2021 Edition #12 Just scrawling….

10 April 2021

Just scrawling…

It is funny. When I made a humble living working in a bank, every piece of internal and external economic data was read and analysed. Every release and decision discussed vibrantly in the Dealing Room for impacts for our clients. These days I can go days without following with such vigour. A bit like “forest for the trees” I think you can get information overload that actually impairs your sight of the world ahead.

That said, everything still appears tickety-boo. Most economic readings and share prices are at or higher than pre-Covid.

Even CSL share price is surviving the AZ vaccine setback. Its share price is doing what these crabs are – going sideways.

Going sideways

RBA kept the cash rate at 10 bps and “steady as she goes”. They will stick to their course and need to see inflation consistently above 2-3% before higher rates. 2024 is their time frame. If we keep pushing ahead, that time frame will be tested. Latest forecasts are for a GDP of 4.4% this year and 3.7% next year. A really interesting article in the Age this week RBA fails

The main theme is that the RBA has failed us for decades by keeping rates too high. Quite long, but worth your time if you have 15 mins. It has a few good points, but 30 years of unbroken growth till 2020 says they may have got more right than wrong…or we really are the lucky country.

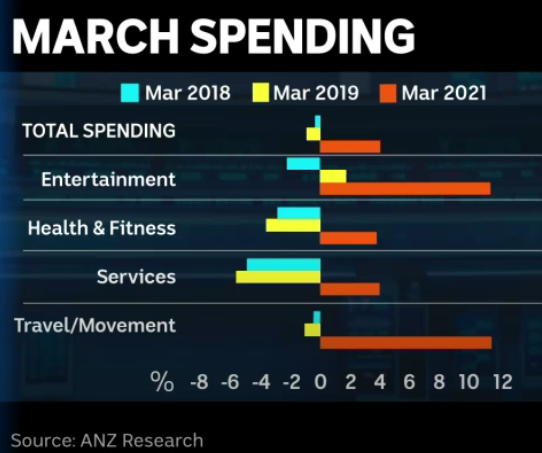

House prices expected to be up 8% this year (with upside risks) and good luck getting a tradie to do any job shortly. Spending is also super strong. The chart is almost unbelievable. Interesting snippet overheard this week about a lumber yard that is all but out of timber. Builders are told that none will be forthcoming. Some builder’s cash flows are being tested because they can’t get the framework up to allow the other tradies to do their bit.

Spending like drunken politicians

So no reasons to worry then. Except I was born to. I walked a fair portion of the CBD yesterday, and the number of small and larger shop fronts empty and for lease reminded me of the Darwin CBD in the depths of its recent downturn. Employment numbers (and the chance of a massive equities correction) still concern me.

A quick read of the daily papers reveal a number of receiverships and liquidations – noting there were none in 2020. Our predicted risks to the GFG group have also unfortunately come true. Early rumours are that the Fed Government may come to the rescue.

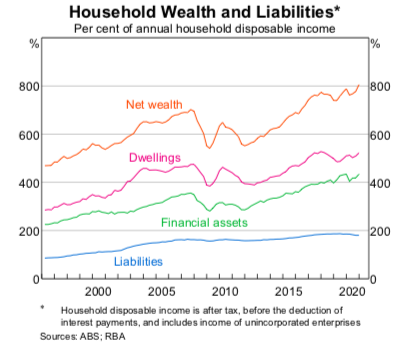

So we all feel good – in fact good reason to as our collective net wealth has never been higher. So much for too much debt and leverage.

We are rich I say….

So given Australia’s relative “unscathed” health effect from Covid, has this been the best thing that ever happened to us? Has the temporary halt to globalisation actually been a positive?

In fact our growth is not as strong as the USA. They are expecting a 7%+ GDP growth figure this year – fastest since 1984. Their monthly trade deficit also hit an all-time high. No one has a problem spending stimulus money on Chinese trinkets. China to grow by 9%+ this year.

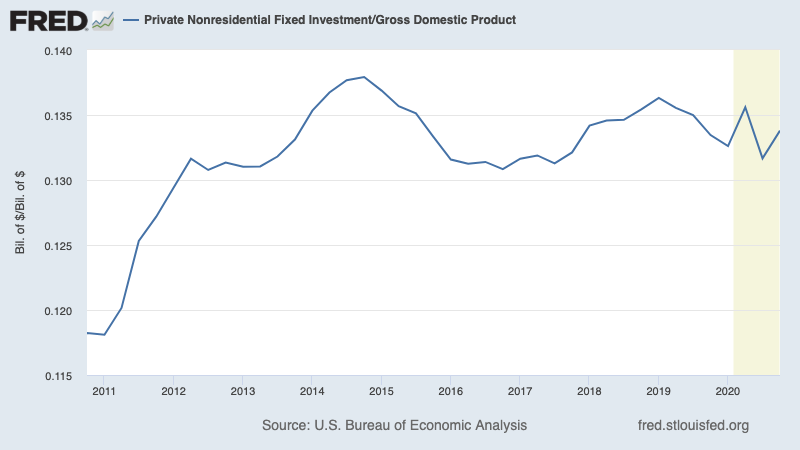

One area that is not flourishing over in the States is business investment. It was suggested that Trump’s corporate tax cut was a big stimulus in 2017 and if Joe Biden hikes corporate tax rates he puts business spending at risk. The chart below shows it only had a modest rise initially and has faded since.

