2021 Edition #16 Fly me to the moon

8 May 2021

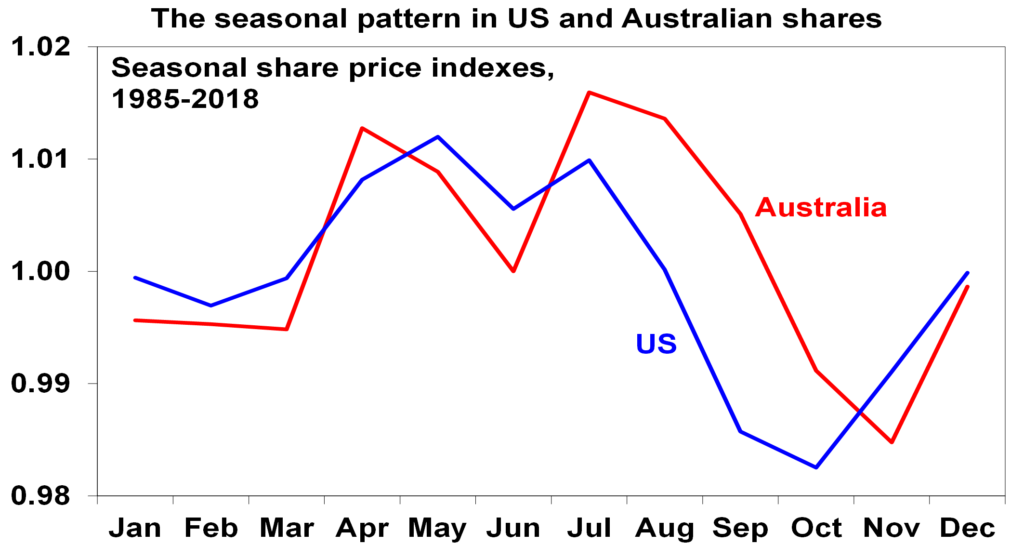

That old bear of mine is under lock and key this week – I’m jumping on a few bandwagons and heading off to the races.

But it wouldn’t be a week without some absolute stupid events in crypto. Unlike many, I don’t begrudge those that are “in” and well set. Good on you. For the couple of iterations that might actually survive, I don’t want FOMO to cloud judgement either. And if I jumped on that bandwagon you can be sure that house of cards would immediately implode.

Only saw the tail end of 60 Minutes on the weekend. Gave me grave concerns that the crypto clean out may be sooner than expected. Some tattooed muppet “millionaire” claiming Bitcoin was too big to fail and was set to blast to the moon. Like Antares rocket it may eventually fly, but a few bangs first.

Bitcoin is not the worst of that lot though. New ones emerging every day – the latest is Titscoin.

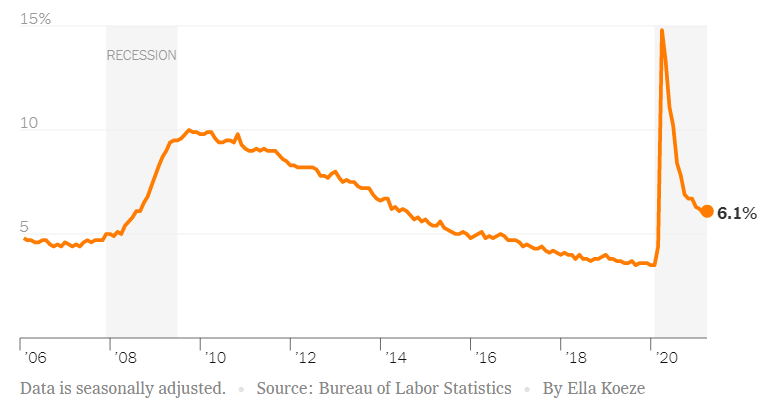

But then again, what would economists know? They got the US employment report horribly wrong. New job creation down, participation up – thus unemployment rate up.

You would think that is a negative for the market, but no…Dow and Nasdaq up strongly on Friday. The good vibes of animal spirits say that is just a short term aberration.

