2021 Edition #15 Really – are we that stupid?

30 April 2021

Stupid is…stupid does

The much anticipated Crypto melt down did not eventuate. Bitcoin recovered from sub $50k USD to be 10% higher on the week.

Whilst “holders” of Bitcoin rejoice, to me it just further enhances the argument that Bitcoin is NOT a currency. Yes, it may be a means of exchange, but it is not a store of wealth. Way too volatile. Imagine if the USD actual value or even AUD jumped up and down by 10% in a week. Chaos.

The “real” Black Swan, Nassim Taleb ( Highly Improbable ) told CNBC this week he was once a fan, but now sees Bitcoin as a gimmick. Further he argued that seeing Bitcoin as a natural hedge against inflation is bullshit. “Bitcoin could go to $1 million and I wouldn’t change my mind”.

To me the absolute real risk is “the man” taking control of the crypto space and regulating the existing challengers into obscurity. Visa, for example, is in talks with Central Banks around the world about introducing their own version. Central Banks might be tempted to support just to get these pesky millenials back in their box.

Rumours that the Chinese may ban Crypto mining to cut down energy use and emissions. That will be interesting – will it push prices down or up (limiting supply)?

Michael Collins, the third of the three tenors, died this week at 90. He could hit a high note….

US equity market ploughs on – but at least has a few down days to appease us bears. About a fifth of the companies have reported results recently – and over 70% of those have beaten forecast revenue.

So maybe on a P/E basis the run continues : Price higher and Earnings higher.

US GDP a massive 6.4% for the March quarter – very supportive for markets.

Real estate is now officially crazy. A 348 sqm house at Bondi was snapped up this week for a mere $5.8M. Black Swan’s pond has a better kitchen than this joint…..$5.8MILION….

Let’s at least hope that the buyer was not a first home buyer…

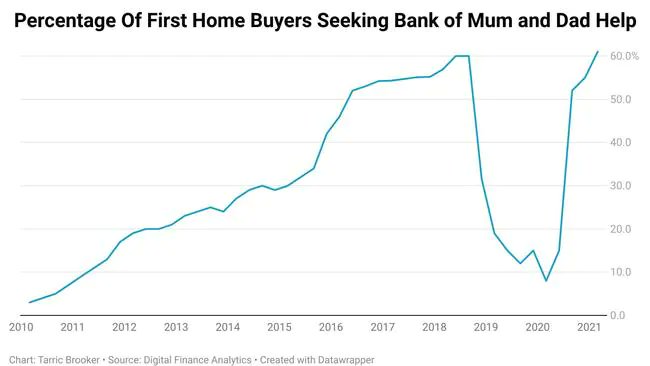

The chart below is interesting. A decade ago less than one in ten kids hit up Mum and Dad to support their first house purchase. Post Covid dip, it is now back to 2019 highs of over 60%.

I don’t know who that is scarier to – me or my cygnets. Interestingly one indicted this week that she never expects to actually own her own home, and will probably rent all her life. Some financial talks will follow.

Perhaps Boe Pahari bought it for his kids. The Ex AMP executive stands to walk away with $50M from his amicable departure. Set up in 1848, AMP has made an absolute dogs breakfast out of managing investments, and well, managing a company. They have virtually halved share value in the last year, and any big rebound seems unlikely.

Why would an investor that has lost 50% of their money begrudge Boe taking his fair share…$50M. Then again, I call bullshit. That is absolute crap.

Iron Ore is over double the price that was predicted for the Federal Budget and remains strong for now at least – a massive boost to budget bottom line. China happy to keep taking our ore as Brazil remains in sub optimal production. If you listen to some of the drum beating, that iron may be coming back at us in the near future via new kick arse naval boats.

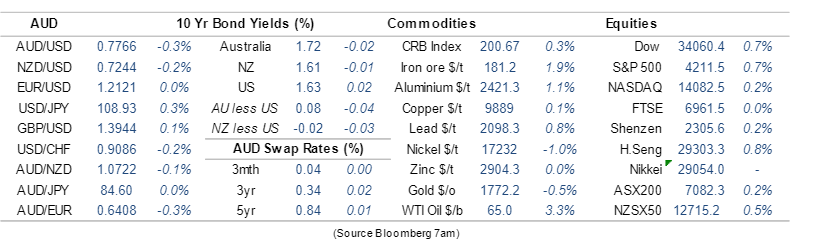

The Aussie dollar is a bit ground hog. Doesn’t want to test 80 cents just yet.

And if you overlayed the Aussie 10 year yield it would look very similiar – see last week’s blog for why.

The big data release for the week was inflation…or to be precise the lack of inflation. More on that below.

