2021 Edition #14 Dance monkey dance

25 April 2021

I wasn’t there…

Diggers Day long weekend – and thanks be to the few that have made sacrifices for the many. I had a tie for tweet of the week. Following on from our blog last week about the possibility of military conflict, we get the following via Sky News:

Thank goodness Katter is an irrelevance.

And of course, Australia may not be top of the pops with Biden anyway, after the expected mediocre performance from ScoMo with regard to the Climate Summit.

Regardless of whatever your perspective on climate action is, the current “policy” or to be more accurate, a policy of not having a policy, is making Australia look increasingly inward looking and self indulgent. The Coalition can’t afford to offend the growing number of voters that want action (even the latte sipping inner city hipsters) but appears very commited to keeping the big end of town happy. So they get dragged reluctantly along and do the absolute bare minimum of change. When you straddle a barbwire fence you risk torn pants and torn parts, from one slip.

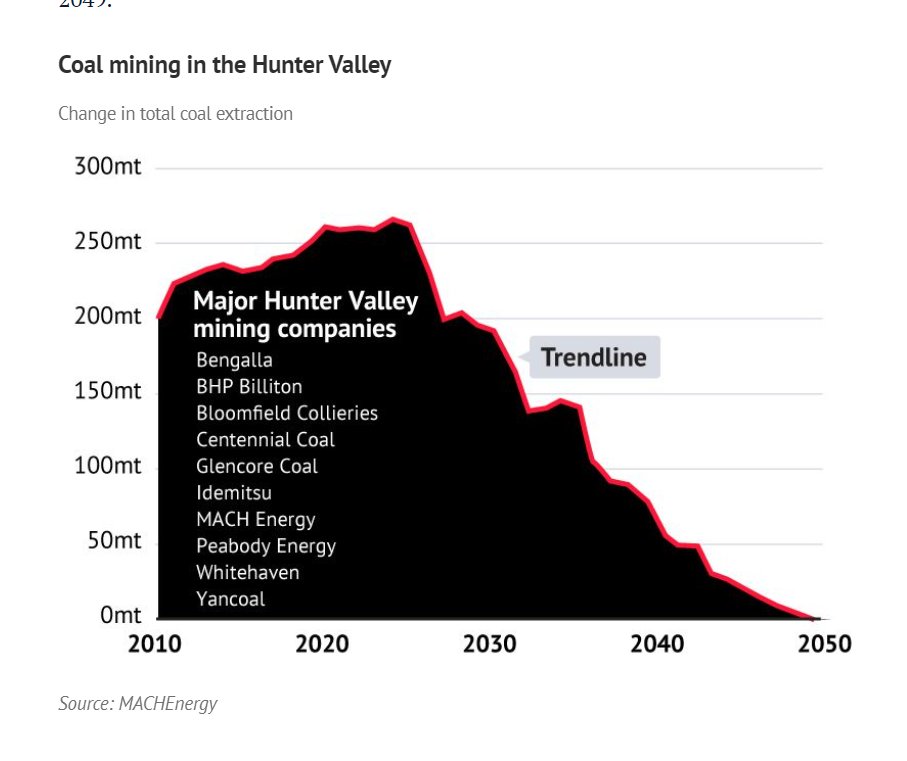

Funny thing though, is that even the coal miners see the end coming – why can’t George?

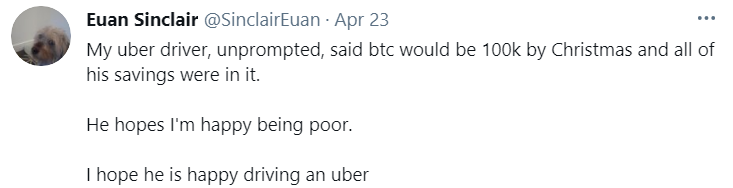

The second potential tweet of the week is:

Never say never, but crypto currencies generally had a rough week. Rumours of a massive crypto fraud and international escape from Turkey started the slip, followed by an update from Eun Sung-soo, head of South Korea’s Financial Services Commission, who said all of the nation’s crypto exchanges (200 odd) could be shut down in coming months to meet Anti Money Laundering and Financial Reporting requirements.

We saw that train coming, we called it out…and did nothing. I’m not even sure how you would short sell crypto for that matter.

Bitcoin chart (USD) below – at close enough to $50k, is at monthly lows. My local “insider” tells me the technical support trigger is $45k, and if it goes through that then watch out.

