2021 Edition #13 Don’t throw your weight around here

18 April 2021

Looking for a cup o’tea and a lie down..

More of the same – broadly higher equity markets everywhere.

Local releases were solid – sentiment up and unemployment down.

Westpac appears to be $300 million to the better after it was revealed they owned a stake it Coinbase that floated this week. If you don’t understand or believe in Bitcoin, then investing in a company that acts as a crypto exchange would seem even crazier. Brian Hartzer referred to it as the same as funding picks and shovels during a gold rush.

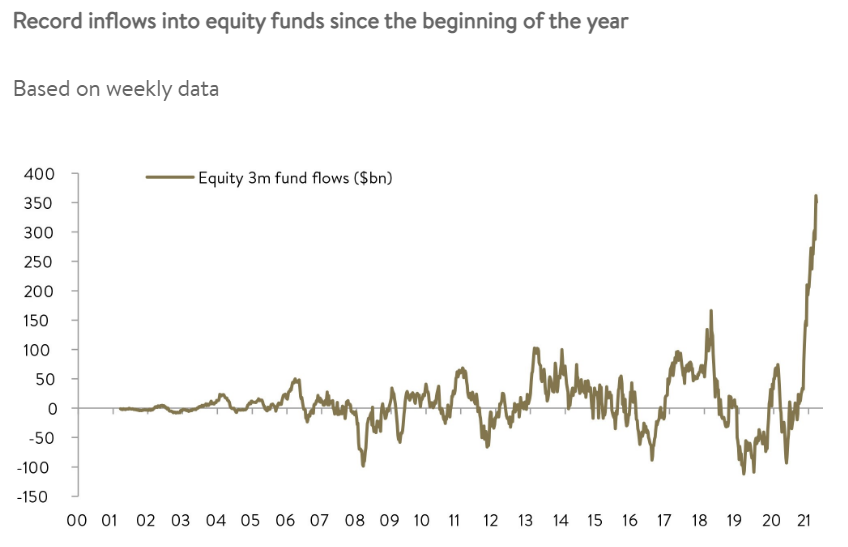

FOMO has never been higher. Flows of capital into equity funds have been huge. In the chart below you can see circa $400 billion has been invested in the last three months. If we assume that those funds have not been used to short companies ala “Gamestop” style, then that alone would push the index to new highs.

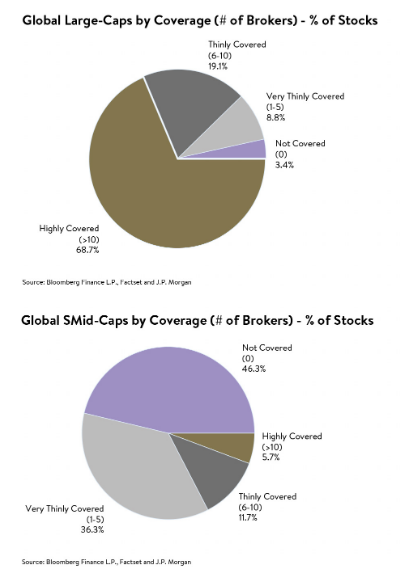

There is a growing number of punters that are bypassing the more established “blue chip” shares to invest in the small cap businesses. Partly that is because everyone now wants a 10% return weekly rather than over a year. Partly it is because some are seeing value that has been “missed” by larger broker firms that specialise in giving buy recommendations.

That is best demonstrated in the chart below. In the big end of town, nearly 90% of the firms have some depth of “coverage” (stock broker analysis). In the small cap space, that falls to 17%. If you understand the business, or can get to understand the business, then there must be some bargains out there that broker firms are totally unaware of.

Aussie house prices still on the fly…I liked the disclaimer to the statement below.