Josh Frydenberg softened us up for next weeks budget. For a small “l” government it has more than tripled the Federal deficit as a percentage of GDP since it took over power. No tightening in sight, and if anything he seems to be promising more fiscal cash splash. I’m not advocating massive tightening, but the recovery seems solid enough that even more fuel on the fire may not actually be needed. The theory seems to be an aim to get unemployment at or even below 4% in order to squeeze wage increases from employers. Theory might be right – or we may be following USA like lemmings over a cliff.

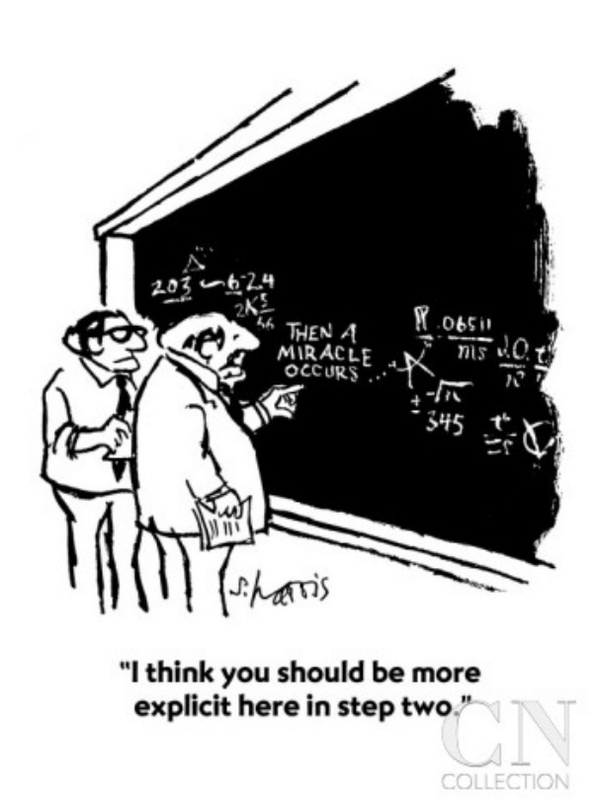

He has his brains trust working on the numbers though.

CBA data:

Read this little snippet:

“If we fail to apply the brakes sufficiently and in time, of course, we shall go over the cliff.

If businessmen, bankers, your contemporaries in the business and financial world, stay on the sidelines, concerned only with making profits, letting the Government bear all of the responsibility and the burden of guidance of the economy, we shall surely fail. … In the field of monetary and credit policy, precautionary action to prevent inflationary excesses is bound to have some onerous effects–if it did not it would be ineffective and futile.

Those who have the task of making such policy don’t expect you to applaud. The Federal Reserve is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

It seems to fit todays issues (other than chaperones are hard to find) but was told by the Chair of the US Federal Reserve, William Martin in 1955.

In other words, Central Banks have the role to try to cool the heels of investors when things are getting hot. You could argue, the USA is in that space now, but the current Fed Chair Jerome Powell is sneaking bottles of vodka into the party to add to the punch.

Or as I read this week, in 2021 terms…“We are now in the last hour of the party. The table is full of drugs and hookers.“

Thought of the week. Fighting the inner bear

Like many I follow a number of smart people on social media. If you only follow one”style” of politics or economics you can become very blinkered.

As I highlighted before – I would have been a shit-house trader, because I know I hold onto my convictions for too long, rather than close out, take some short term pain but live to fight again. You may be wrong, but like a clock, you could be on the money twice a day.

I follow a number of pundits that have called for a massive crash in the US and Aussie sharemarket almost every day this year. I have read so much spiel re Crypto that it must be evil. But others call it the saviour.

Thus like a deer in the spotlight, my personal portfolio stays right in the middle of the road…not only expecting a crash…but highly likely to be involved in the aftermath carnage. Yeah, I piss about at the fringes, but a 20-30% market pullback would mean serious pain.

I do see it more as a probability than a possibility – just the timing is fluid. I think I said a few weeks ago by September 2021, and that timeframe still works for me – far enough away that I don’t need to buy/sell just yet.

So what will trigger this pullback, given pent up demand is strong, profits are ok as we saw above and capital has never been this cheap?

I spoke to a couple of charming millenials this week that saw crypto and general market trading as sexy. Just like the casino – exciting.

It struck me that a lot of new money flooding into equities may be via new/inexperienced punters having a crack. Worse, how many are not using just a bit of spare change for the venue, but going “all in” via borrowed money?

No one knows the power of leverage better than banks – it is their bread and butter. You deposit $10 and they lend $100 off it.

