2021 Edition #1 – Out of the fat and into the fire

21 January 2021

Watching the market bounce.

Wow. A summer break like no other I can remember. No interstate or overseas travel for most, so we get to watch the full White House reality show in all its gory glory.

Not even I could predict that Trump would so successfully release the rabid throng upon the Capitol. By the way, Washington DC is the Capital but Thomas Jefferson insisted the legislative building be called the “Capitol” rather than “Congress House”. It is derived from Latin and is associated with the Temple of Jupiter Optimus Maximus (the original Transformer) on Capitoline Hill, one of the seven hills of Rome.

As an aside, we Aussies have looked on with some morbid interest to what is happening in the USA. But what is the rest of the world thinking?

- Americans have “tasted the fruits of the tree of knowledge of good and evil, and their virginity cannot be restored.” U.S. democracy is forever tainted, said Yevgeny Shestakov, at the Russian Gazeta.

- The U.S. has lost its right to criticize other countries that quash riots, said Ai Jun at the Global Times (China). Remember when Hong Kong protesters broke into the city’s legislative building in 2019? At the time, House Speaker Nancy Pelosi called the scene “a beautiful sight,” while Secretary of State Mike Pompeo said the U.S. stood with the activists and supported their “freedom of expression.” Yet when the very same thing occurs in the U.S., they “define it as lawlessness” and call it “unacceptable.” China was also smeared and criticized for arresting rioters, even though, unlike their American counterparts, Hong Kong police never fatally shot a protester.

- Lebanese diplomat Mohamad Safa tweeted that the events of Jan. 6 in any other country would invite a U.S. invasion. Others joked that the reason the coup did not succeed was that there was no U.S. Embassy in Washington to back it.

I liked this comment too….”Given how much oil America produces, it’s actually surprising America didn’t try to overthrow America earlier”.

I was up in the wee hours in the morning of the attack, and watched it all unfold. Bizarre indeed. It was both funny and scary at the same time. Everyone’s favourite though was the lead singer from Jamiroquai ..

With the Democrats winning over the Senate, they should have easy passage for change ahead in the next few years. Many of my more right orientated friends believe this is a dangerous thing, but if ever there was some time for loose spending, it is surely now. Rumours already that Biden may even delay or withhold the impending tax hikes.

Initially though he will face a very hostile environment as he will seek to enforce a mask mandate and tougher lockdowns to get Covid under control. Only the British seem to have made a worse mess of the pandemic.