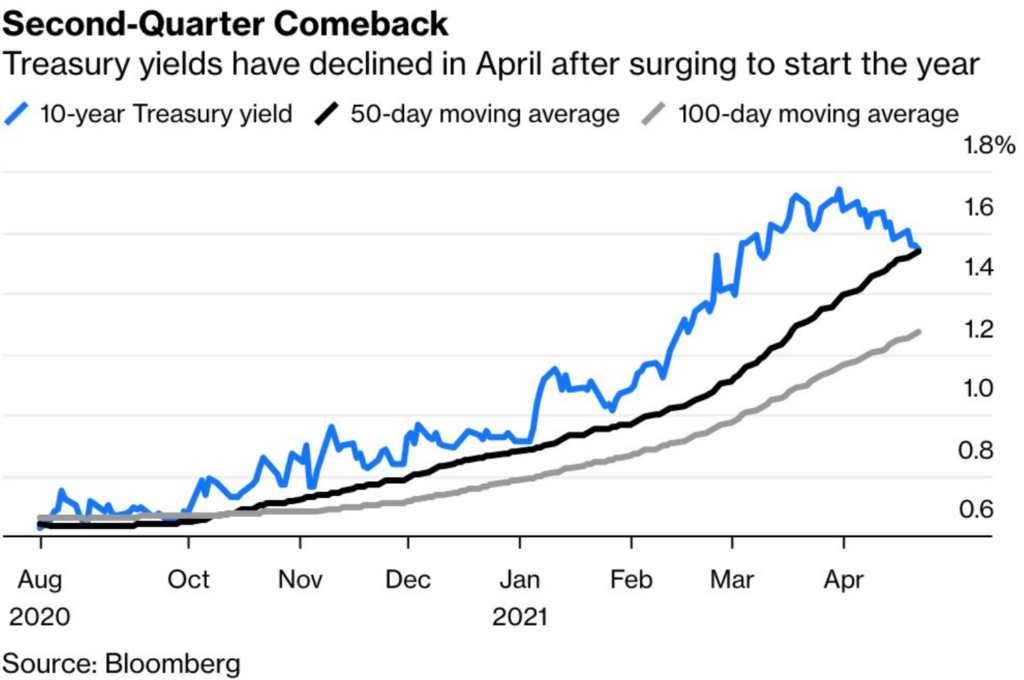

Treasury yields are off a bit this week. Remember that lower yields means a higher price, so Bond Traders are happy. A good friend highlighted a Bloomberg article that seemed to support the theory that we have held for a while here – namely that term yields will have a hard time getting higher whilst cash rates remain low (and expectations are that they will stay there). Furthermore it tried to match long term neutral rates to US Fed Dot Point expectations. In 2012 that rate was 4.25% – now it is closer to 2.5%. Even at 2.5% that is a long way from current cash rates, and the 10 year yield is 100 basis points lower that that. Aussie yields are in the same space.

So no need to fear? The risk is that the pent up demand in the system will see inflation re-appear.

Not many seem concerned yet. Noting some of the commodities below got a price whack in the early Covid days, the USA data below may be a wake up call:

Commodity prices over last year…

- Lumber: +265%

- WTI Crude: +210%

- Gasoline: +182%

- Brent Crude +163%

- Heating Oil: +107%

- Corn: +84%

- Copper: +83%

- Soybeans: +72%

- Silver: +65%

- Sugar: +59%

- Cotton: +54%

- Platinum: +52%

- Natural Gas: +43%

- Palladium: +32%

- Wheat: +19%

- Coffee: +13%

- Gold: +3%

Potential late play for tweet of the week:

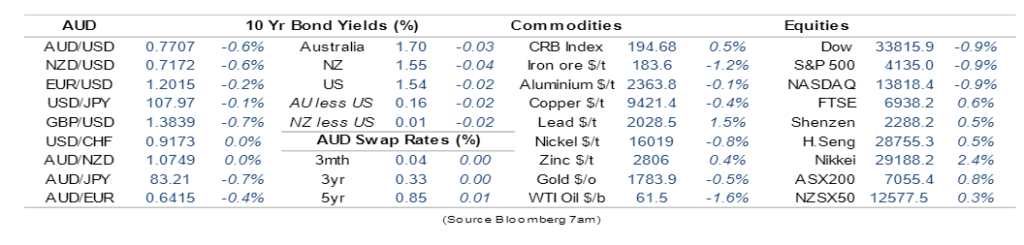

The Aussie dollar also got smacked a bit at the tail end of the week. We seem to be on a mission to make ourselves feel good that we “stood up to the man” (China) but at the same time shoot ourselves in the foot. Reneging on the Victorian Belt and Roads deal was bad enough, but rumours around now that we may revisit the Darwin Port lease arrangement. That stuff gives a serious soverign risk price deduction to Australia.