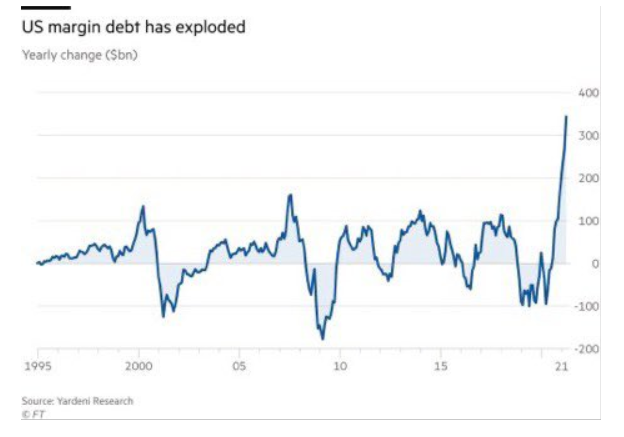

Chart below is US margin debt. Spiking higher than Indian Covid cases – lets hope it ends better. Clearly there is a raft of top end money mixed with punters.

Margin lending is just pure leverage. Great returns can be had. And of course you can leverage to the downside via short selling/puts – but you and I know this is all invested to the topside. So everybody feels great, until the punch bowl’s removed.

What will be the cause? To my mind, the most obvious is inflation.

Aussie inflation this week. RBA’s chosen measure (trimmed mean) rose by just 0.3% for the quarter, dropping the annual rate down to 1.1%.

Only Darwin has inflation running in the 2-3% preferred band at present – everyone else is well below. This would give RBA and Josh much comfort that the “lower for longer” story is intact.

A very similiar story in the USA. Is the world entering a “Japaneasy” phase where inflation can be bottled for years? I’m out there looking for it…

Last week we looked at some commodity prices. Take a look at US corn prices in last 12 months:

I’m not a big cornflake man myself, but I’m told this is an extremely rare price action without a drought.

Also take a look at The Baltic Dry Index. The index provides a benchmark for the price of moving the major raw materials by sea. It is as high as anytime since 2010.

Similiar chart for copper etc…

So both the US Federal Reserve and our own Reserve Bank have taken the official position of looking past such data, and believe they may just be “transitionary”. They will only act once inflation is clearly here and visible in the rear view mirror. This is a massive change from past conduct. And we are doing this in a time of history when there has NEVER been as much fiscal stimulus globally with co-ordinated quantitative easing (read money printing).

So we go out on the high wire without a balancing pole and with no safety net.

Q: What could go wrong?

A: Just about everything.

Meanwhile the measure of market fear (the VIX index) is 10% lower than its long run average – nothing to see here.

CitiBank Head of Trading says: ‘I hear a lot of “I can’t see a catalyst to take the market lower” chatter, which is not the kind of language that sits comfortably in the stomach of this author’. Yet he measures and monitors warning signals and shared a number of concerns this week.

But I watch and I wait. Wake me up when September ends….

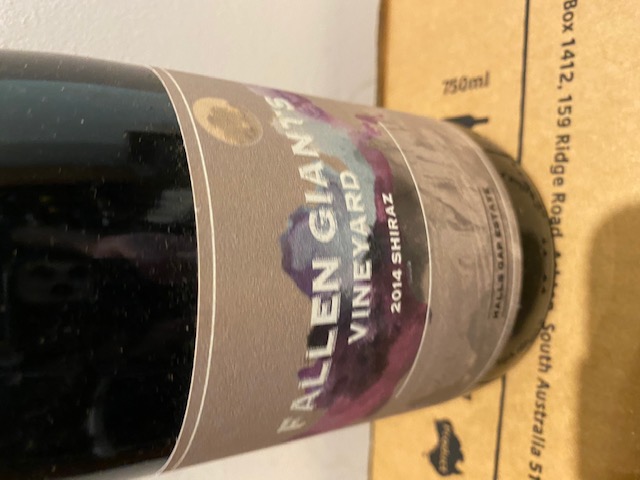

Drinking favourite…

Grabbed this one from cellar door awhile back.

Wine List Australia says: “A western districts Shiraz of opulence, generosity and palate richness to accompany the bravest fare, full flavoured meats and root vegetable dressed in a powerful red wine glace de viande.”

I agree mostly, except with the root vegetable bit. Cool climate shiraz.

7.5/10

But…

Until next week.

Remember you can fool most people most of the time…

This has absolutely no link whatsoever to ScoMo – I’ll keep my hands off that.

Listening to…

In keeping with this weeks theme, I chose a new release from UNKLE….If We Don’t Make It.

Have followed him for years. I like UNKLE’s Lofi sound and rhythmic beat – neither dance nor sleep. Maybe trance?

Until next week….

Cheers BS