Investment now lower under Trump/Biden

Also we are now a global “leader” in first world countries to be the slowest distributor of the Covid vaccines. Given the recent queries on Astra Zeneca you could argue that our “conservative” approach is well founded. That may be so, but public confidence towards SlowMo and Greg Hunt is not high at present…half their lies aren’t true. The delay of vaccine roll out into 2022 will have significant impact on opening our borders up and will cost us billions in lost education and tourism income.

But if you are having a bad few weeks, at least you can look good.

We have 20 zillion Pfizer vaccines coming…

Long term yields have had a steady week. Upside to yields probably limited for now, but little chance of any significant pullback either.

The Aussie Dollar remains curtailed by a stronger USD for at least the moment. .7620 today. May look into the 75 cents briefly but we still favour getting towards 80 cents by mid year.

There are plenty of sites that give you “investment tips” – this is not one of them. But I am always happy to share my successes and failures. For those that followed my back stories, here is a quick overview…

My gold purchase (Perth Mint EFT) – was up for the first time ever yesterday, but has fallen just below break-even. Must be noted that they were funded by sale of bank shares.

- Bank shares – up 3% odd for my remaining since I sold a truck load…see above

- Managed ethical investment fund (Alphinity) – up 2% in 2 mths (on par with broader market). Dragged for a while

- Managed Fixed Interest – (Westpac Capital Notes and Mutual Income) both up on capital and with better than market yield.

- Other Direct shares – a mixed bag. My best is up 80%, my worst down 38%. Best guess positive circa 10% across the spread.

I’m comfortable enough with the positioning at present. I would love to look at buying some Puts to cover my doomsday clock scenario in coming weeks/months. Will let you know how and when I go down that path.

It has been suggested that I throw some cash at Bitcoin for “sport”.

Maybe I will do that, but first…

Thought of the week. Guest writer. Hitcoin or shitcoin?

Our thought of the week, will be from a guest contributor. Stark Dar has worked Wall Street and knows their stuff. Many say English is their second language so it is written in a very different style than Black Swan – but perhaps better.

Like me they have been a Crypto doubter, but rather than remain uneducated and full of opinions, they educated themselves and still remain full of opinions.

Over to them:

Gary Gensler has been appointed head of the US Securities and Exchange Commission (SEC). OK, so Stark Dar’s lab is in the basement so we get the news a few weeks after everyone else….

Don’t (yawn) remember him? MIT professor who gave an 18 week course on crypto and blockchain over at MIT back in 2018 (and now free on YouTube Gensler MIT lecture )?

He was also the former head of the US Commodity Futures Trading Commission. Yeah, so what?

Well, yes, a John-Oliver-style whoopty-do, except for the fact that bitcoin and ethereum futures and options can now be traded on the Chicago Merc and the CBOE and also appear on Cantor. And if those names mean nothing to you, stop reading now and detour to Google to learn how the global financial system actually works…

Skkkrrrrrttttt!….let’s back up a few years to those Grange-fuelled lunches somewhere around 2015 when we mercilessly trash-talked $400 bitcoin to the curb and back? Yep, no doubt about it, the three functions of money fully failed. Charles Ponzi would be proud. Unfazed by the run-up to just under $20k USD in 2017, we soon feasted on sweet vindication with the inevitable decline back into the low $1,000s in 2018. Case closed. Crypto would soon join pet rocks and betamax in the archive of humanity’s failed experiments.

But as we ploughed merrily into the fourth bottle, in some antipodean lair, our protagonist Herr Gensler was poring over the blueprints for the crypto revolution….

OK, yes, whatever…. but is this crypto thing for real?? My dentist, smiling smugly and waxing lyrical about “stores of value,” assures me (quite earnestly) that it is. His confidence is well grounded in extensive consultation with his Uber driver, his 17 year old son and, and pretty much everybody on Reddit, amongst other functionaries of the new world order. Dentistry is looking rather pedestrian, he tells me. And yes, with Bitcoin hammering away at $60,000, and Elon Musk mushing his Doggy-coins, it all stings a bit. Gold is for losers, apparently, and let’s face it – anything you can actually touch is simply passé….

But perhaps Saint Gary at the SEC will save me (from myself) yet.

Because you see, even though entire crypto ecosystems are built overnight while I dream of beer procured in the ancient way – somewhere deep in the woods the rusty machines guarding of the global financial system are rumbling back to life. The regulators have begun to work. Having lurked for a crypto-eternity in the shadows “studying”, they have finally been spurred to action by breathless calls from panicky central bankers foreshadowing the collapse of money and probably civilisation as we know it. Shaking off the absinthian funk of the Trump years, legions of lawyers and rashes of regulators (is that the right collective noun?) are dusting off rule books and sharpening spell checkers to meet these cryptonite hoards head on.