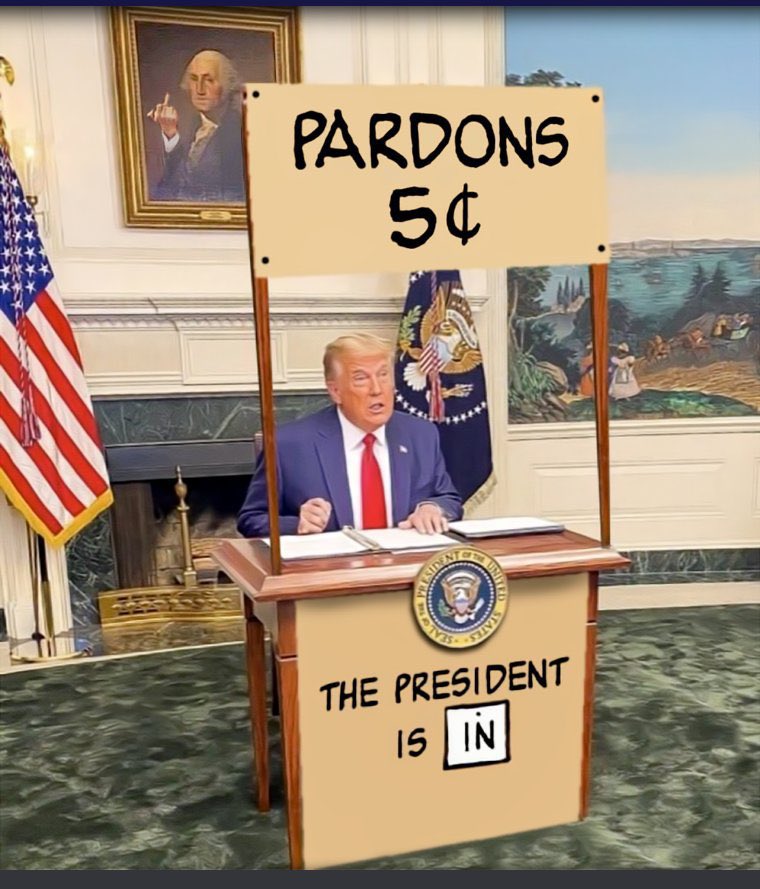

I will speak no more this week on Trump and his band – they have done enough damage to society, health and democracy to last many lifetimes. Those few fans here in Oz seem to have gone quiet of late, and for good cause. No pardons for Trump Jnr. Clearly he didn’t pay enough to the fund.

Love the portrait behind.

More of the same for equities here and abroad. I’m still adjusting to the mismatch between Wall St and Main St.

The Nasdaq went up a staggering 40% in 2020….much of that on companies that have yet to make a profit. Nasdaq stands for the National Association of Securities Dealers’ Automated Quotation system and its index includes most of the technology companies listed in the US, as well as many of those elsewhere in the world. Launched in 1971 the Association no longer exists, but the name lives on.

In Oz our equities had a good run, but not that good. Still hard to get too bearish though with the cash splash likely to continue this year.

Plenty of reason to feel good. Westpac sentiment survey out this week took a bit of a hit (survey taken during NSW lockdown) but still more optimists than pessimists. Australia is in the top 5 nations in the world to have managed the pandemic and our economic rebound looks solid. The vaccine roll out should see us have effective herd immunity by late this year. Plenty of pent up demand from consumers, and cash in bank accounts ready to splash. Westpac sentiment may not be so high in this new bank “drive through” model.

You can’t please everyone all the time….

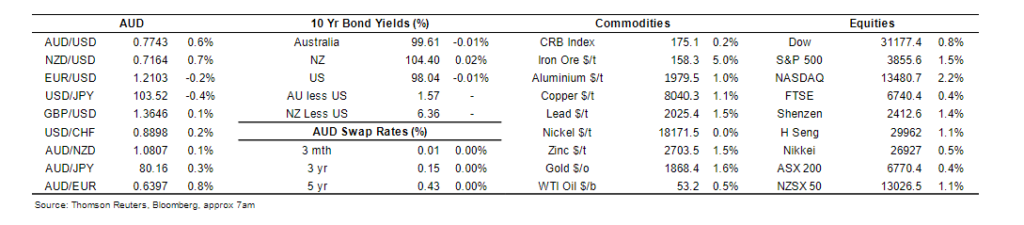

There is the issue of China trade war to contend with, but they ended 2020 as the only large nation that economically grew (2%+). They may not like us, but they will need our iron ore again this year. Prices for iron ore are sitting at 10 year highs, and may have a bit more in them yet. To put some context here, Fortescue Metals has their production costs at around USD $13 a tonne. That is a shit tonne of profit if you are selling at $170. Mind you I’ve never been keen on Twiggy Forrest since the time he stiffed investors badly in Anaconda Nickel years ago, and now portrays himself as a really good all-round Aussie bloke. Like Trump, anyone that has to tell you they are good, is no good.

Iron Ore is up faster and harder than Black Swan’s first strip joint visit.

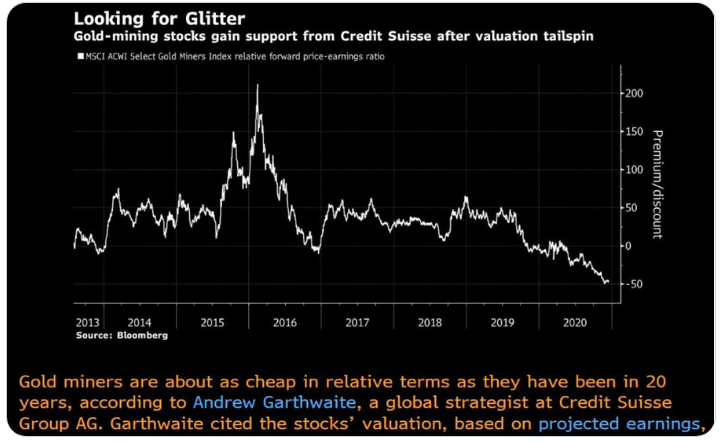

I might be talking my own book here (into gold), but interesting comparison below:

- Tesla reported $2.9B in operating cash flow through the first 3 quarters of 2020, market cap is $668B;

- Barrick Gold reported $3.7B in operating cash flow during this same period, market cap is $40B.