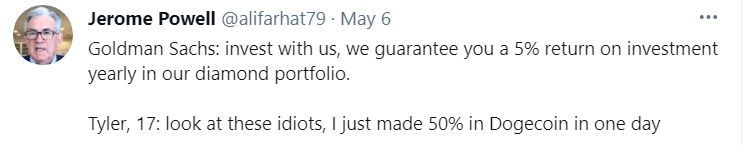

A couple of US Central Bankers spoke: “Vulnerabilities associated with elevated risk appetite are rising,” added Fed Governor Lael Brainard in an accompanying statement. “Stock prices are high compared with earnings, and the appetite for risk has increased broadly, as the ‘meme stock’ episode demonstrated.” Fed Chairman Jerome Powell also said parts of the market were “a bit frothy” last week. “I won’t say it has nothing to do with monetary policy, but it also has a tremendous amount to do with vaccination and reopening of the economy.”

Not sure this Tweet is from the real Powell:

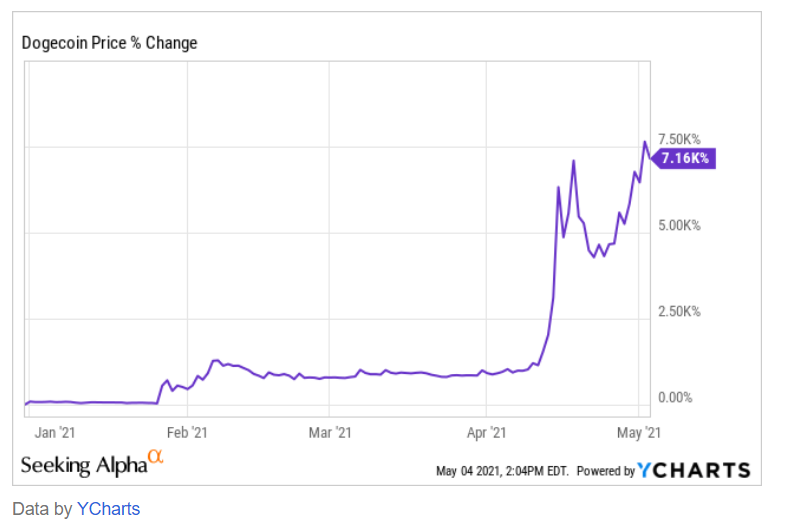

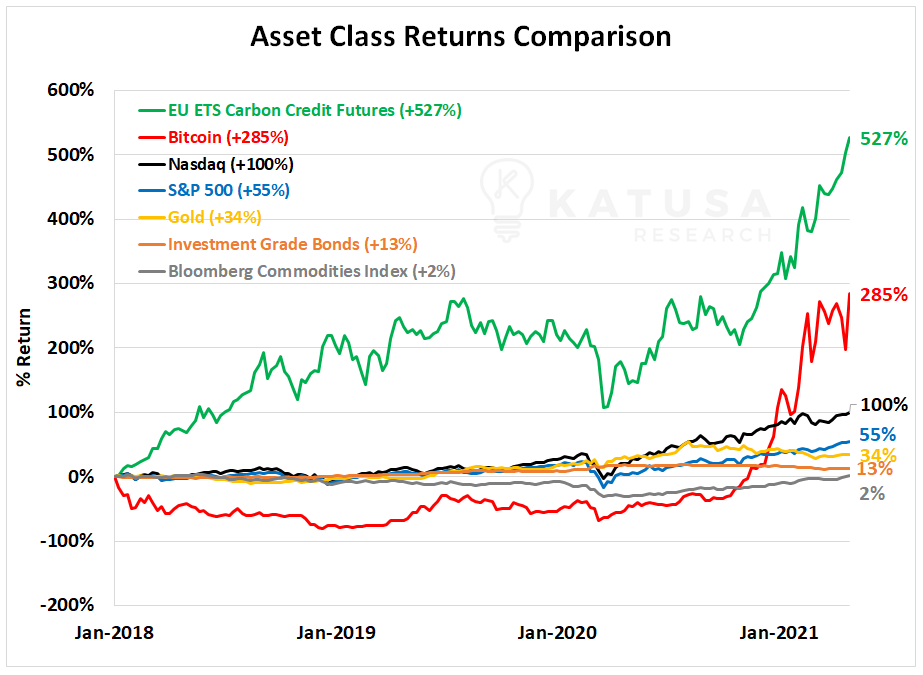

Frothy aside, Dogecoin (a made up meme joke now worth $90B USD) is not actually the only big climber in price in the past couple of years.