Is it a currency, or is it a security?? The promoters, influencers and self-enrichers flogging 4000 (yes that is 4,000) nascent cryptocurrencies are desperate to know. Drug dealers, the unbanked, and 20-somethings who don’t trust banks (OK so no one actually trusts banks) also need to know – : can I just please use this thing to buy loo paper on Amazon, or does the government want me to pay tax on my windfall gains first?

Is Bitcoin a currency? Is Ethereum a currency? Is XRP a currency, or just a giant scam to make Ripple fabulously wealthy? The holders hang on every detail of the day’s crypto court battles, searching for clues as to which way the regulatory winds are blowing. Like giddy red-hatted schoolchildren invading a national monument, they egg each other on, telling each other “we own this place!” and occasionally bursting forth with proclamations that no regulatory agency on earth has the moral authority to regulate digital currencies!

And yet Gensler and his agents slowly, steadily advance…. KYC they whisper. AML they intone. Protect. Retail investors they chant together! FFS we must prevent crypto unleashing the next Gamestop debacle!

Meanwhile in the thickets on the edge of the battlefield, the central bankers are preparing to flank the crypto-hoards with their own digital currencies! Sacre bleu! Zuckerberg is disgusted (“I had that idea first!”), but even Xi knows that there is no such thing as a rear view mirror in Chinese central banking. And anyway, how much fun can a crypto currency be if everyone knows who everyone else is in the ledger!

But is it really the cryptonites the central bankers are after, or is that just a diversion as they stalk bigger game. A “catalyst for change” is how Saint Gensler has cryptically described crypto currencies. But what does that mean? What change is he talking about?

High above the fray, the bankers sup from sumptuous platters prepared in the APRA kitchens, mildly amused as they watch the Blackrocks and the Teslas prance about waving their new tickets on the crypto train. Surely this unseemly digital side-show has nothing to do with the world of proper money and finance?

Traditional bankers peering on nervously as the train speeds away from the last station look more exposed by the day.

- Multi-day settlements you say?

- Gratuitous fees for human-less transactions?

- Call centres based in the Third World?

- Infinite levels of middle management and risk compliance?

- I have to make an appointment to see a Relationship Manager?!?!?!

To the seasoned bitcoin user such anachronistic nonsense is laughable. No sir, straight-through for me thanks. It works every time. You can just go to the bank by yourself.

And as crypto transaction processing times inevitably grind down technologically towards instantaneous, the target on the banks just gets bigger. The final knife on out modern-day Orient Express may come from the central banks themselves.

If they eventually conclude that that the only way out of the battle with the crypto hoards is to fight fire with fire by establishing their own digital currencies, then someone’s lunch will have to be eaten.

You and I – the little retail clients – could well end up with individual, transactional digital currency accounts set up directly with our central bank – with no intermediary – where my transfer to you is instantaneous and costless. Surely this would be a deposit-taking-institution banker’s worst nightmare?! Even Real Time Gross Settlement for the masses cannot save them now.

There may be a reprieve. As every finance professor has told you, the one job a bank is supposed to be (uniquely) good at is allocating credit. That, then, is where the boss fight will be. The challenge of DeFi is the OK Corral for banks and crypto, where the $64,000 question will be answered: “Are banks really best-of-breed at choosing who to lend to”, or does a decentralised credit allocation mechanism – like a giant go-fund-me page for home borrowers – work just as well? Personally I am barracking for the bankers, because if it turns out that my dentist and his mates turned down my home loan application I am going to be really pissed.

The clock is ticking. In the US, the regulators can only hide behind congressional barleese for so long before they have to deliver a coffee-table thumping set of regulatory guidelines.

Janet Yellen is baying for blood, and as the US dollar is looking more and more like kindling for Texas BBQs, Ubercommissioner Powell can only keep his finger in the dam for so long. Every producer price release and every spike in the US 10 year yield inflames the chest-beating crypto hoards who smell the stench of death on the mighty USD. There is not much time for Gensler & Co to stop the train from running out of track as it reaches the edge of the known world. Can the world economy be saved from digital oblivion and an eternity of TikTok videos? We will know soon.

Far from the madding crowds, an Afterpay speaking softly to the AFR scribbles on the wall: “Our product brings joy; it is actually no longer just about a transaction. It is about the way millennial’s now see the world.” Pointing a bony finger toward the inevitable transformation of banking, she declares “All the banks are still working out what their propositions are.” And just over there on a parallel track speeds to Crypto bullet express…. At some point those two sets of tracks must surely converge…

Will Gary Gensler get to the switch in time to save us all from a massive derailment? Stay tuned for the next thrilling chapter in the crypto conundrum…

My executive summary:

- Crypto currencies may well be here to stay

- They will force efficiency into the transfer of funds/money

- Powerful forces and Central Banks will not give up their dominance without a fight

- Key risks to existing crypto appear as regulation and/or designing “in-house” similar product

No time for anything else….

Until next week….

Cheers BS