Summary: Producing Gold Miners are ridiculously undervalued vs. all other companies:

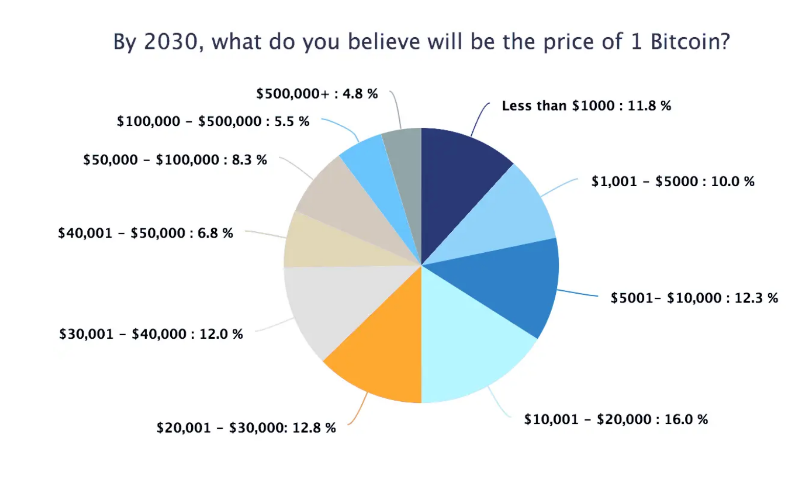

Our last edition of 2020 looked at bubbles. Bitcoin was mentioned. It’s remarkable run continues, and it sits over $35K USD today. A recent Genesis Mining poll was telling to me though. Over 2/3rds surveyed think it will be worth less than it is now in 2030, with over a third saying it will pull back below $10k. Great game of musical chairs, but sit down (sell) before the music stops.

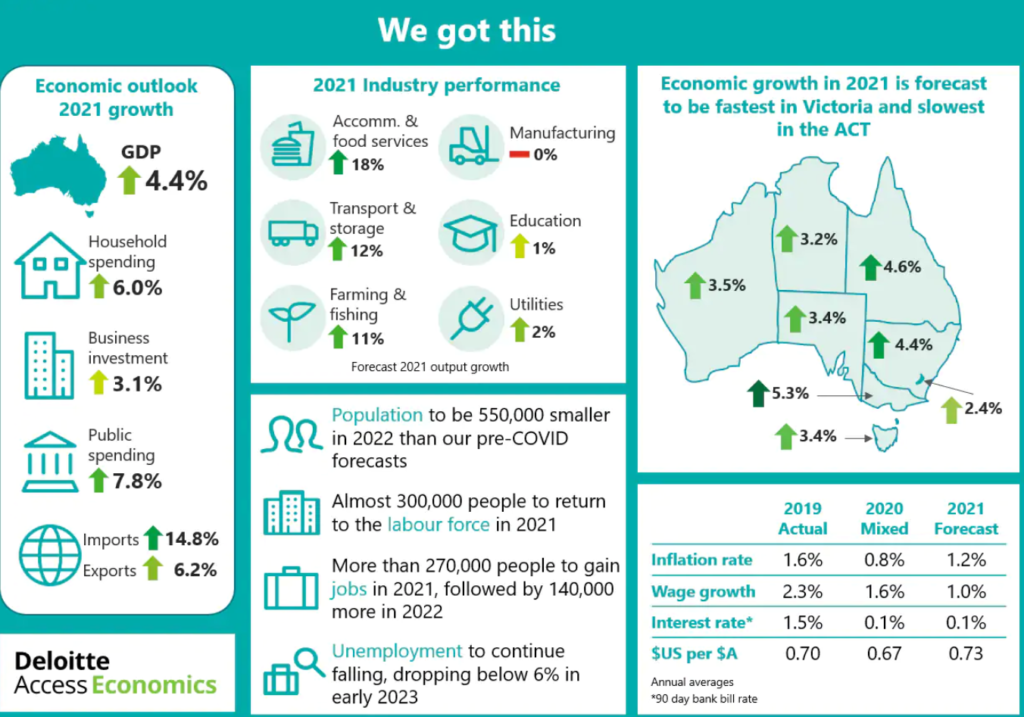

Although Deloitte’s are also pretty keen on a 2021 recovery (see below) they flag that we may be playing our game with over half a million players short next year.