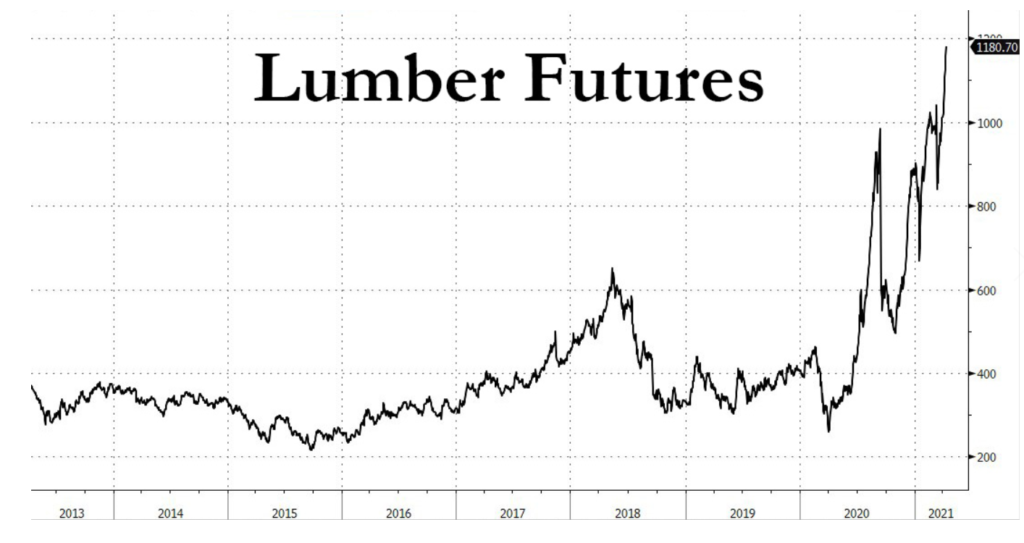

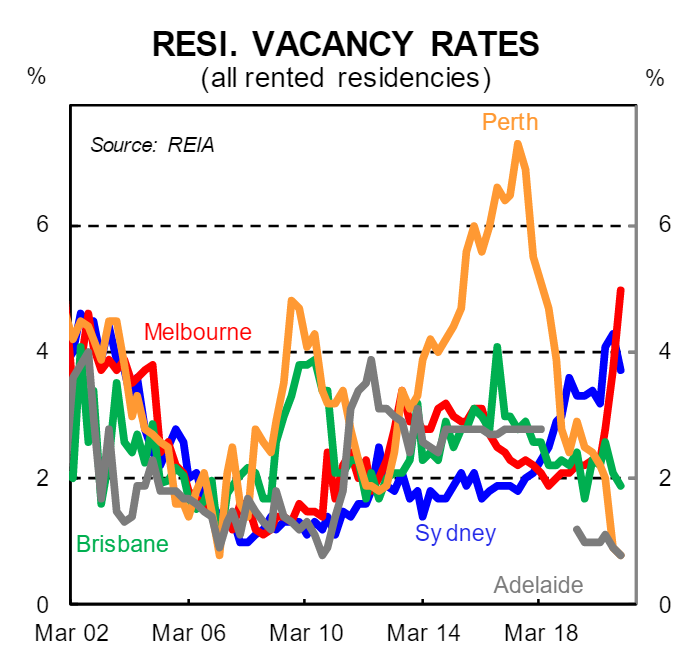

Howls are starting about rental costs and availability. Sydney aside, you can see why there is a squeeze. The government has extended time for building commencement in order to receive grants, given supply issues. We mentioned that last week, but below is a chart from the USA that shows timber shortages as a global issue.

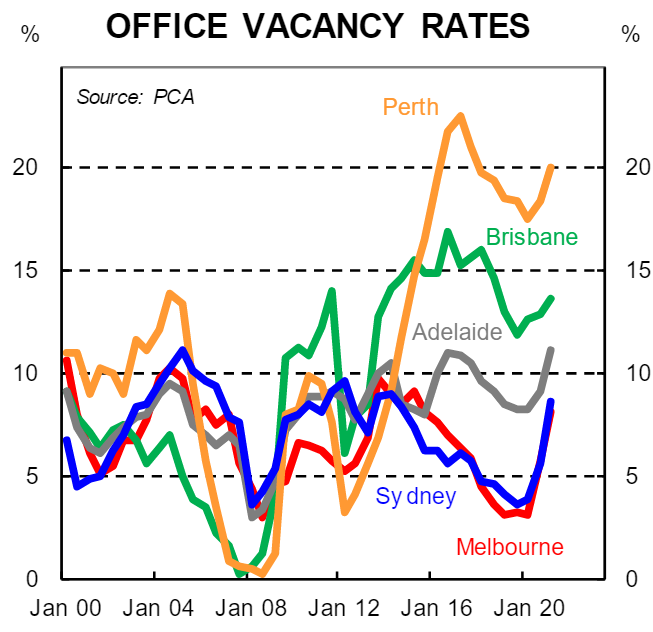

Totally different perspective on office vacancies. With the economy recovery so quick, it is surprising economists, politicians and us punters, why hasn’t offices snapped back? Well initially you can see vacancies have been rising in most capitals for a number of years well before Covid. The structural change appears to be permanent post Covid though as it is apparent work efficiency from the work from home phenomena is clear.