AUD went into the 76 cents briefly but is back in the 77’s at present. I would understand why exporters may not be excited at that level, but may be target entry levels for some cover if it heads back down again. Importers….may be hold.

Thought of the week. Risk free money…how do I get a piece of that pie?

A new guest contributor this week.

They still ply their trade in the market, so they only want to be known as the “Credit Crusader” . They don’t work in a bank, but work with many banks.

Their views:

Risk Free Investment – could it exist?

Yes it can, and it’s available on a massive scale in our property obsessed country. It is not in property itself, but in the Banks that lend money to people buying residential property.

Working for an investment firm we receive lots of glossy presentations with colourful charts that have the end aim of attracting our investors’ dollars.

A Bank sent one through recently that got me thinking. The disclaimer on the preso told us ‘The Notes subject to Investment Risk’. So, as prudent investors we go looking for where these ‘so called’ risks are hiding.

This particular deal being offered was a structured credit, specifically Residential Mortgage Backed Securities (RMBS). In short, the Banks lend money to you and I to buy a house. Sometimes they on-sell these loans to investors, who take over the risk of you and I repaying the loan…or not repaying the loan. Now, it’s much more complicated when you dig into it with big words used like subordination, excess spread and weighted average life. But really, as an investor buying into these securities you are essentially taking on the role of the Bank.

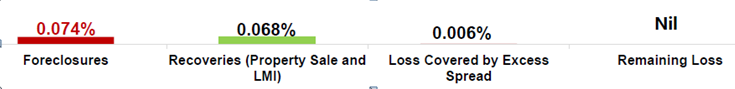

So back to the presentation pack. Below are the numbers that got me asking whether investing in these securities, or in Banks that lend to fund residential property (CBA being the biggest by some margin) is in fact risk free.

Now, a few caveats: Banks do a lot more than lend against bricks and mortar, and the issuers of RMBS do get to pick which loans they sell and, tend to pick on average, better ones.

But, check out the loss rate on 10 separate RMBS issues dating from 2013 to 2019 – nil, zero, zilch – say it anyway you like. Investors have ploughed over $7bn into these securities and the total cumulative loss rate was 0.01%. After excess spread, the loss was Nil.

The financial doom faced into at the start of COVID does not appear to have disrupted the risk profile of residential mortgage lending. In fact, with the explicit Government support delivered to the Banks via the RBA policies and income support channelled directly to borrowers from the Government, you could argue lending is even more risk free! Westpac are calling for a 15% house price appreciation this year and 4 – 5% next year. You can’t hold back the old cow…

Going back to CBA, their most recent figures show they have over $550bn in home loans. That is 71% of their total lending book. Some of these loans will go bad and CBA will lose a few dollars. The pool data we get to see on RMBS issuance tells us these losses will never amount to anything like the net interest margin the CBA generates every year.

It’s the same at all the other Banks give or take a few basis points.

The best position on the roulette table is the one spinning the wheel – the house. The Banks are in this seat, making fat margins on residential mortgage lending under the guise they need a return on the risk. The Banks are canny – there is no risk.

They keep almost all of the margin, sharing it as dividends with their investors (COVID blip aside). This is the risk free investment available to all!

Go find yourself a hat full of money.

Drinking favourite…

I’ve been drinking Great Northern beer this week. Crap beer, but perfect bottle to bring down pesky drones trying to get investment tips from Mrs Swan and I.

2.5/10

I chuckled at an incident in SA this week. A couple of likely lads broke into the Sesame Street circus at 3am (after a few too many Great Northerns) and pinched Big Bird.

Apparently the media wanted to spread the story, but were also keen not to declare Big Bird as not actually being alive. There were a few claims of sightings until he was returned safely later in the week – but in need of a clean as we all would expect.

Listening to…

Sophomore singing well beyond my range. Play it in bed with someone special.

Until next week….

Cheers BS