European carbon credits are on fire (pun intended). Unfortunately, like crypto I have no idea how to actually buy into that asset class. And certainly, no real likelihood that an Aussie market is imminent.

Iron ore prices continue to rise. A snippet below from fat PROPHETS I thought was interesting. Certainly China looks keen to find alternate suppliers, but at the moment we are “it” for about 65%.

Australia is the dominant supplier of iron ore to China, delivering upward of 700 million tonnes of China’s 1.17 billion tonnes of imported iron ore in 2020. Iron ore pushed up to a record high above $US200 a tonne. The price of benchmark iron ore rose to another record and given the Chinese steel mills are making record profits as well, appetite for the bulk material is insatiable at present.

Iron ore made new record highs and looks set to push the bulk material miners higher today;

Iron ore is a vital component in the production of steel, and with China embarking on a US$500 billion infrastructure spending spree to help the economy recover from the pandemic, Beijing’s need for it has never been greater. Now we have a paradoxical standoff with both countries too big to do too much about the other.

Speaking China, the “war” rhetoric continues and they upped the ante this week by cutting diplomatic talks that were not happening anyway.

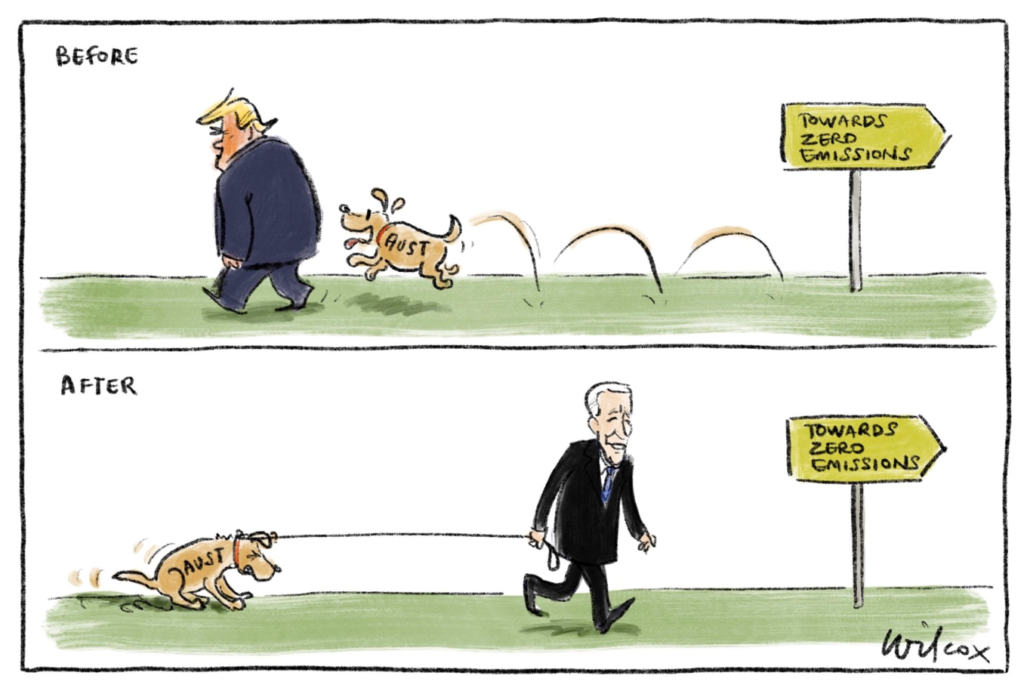

Dutton thinks there is votes by being the tough guy. Liked this tweet:

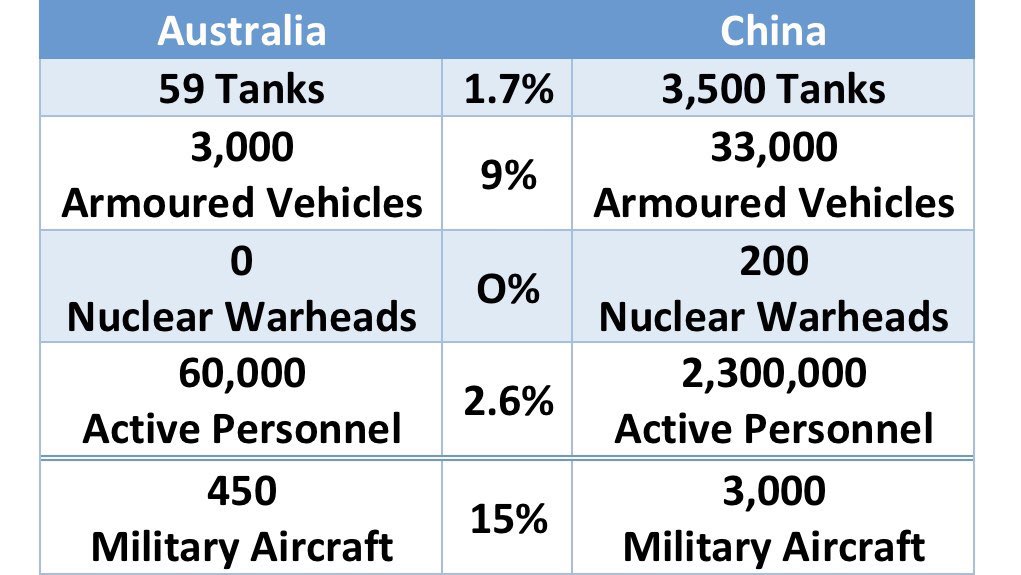

Of course it is unlikely to happen…but if we did get into a stoush with China, the stats above do not look good for success.

Back to markets …and how we will all be rich, rich….rich.

Apart from us all making a motza on the share market, our house prices are on the fly still.

One smart punter this week flagged a small concern that growth generally may be dramatically slowed in Australia in the next few years. Theory is that our positive GDP pre Covid was just about all due to population growth, aka immigration. Without it we would have been in a recession 10 years ago. So he ponders how equities can push much further from here.

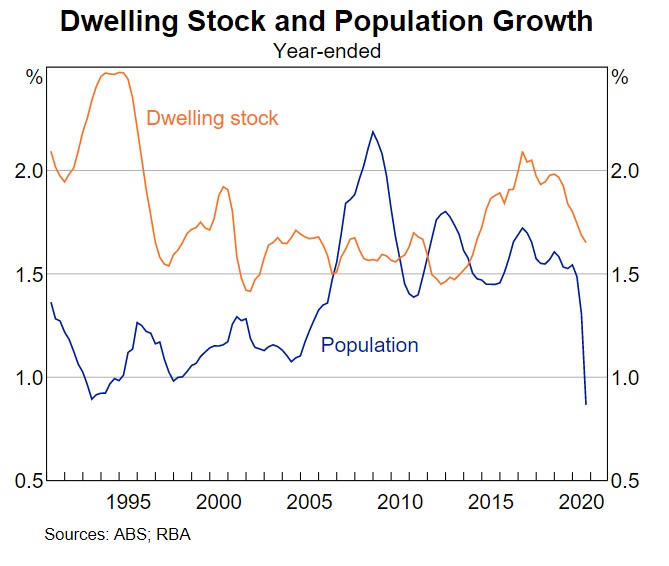

Being positive this week, I leave that question for you to answer. But on housing, look below. Makes good common sense that the stock of available housing falls when population grows and vica-versa.

In 2020 stock fell as did population – for the reasons we know. But in 2021, stock is increasing again, but population has not and will not for quite a while. Under “normal” rules then we may see an over supply of stock which should see house prices cool. Like everything at the moment though, you can perhaps justify that under “transitionary” theory and post 2023/24 people will be gagging to get to the Lucky Country.

Aussie dollar took a dip after the China issue blew up – but ended the week very strongly – mid 78 cents. Reason for the near 1 cent climb appears to be RBA’s Statement on Monetary Policy released Friday.

In a Goldilocks moment it has predicted a remarkable V recovery with no apparent repercussions.

GDP of over 8% combined in 2021 and 2022. Unemployment down to 5% by year end and 4.5% by 2023.

Inflation to not be a problem – slowly rising to 2.0% by mid 2023.

But best of all – cash rates to remain at current levels until wage pressures push inflation much higher.

