and sell. Lucky that large emerging countries were on our northern doorstep. Lucky that we had a stable climate and stable political climate.

So I know I bang on too much about politics. And I bang on about renewables. There is the old saying “never waste a crisis”. I fear as a country we are the equivalent of the Blockbuster chain at the height of VHS…but digital is coming. Yes we have literally truck and shiploads of coal and gas. We KNOW that offshore demand for both will fall in years and decades ahead. But instead of using the current value of what we have to adapt to the future, we have chosen…

So we find the Federal Government commissioning their own coal seam gas power station for $600M. It is purely coincidental that it will be built in the Hunter Valley and there is a State bi-election due this weekend. The seat is narrowly held by the Nationals but polls are at 51/49 on two party lines. The incumbent National member Michael Johnsen has resigned after allegedly assaulting a sex worker. Clearly he had Federal ambitions…

So we go with gas, even though the government’s own internal agencies advise against it.

This on top of what we had flagged here some months ago – the possibility of the Federal Government throwing additional subsidies at Aussie oil refineries. The end result is a lazy $1B to each of the two refineries over the next 9 years.

And through the whole time, no one in the Coalition can get their lips around battery storage or EV car support. Utter fucking madness.

Meanwhile in the USA this week, Ford unveiled its first all electric F150 ute this week. The F150 “pick up” is the highest selling light truck in the USA since 1977, and biggest seller across the globe. For Ford to go all electric the decision was easy – it is just a better car. Manufacturing jobs in the USA will follow. Here in Australia…politicians are bagging EV’s as being pussy. In fact this Ford can hit 0-100kmh in less than 5 seconds and no problems towing 6 laden train carriages in demonstrations. Not only have we backed the wrong horse….it is not even at the same racetrack.

Don’t get me wrong – we are in troubled times, and guaranteed fuel supply is important. But your and my money being locked into subsidy support until 2030 seems a longer term commitment than may be needed.

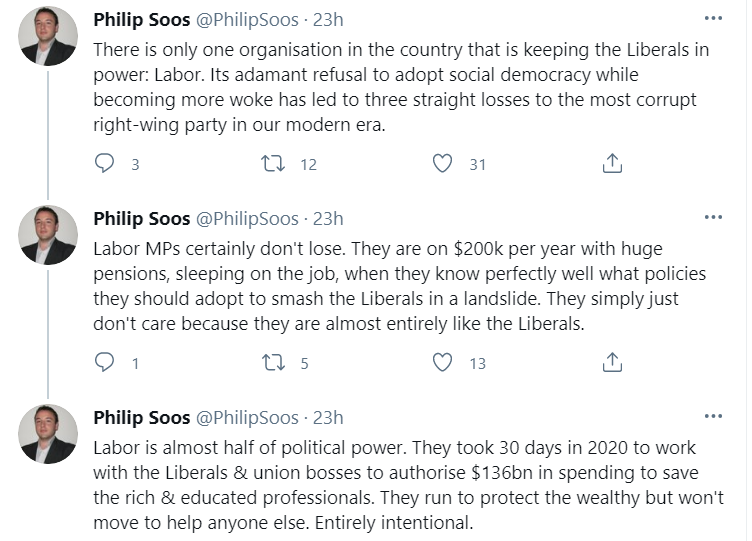

Labor – no better. Well put below by this first tweet of the week:

Rant over, back to the markets.

Firstly my nemesis – Crypto. We also flagged previously that Bitcoin had a significant technical support level of $45k USD. It has smashed through that and is sitting at $40k USD at present. China are not playing ball at all.

Hard to see any meaningful and sustained bounce from here, but the players in this performance are not the usual seasoned professionals, so your guess as good as mine.

Crypto should (at least in theory) be a hedge against inflation. There is much more chatter around about inflation in the USA and here of late.

Seems very finely balanced between :

- This time is different

- New paradigm

- Transitionary

- We are stuffed

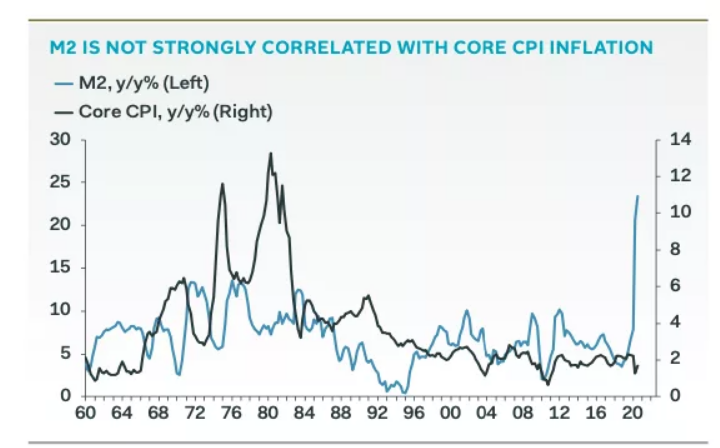

Chart below argues that there is little correlation between cash printed and inflation. I see it differently. There is a correlation – just with a time delay. You see the blue line increase (more money) and 2 years later you get the resultant inflation. True for 1970, 1975 and to a lesser extent 2009. If that is true, what do you reckon will happen in 2022?

The real issue for me is that level of increased money supply (here and the world) has NEVER happened before. So how the stuff would we know what is going to happen?