Pretty solid predictions, except population.

That will be significant, and the building and construction industry may feel it hard.

Which is why this week’s AFR article RBA predict 30 jump in house prices got a lot of discussion going around my coffee shops. Given that most readers of this blog would own a house (or two), rising asset prices are generally a good thing. RBA’s Governor Lowe expects that current low rates will see houses up by 30% by 2024. The entire basis of this argument is that low costs of owning a house (mortgage rates) will lead to higher demand.

That argument fits in with my long held belief that we are collectively “smarter” than politicians give us credit for. If you were ever going to “gear up” and buy a first or bigger house, now is the time to do it. In fact for many renters it is now cheaper to take a mortgage out than to keep renting.

Of course the coffee shop discussion revolved around if a 30% rise would actually be a good thing? It is hard enough now for our kids to scrape together the 20/25% deposit needed to enter the home market, and this sort of rise would lock many people out of the housing market forever.

The two other risks to the theory are as follows:

- Yes demand may increase, but so will supply. If developers get a sniff of this sort of opportunity, they will pounce. Costs of construction will not rise by 30% so fatter margins are on offer, and supply will meet or exceed demand. Thus prices will stabilise or fall. And of course remember above – there will be 550,000 less Australians here in 2022 than initially forecast pre Covid.

- Expectations are entirely based on interest rates staying low. Whilst that is RBA’s prediction, all of that will depend on Australia’s bounce back and more so on inflation. Given local and global fiscal spending over the last year, anyone that can guarantee that inflation will stay this low into the 2022/23/24 are wizards or fools.

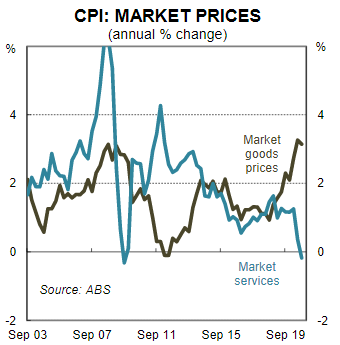

CBA gave a little insight into inflation this week. Not all inflation is the same. Market goods prices are tracking over RBA comfort zone already, whilst services are negative. CBA predicts CPI could be over 2% by the second half of this year. Be alert but not alarmed…yet.

Careful of the black cobra.

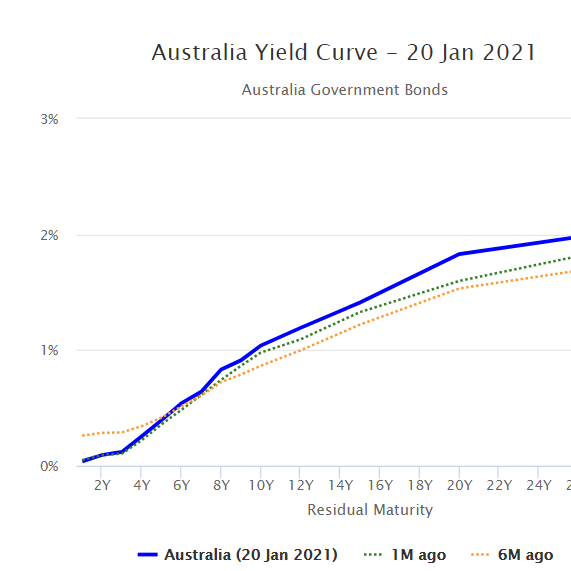

Smart money seem to agree as well. Long dated yields on the rise already. Ten year bond yields up 18 bps in 6 months – not huge by traditional terms, but in percentage terms from 86 bps outright to 104bps it is a big jump.