Vale this week to Bernie Madoff. After a 150 year prison sentence from 2009, he made famous the get big or get out approach. A Ponzi scheme of circa $65B USD he was not fussy who he ripped off.

He was once Chairman of Nasdaq and highly respected…until he wasn’t. Points for his puppy dog eyes though.

In the USA, Joe Biden has begun talks to reduce gun ownership. To us Aussie’s this issue highlights more than any other, how f#cked up and divided that country is.

No body expects any meaningful changes. Even if (highly unlikely) he can keep his party united on this issue, the Republicans will filibuster any motion into oblivion. Serious real life photo below highlights the challenge.

Long term yields have mostly stayed flat this week. Not my chart, but naming it the Moron Bubble seems appropriate. Goes back to 1996.

Black line is the USA share market, the red line long term interest rates. The piece below matches the Google search for inflation. People got “excited” about the possibility of inflation back early this year, but seem to have forgotten about that as any concern.

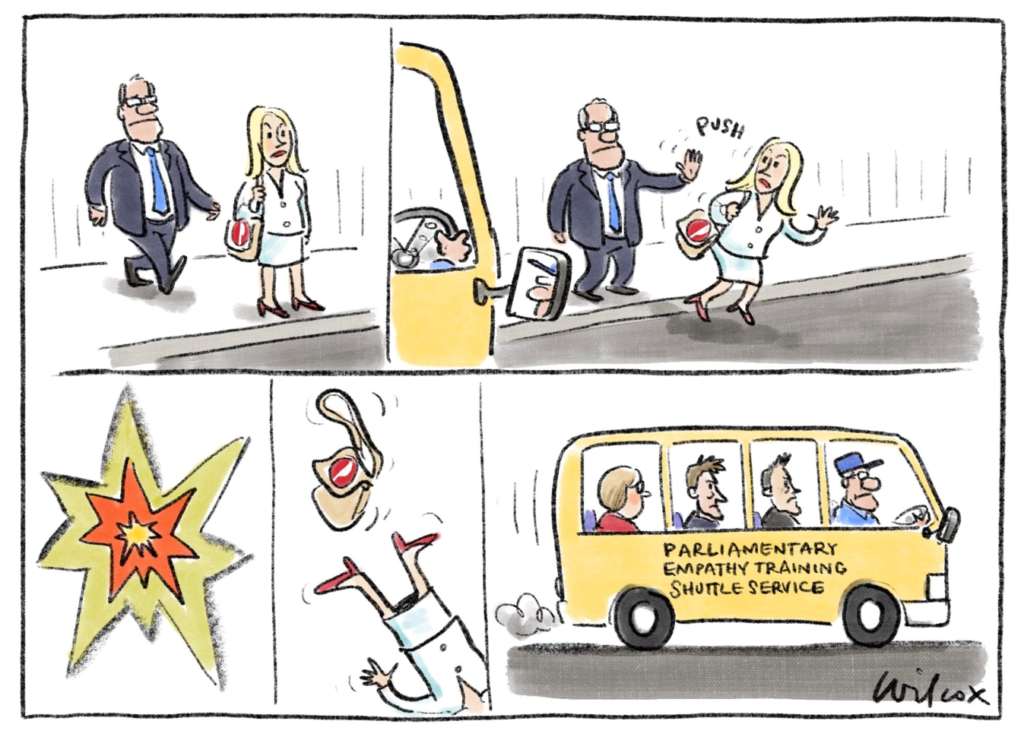

Labor are not blameless either, but how crazy is it when Please Explain is the voice of reason….

Thought of the week. Under pressure.

Our Asian correspondent is currently under house arrest but should be able to smuggle their report out later this month.