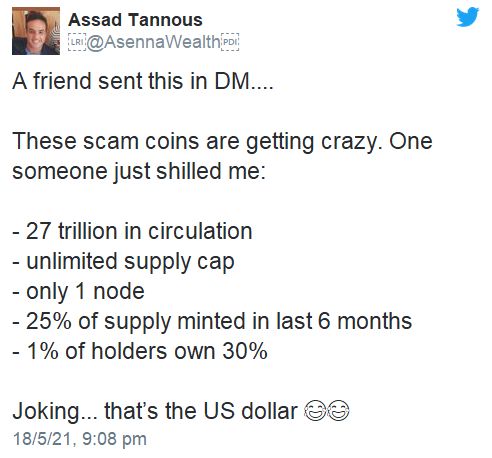

Tweet of the week #2 is related.

I left my purchase too late, but I have purchased a tranche of leveraged puts via BBOZ to protect my broader portfolio. To reiterate, I believe this market may well run higher for another 12 months or more, but this is a peace of mind trade. If the market runs higher, I have only really lost via opportunity cost – the portfolio will keep running. If it tanks at least I can say I acted on my basic instincts.

The AUD is continuing its sideways passage. Consider it at 78 cents. Nothing else to say.

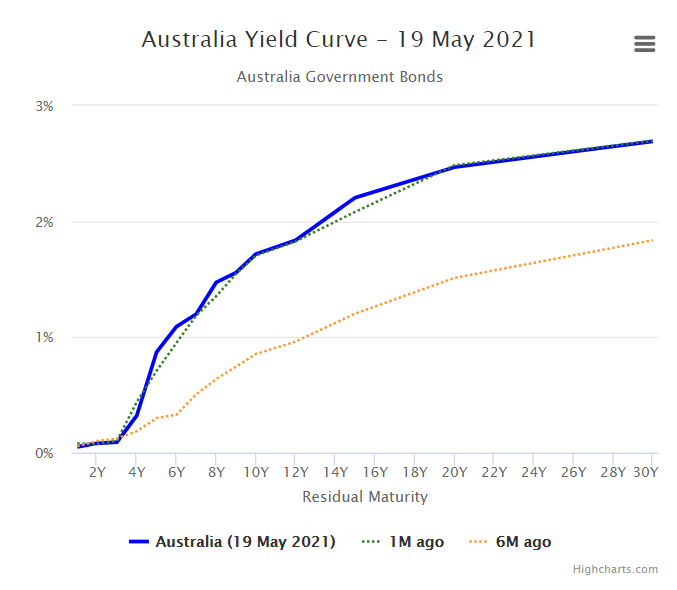

Similar story for long term fixed rates and bonds. Noteworthy is that a number of larger banks have increased their term rates for fixed home loans past 3 years. The belief is that, as “insiders”, they know what is ahead. Maybe so.

If the inflation talk was really believed by the market, you would expect 10 year rates to have moved a lot higher. They have held from the big “correction” in Dec/Jan, but little moved over the last month. Personal view is that it may not last.

CBA data

Thought of the week. Up the ladder and down the lift.

Lots of noise starting to be made on this one – but I find the whole thing unbelievable.

Disclaimer – if I say anyone is an absolute thief and crook below, you know I’m joking… 😉

Nuix is an Australian tech company that produces investigative and intelligence software. I struggle to use intelligence in this story actually.

They started doing a lot of work in the USA with the SEC. It was well backed by Macquarie Bank.

It’s chairman was a well connected businessman Tony Castagna.

The decision to float the company was made – and if successful then everyone would get a healthy pay day.

Two key problems emerged. Firstly Castagna had been charged with tax fraud and money laundering and was in the klink. Second, was that the firm had lost key personnel and was having a financial stinker.

To get past the first, the float document just quietly erased Castagna’s role in the firm or any mention of the issues. Note he was later released on appeal, but that is a whole different story.

Likewise Maq Bank still pushed the float and to quote an insider…it was a case of “dress the pig in the gown and sell it like it’s a princess”. A tip off to ASIC was investigated and dismissed.

The float went off with a bang in Dec 2020. Shares closed at $8 – double listing price. In January it hit nearly $12.

Maq Bank made nearly half a billion+ on the IPO and Castagna turned $3,000 investment into $80 MILLION.

Late February Nuix revealed sales had fallen in 2020 – instead of rapid growth. Shares fell by a third and now sit at 3.68…well below float price.

We are not talking years here. Float in Dec 2020 and crash in Feb 2021.

We are supposed to have faith in “the system”. Legal requirements for full disclosure should give us faith that we invest in companies with eyes wide open.

This to me appears to be a disgrace to the company, to Macquarie Bank and to ASIC. How would you feel if, as a client of Maq Bank, they had sold this pig to you?

Class action to follow perhaps?

Drinking favourite…

Very modest drinking week again – expect that will be corrected over coming days.

Shared a bottle of below, on a cool Sunday afternoon. From the Veneto region near Lake Garda.

A blend of sangiovese and merlot. Not expensive and the web says it well : Not complicated, not pretentious, but overendowed with slippery and seductive flavours and utter drinkability.

You could drink and ride…

7.5/10

Listening to…

Finished watching the Foxtel series, The Serpent, finally. Set in the late 1970’s it has a soundtrack to match. Harry Nilsson’s Jump Into The Fire at 7 minutes is a long one. I just like the underlying drum beat. And who doesn’t like a rock star in a dressing gown.

7/10

Cheers BS