RBA says: “For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.”

Maybe that porridge is too hot.

CBA data:

One more thing…

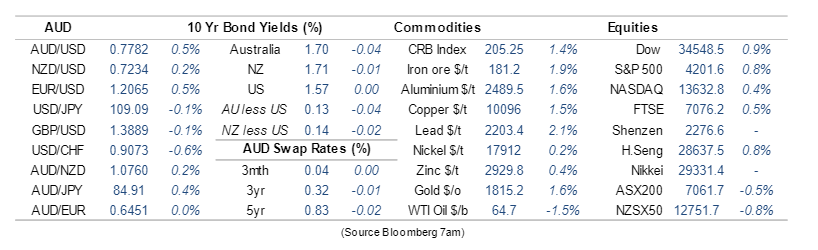

We all know that generally the share market has some degree of “seasonality” – when it is a good time to buy and sell. Interesting chart below. Interesting for two reasons. Firstly how close we track the US (with a lag). Secondly, June and July is a buy time. Banks profit results this week were very positive, albeit a lot of the “profit” was Covid provisions pulled out from under the log and posted as $$ in the tin. Share prices up…lucky (not) that I sold a truckload two months ago…

Unrelated tweet but too good not to use…

Thought of the week. Fighting the inner bear

Red n White Swan did a guest article in Edition #1 this year. They are back with some thoughts on the big picture;

It is not just the Federal Government that has blown its budget.

State Governments have reduced revenue streams and/or reduced GST allocations. They have also looked to provide stimulus where possible – aided by local election cycles in some States.

Therefore AA rated state governments have gone back to tap into capital markets via borrowing.

Last month we saw:

- Queensland raise $2bn

- Tasmania, $500m

- Northern Territory $650m

Terms ranged from 6 to 12 years with margins of 9 to 68 basis points over the Commonwealth’s cost of funding.

All three fund raisings were well oversubscribed – nice given previous lack of need to borrow over recent years.

Is this the new normal?

With reduced GST receipts, if States borrow more, will their Credit Ratings be under pressure….with the resulting higher borrowing cost.

The short answer may be no. Liquidity in the financial system is extremely high, and the “system” appears in tip top health.

The big banks have been told that they need to hold more “liquid asset debt securities” – a bit like squirrels keeping some nuts tucked away in case of a snap freeze. State government debt issues fit that space, and the Banks are thus almost forced to buy them. Maybe more a case of highlighting how the system protects “the system”.

RBA themselves also gave the Banks a free kick with access to cheap committed liquidity funding.

We saw from the RBA in their March quarter report that Australian banks increased home lending by a net 74bn in the twelve months to March 2021, whilst deposit grew by 78bn in the same period.

So where did all of that cheap RBA funding go?

Well some of it went into repaying riskier funding in money and bond markets and some of it went into buying more bonds…..State government bonds by the looks of things.

With COVID deferred home loan interest payments long gone and the RBA’s 200bn generous 10 basis points costed 3 year funding scheme wrapping up in June not even fully utilised, Banks have cash coming out there ears.

No wonder we have a red hot housing market, banks cannot give away the money fast enough.

Rating Agency Standard & Poor’s recently upgraded the Australian banking systems financial strength. Iron ore priced are high – giving the federal budget next week some much needed relief.

Thus any money the Aussie State or federal Governments want from offshore will be easy to find – and the exact same situation applies to our Banks.

But how will that money be spent? Housing finance has to (surely?) slow soon. That leaves either new business lending initiatives or building programs for new arrivals when the migration borders finally open.

If not…the RBA bond buying program and QE might need to take a breather and that means higher rates….even if RBA have their mandate to keep a lid on it.

Meanwhile credit should be free flowing for some time to come. Life is good. Have an ice-cream.

Drinking favourite…

Tried to keep a lid (or cork) on my drinking this week, but weakened when I saw this beer on the menu.

I love a good Kolsch and good humour. No cheap wine or three day growth.

Dan Murphy says…Subtle bready, malt flavours backed up with a hop spiciness that makes you want to come back for another.

9/10

Listening to…

Trying to keep up and about. Good rift, and good lyrics. Time to wake up.

Until next week….

Cheers BS