We reported last month that Greensill Capital was one to watch. It has blown up more spectacularly than we predicted. The latest of these fails appears to be Huarong Asset Management. It is a Chinese Government backed “bad bank” that was set up to assist troubled assets. They are in deep poo poo themselves, and their bonds are trading at 80 cents in the dollar. Possible contagion is the real issue. Chinese state owned entities owe circa US$3 trillion in onshore bonds.

What we like is that they just don’t mess about in China. Huarong Chairman was executed early this year for “bribery” – or just pissing important people off. Good read here:

But generally the global economy is travelling beautifully. What could turn this monster ship of momentum to turn? A black swan event.

The very essence of a black swan event is by is name and nature – unforeseen and unpredictable.

But we will try to unpack two potential future events that might shake down this economic nirvana.

We in the west have got used to a relatively peaceful existence. If there is a military stoush, it is in faraway northern hemisphere and usually involves a lot of sand and dust.

But there is a growing uneasiness that two key players are preparing to test the world’s resolve. And if they do, what will the effects be?

You could have a trifecta of crazy world leaders, but Trump is too busy getting his golf handicap down for now. But you do have a couple of whacky guys running China and Russia. Let’s quickly look at each:

China – Xi Jinping

He became President in 2013.

He believes that the Chinese form of government to be imminently superior to democracy. He also believes his key role and mandate/legacy is to “reunify” China….specifically get Taiwan back into China. Hong Kong already achieved. Indian border pressure is building.

We all know about the South China Sea “islands” that China built and then claimed sovereignty over. Chinese military incursions over Taiwan airspace are becoming regular. As you can imagine Taiwan are concerned.

Aussie analyst Jonathan Pain proffers the following as a possibility – not a prediction….

China invade Taiwan

USA and its allies (Australia) need to respond. If they fight a conventional war, China would win. If they go nuclear….then no need for any of us to worry about economic consequences – game over. And on the sidelines is another nutter Kim Jong-un who has nuclear ability and would rather a fight than a feed.

The USA is busy fighting internal pain, and is not looking for a stoush – as verified by its withdrawal from Afghanistan.

He thus expects the USA may do lots of posturing but ultimately allow that to happen. If you think there was trade tensions now, imagine if that scenario plays out? I know a couple of Taiwanese business people – and they see catastrophic outcomes.

At least the Chinese own the Darwin port if they decide to continue to move southward…

Russia – Vlad Putin

Vlad – former KGB spy. He believes the USA destroyed the Soviet Union – and wants payback

Recently declared he is President until 2036 (mind you ScoMo would love that bit). Believes he is the old school Emperor. But at 68 he needs to get moving. He has no qualms in using violence to get outcomes.

So what might be possible in his game plan? You see Joe Biden coming out this week pretty much telling Putin to cool his heels. I see that as a waste of the few breaths Joe has left.

Russell Warren believes he will soon move on Ukraine, and then tackle Turkey. Why Turkey? To give access for the Russian navy to a warm water port – something that has held their military ambitions back for centuries.

A bit like China, Putin is gambling that the USA is a weakened beast that will not get involved in a Ukrainian tussle. That may be so, but if he also moves on Turkey, then as a NATO country with “close” ties to the USA, then expect fireworks.

Wildcard event on top of both scenarios is that the two nations coordinate the timing for the incursions to further add complexity to any response.

Outside of military impacts (and possible nuclear wipe-out) expect a stronger USD, and oil and gold to rise. Or Bitcoin, if that is your thing…

Drinking favourite…

Whilst it would seem like I rarely buy wine, this may in fact be true. This little beauty was supplied by a wine maker friend that he had traded. A burgundian chardonnay. The professionals claim “Stone fruit aromas that remain on the spritely palate mingling with more yellow fruits, lees mealiness and a savoury tie-off. Fruit forward but modern in shape.” I did like thier assesment, that at AUD $42a bottle it’s drinkability is rated as “guzzle”.

7.5/10

Listening too…

I’ve been doing a bit of outdoor solo work this week, and good old spotify must have recognised my need for country swing. This 2015 release has a good beat and rythmn. And Colter Wall has a solid ginger beard, so must be tough.

Until next week….

Cheers BS