We are fortunate enough to get access to another “insiders” perspective. They have worked inside the Capital Markets divisions of many major Aussie and international banks with the odd corporate role in private enterprises. Promises of regular input.

A veracious reader, we present the views of the Red n White Swan :

A little reported yet potentially significant piece of financial news was released on January 6 whilst most people (ScoMo?) were on their beach towels working on their tans. The news was post Christmas, but was it an epiphany or gift from the three wise kings?

More like a big boost for government bond issuers , both federal and state. APRA announced it was reducing the ‘committed liquidity facility’ made available to Australian banks by a staggering $46 billion. Since December last year, this facility has fallen $81bn from $223 bn to $142bn.

So what, what does that mean ? It means Australian banks need to replace another $46B of ‘stand by’ facility which counted as eligible liquid assets, held as reserves for cash flow. To do this they will need to buy Government bonds. A ready (albeit compelled) buyer for all of those IOUs to support the necessary Covid Stimulus. It will be good for bond markets (yields should fall) and very good for a government that has spent $56bn so far on Jobkeeper with another $100 bn still to spend on this stimulus.

Australia is often unique in many ways. Sandbagging the post GFC liquidity rules for a pandemic crisis looks to have paid off. This should give some breathing space for a Government keen to keep business and consumer confidence up as we enter a new year. Bank profit margins will bear some of this change/pain, but then the big 4 local banks need to do something to spend the additional $190 bn in net deposits that have flowed in over the 11 months reported to January, when over the same period local lending balances have actually fallen by a net $12bn across the big 4 banks. Filling the spending gap with additional government bond issuance couldn’t have arrived at a better time .

Whilst US employment is floundering under the weight of the pandemic, Australia’s numbers this week are impressive given circumstances. Another 50,000 jobs created saw our unemployment fall to 6.6% last month. More than 90% of jobs lost since April have been regained. Unsurprisingly “Jobs, Jobs Jobs. Jobs is our focus,” Mr Morrison said minutes after the employment figures were released. Given he has previously declared the government can only do one thing at a time, it’s a good thing they are doing it well. They are even leaving Dan Andrews alone for now.

Aussie dollar liked the release and has climbed to .7770. We remain bullish on the AUD for now, but the USD may bounce a little in weeks ahead that may limit the rise.

Thought of the week.

Thoughtless.

Had some time to ponder, but room has run out this week – you are probably already just scrolling the pictures. Will cover one next week.

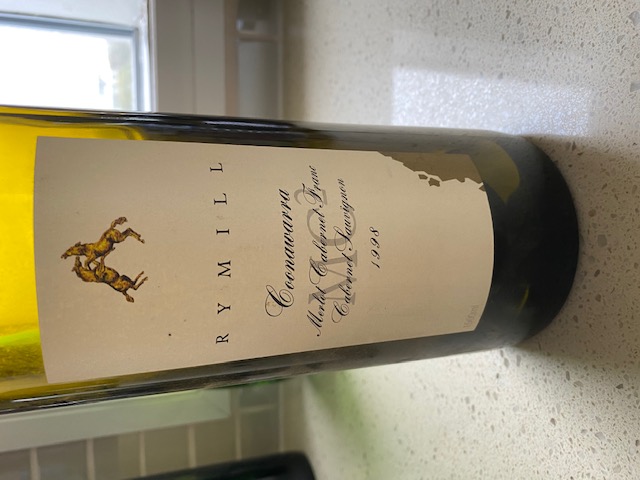

What is Black Swan drinking?

Stand out for me was a NYE special. Supplied by a good mate it was a 1998 Coonawarra Cab Sav.

It was soft and gentle, but with sufficient depth and carry. I reckon it had a few more years in it yet.

Brilliant 9/10.

And listening?

I listened to this last week, and couldn’t help but bring the analogy of Trump’s Big Lie. Putting out the fire…with gasoline.

As if the world was not already batshit crazy, who missed Tom Waterhouse’s Christmas photo below? Originally claimed as his daughters, it was later revealed they were paid models. What are the odds? You silly goat.

What’s the difference between a hooker with diarrhoea and an epileptic oyster shucker? One shucks between fits

Cheers BS